September 9, 2016

Once again eyes will focus on the Federal Reserve which meets later this month to decide whether it is time to nudge rates higher. The economic situation has not changed much since it last met, but there has been far more chatter from Fed officials indicating that another rate hike is likely prior to yearend. Three meetings remain – September 22, November 2 and December 14. Which one is it? We suspect they will pass this month. The November meeting is immediately prior to the election which eliminates that date. Thus, our bet is December. What factors will be important to the Fed in making that decision?

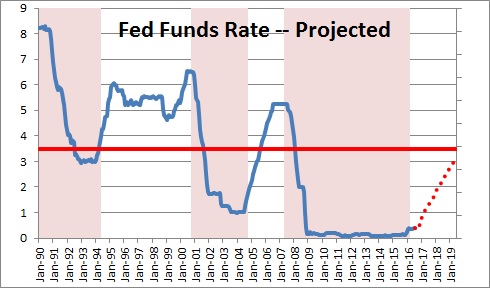

First, there is a clear need to raise rates to a more “neutral” stance. Economists generally believe that the funds rate should be about 1.0% higher than the inflation rate to be “neutral”. Given that the Fed’s inflation target is 2.0%, that means that the nominal funds rate which is supposedly “neutral” – meaning that is neither stimulating nor retarding economic activity – is about 3.0%. But the funds rate today is 0.5%. It has a long ways to go. There is no preset path on how quickly the funds rate should rise. The Fed’s believes it will reach that level sometime in 2019. To raise the funds rate 2.5% over three years implies that the Fed is contemplating three 0.25% rate hikes in each of the next three years. Whether that happens depends upon the behavior of GDP growth and inflation.

Second, the Fed needs to get rates higher is to give it maneuvering room once the inevitable recession arrives. We suspect that that the earliest a recession could occur would be 2019. We are not forecasting a recession in that year, but with the funds rate close to the so-called “neutral” rate it is time to pay attention. Also, by June 2019 the expansion will have lasted exactly ten years and duplicated the longest expansion on record. While the expansion can certainly continue beyond that time, a record long period of expansion could begin to show its age.

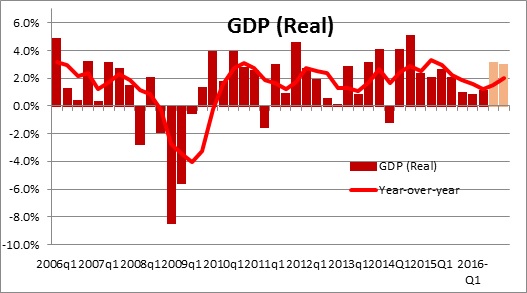

As the Fed approaches the September meeting it will see an economy that appears to have accelerated in the third quarter to about a 3.0% pace after registering GDP growth of 0.8% and 1.1% in the first two quarters of the year. This implies GDP growth for the year of roughly 2.0% which is acceptable given that the economy is essentially at full employment. A growing scarcity of qualified workers is acting as a damper on growth.

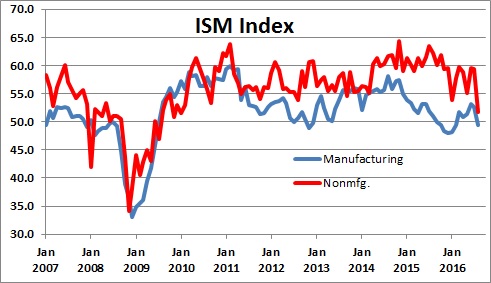

If GDP growth for the third quarter still appears to be 3.0% by the time the Fed meets later this month it should be satisfied. However, August was a weak month. The purchasing managers’ reports for both the manufacturing and service sectors were surprisingly weak. Car sales slipped. Nobody knows why. It is probably a monthly aberration and growth will rebound in September and beyond. However, in response to what we have seen we shaved our projected third quarter GDP growth rate from 3.5% to 3.0%. If subsequent data erodes that forecast to 2.0-2.5%, the Fed would almost certainly leave the funds rate at its current level of 0.5% in September.

Between now and the end of the month the Fed will see the August employment report. Most likely payroll employment will increase by 190 thousand and the unemployment rate will be unchanged at 4.9%.

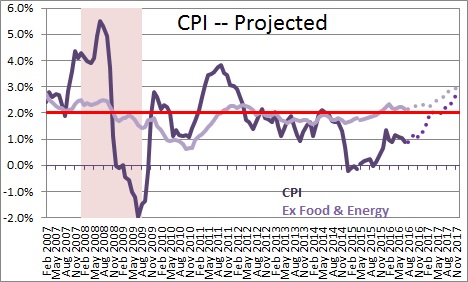

It will also get the inflation data. The CPI measure of inflation excluding the volatile food and energy components has edged its way higher — from 1.6% in 2014, to 2.1% last year, and 2.3% currently. It is not accelerating quickly. However, it is now above the Fed’s 2.0% target and climbing. Our sense is that an inflation rate slightly above the Fed’s specified 2.0% target will not be troublesome. Inflation was below target for several years early in the expansion. If it comes in somewhat above target for the next several years the Fed will be satisfied. As long as it is around the 2.0% objective for the cycle as a whole the Fed can claim victory.

Why will the Fed raise the funds rate at all if the data are mixed? Two reasons. First, as noted above the Fed needs to get rates higher to provide it with the ability to lower rates when the time comes. Second, every top Fed official has been talking about it. Fed Chair Janet Yellen, Vice Chair Stanley Fisher, and NY Federal Reserve Bank President Bill Dudley have all indicated that a rate hike is likely by yearend. Fed officials are rarely that explicit.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me