December 13, 2024

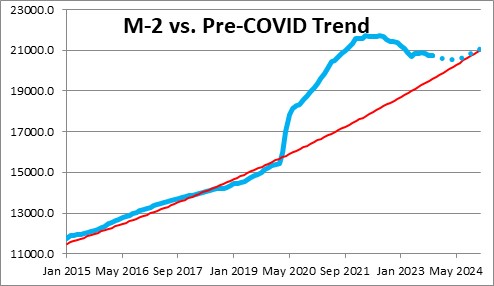

The Federal Reserve will be the focus of attention this week. It is all but a foregone conclusion that it will lower the funds rate by 0.25% to 4.25-4.5%. It told us that is what it intends to do. The Fed is trying to reduce the funds rate to a “neutral” level. The problem is that nobody knows exactly what that rate is. The Fed thinks it is 2.9%. We believe it is 3.5-3.75%. That is a big difference. The Fed needs to get this right. It jeopardized its credibility in 2021 and 2022 when it mistakenly believed the runup in inflation would be temporary. As a result, it started to tighten policy about 1-1/2 years too late and higher inflation became entrenched. It can ill afford another policy blunder. We fully expect the Fed to lower rates gradually as we move throughout 2025, but it should wait for a further slowdown in inflation to emerge before making the next move. The past several months of inflation data have been stubbornly high and are inconsistent with a return to the desired 2.0% pace. But if the Fed keeps growth in the money supply in check inflation will eventually slow. Wait for that to become obvious before proceeding further.

The core CPI rose 0.3% in November. It also climbed by 0.3% in August, September, and October. The year-over-year increase is 3.3%. The 3-month average increase is 3.6%. While the core CPI may indeed slow further, there is always a possibility that the Fed’s forecasts are wrong. Recent data raise that possibility. We expect increases of 0.2-0.3% every month between now and midyear. In that case, the core CPI will shrink to 2.8% by midyear. But be patient. Wait until that happens before cutting rates further.

The Fed does not target the core CPI but, rather, the core personal consumption expenditures deflator. That inflation gauge tends to be about 0.5% slower than the core CPI. If the core CPI hits 2.8% by midyear then the core PCE deflator should dip to 2.3% which is closing in on the Fed’s 2.0% target. That should pave the way for additional rate cuts in the spring and summer. But wait for the inflation slowdown to emerge and become apparent before cutting rates again. If the economy continues to chug along at a 2.5-3.0% pace and the unemployment remains at the full employment threshold of 4.1%, there is virtually no danger that the economy will inadvertently slip over the edge into recession.

The important question for the Fed is figuring out the “neutral” level for the funds rate. Unfortunately, the neutral rate cannot be observed. Economists look at the spectrum of available data for the economy, the unemployment rate, and inflation, and decide whether the current level is too high or too low. They have developed fancy models to determine what that rate is which may or may not be accurate. In the end, it is largely a guessing game.

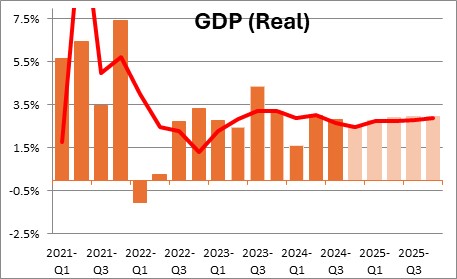

The Fed thinks that the neutral funds rate is 2.9%. For that reason it considers today’s 4.5-4.75% funds rate as quite restrictive. Even though the current 2.5-3.0% pace of GDP growth is acceptable, a restrictive funds rate should eventually bite and cause growth to slow. That is what the Fed is trying to avoid.

But in estimating a neutral level for the funds rate the Fed assumes the economy’s longer-term potential GDP growth rate is 1.8%. We believe that sustained faster growth in productivity has boosted the economy’s potential growth path to 3.0%. If that is the case, the economy does not need a 2.8% funds rate to maintain 3.0% growth. We think that a neutral funds rate today is 3.5-3.75% and the funds rate futures market seems to agree.

While the Fed’s median forecast for a neutral funds rate is 2.9%, the central tendency of its individual member’s estimates is in a range from 2.5-3.5%. At the moment only four of 19 FOMC members believe the neutral rate is 3.5% or higher. They are a distinct minority. Our fear is that the remaining 15 members believe that the current level of the funds rate is particularly restrictive and they push – inappropriately – for a steady diet of rate cuts. To do so would boost growth in the money supply and push inflation higher. Not good.

The Fed would be well advised from now on to take it one meeting at a time. Cut rates this week, but then pause for a while and sniff the air. If the inflation rate truly is headed lower, that will eventually become apparent. Be patient. With the economy still in great shape there is no need to rush.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me