October 19, 2018

President Trump recently tweeted, “I think the Fed is making a mistake. They’re so tight. I think the Fed has gone crazy”. The Fed is not crazy. Fed policy is not tight by any standard. And presidential rhetoric is not going to influence Chairman Powell and his colleagues in any way.

First, a disclaimer. I have great respect for the Fed. I began my career at the Board of Governors many years ago. The Fed’s economists are some of the smartest, hardest working people I have ever met. They taught me how to think about the real world, not the theoretical one taught in school. If we must delegate interest rate control to anyone, I am happy to entrust those decisions to my former colleagues at the Fed.

What is a “neutral” rate for the funds rate? Surely, we can all agree that a 0% funds rate is too low. If the Fed lowers the funds rate to 0%, it is putting the pedal to the metal and trying to stimulate quickly the pace of economic activity. Similarly, a 10% funds rate must be too high. For that to occur the economy must be seriously overheating and inflation on the rise. So what exactly is a “neutral” rate, one which neither stimulates nor retards the pace of economic activity?

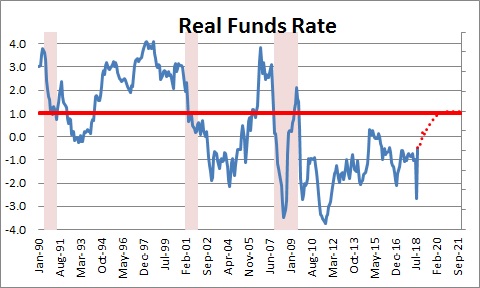

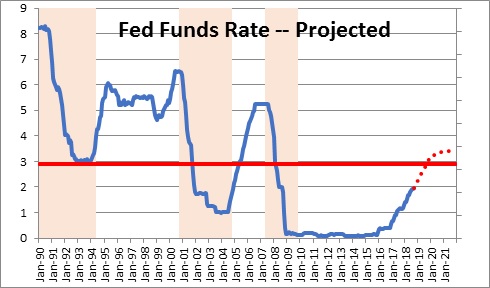

Most economists look at the behavior of the “real” funds rate, i.e. the level of the funds rate adjusted for inflation. Over the past 50 years, which includes numerous expansionary periods and recessions, the funds rate has averaged 1% higher than the inflation rate. If the Fed puts the funds rate 1% higher than its inflation target of 2.0% its policy will, presumably, be “neutral”. That is why most economists, both inside and outside the Fed, regard a 3% funds rate as roughly “neutral”.

When the Fed lowered the funds rate to 0% in December 2008, the financial markets were collapsing, and the economy was slipping over the edge into a deep, dangerous recession. Extraordinary measures were required. The Fed’s move was unprecedented. It had never lowered the funds rate to 0%. It wanted to send a message that it was prepared to do whatever was necessary to get the economy back on track. Fortunately, the Fed’s action helped lift the economy out of troubled times and the recession ended in June 2009.

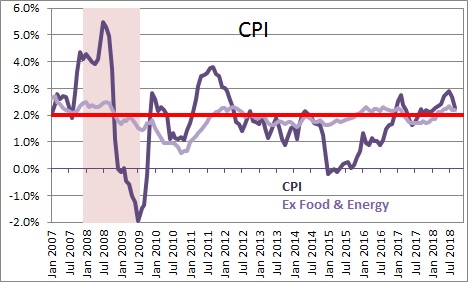

That was then. This is now. The economy has been growing at a 3.0% pace for a year. Inflation has returned to the Fed’s 2.0% target. The economy is no longer in need of a 0% funds rate. It is time to take the foot off the accelerator. That is what the Fed has been doing since December 2015.

Currently the funds rate is 2.0-2.25%. It is still well below the “neutral” level of 3.0%. A higher funds rate does not seem “crazy” to us. Rather, we think it is entirely rational.

The Fed plans one more rate hike in December and four more moves in 2019. By the end of next year, the funds rate will be 3.2%. Fed policy will, at long last, have returned to “neutral”. At that point the Fed will pause and sniff the air. It will scrutinize the economy for signs of overheating and/or inflation on the upswing. For Fed policy makers rate hikes up to this point have been easy. Raising the funds rate from 0% to its current level carried virtually no risk. By the end of next year, the Fed will need to be more careful. Discussions at FOMC meetings will be more spirited and there will be a broad range of opinions about what to do next.

The biggest problem for the Fed is that interest rate changes impact the economy with a lag of anywhere from 3 months to a year. That is why the Fed often overshoots. It may raise rates today, not see any apparent change in the economy three months hence and decide to raise rates again. Before you know it, the Fed has gone too far, and the economy has slipped over the edge into recession.

Because the Fed’s rate decision today is based on what the economy might look like six months to a year from now the Fed can make mistakes. But, in our opinion, the danger of a policy mistake is unlikely to occur until the end of 2019 at the soonest.

The president’s Fed-bashing is not going to have any impact on Chairman Powell and his colleagues. Their discussions will be about the state of the U.S. economy, inflation, the global outlook, the level of interest rates, etc. Politics and elections do not play a role. Some argue that political pressure from Trump will cause the Fed to raise rates more slowly than they otherwise would. Nonsense! Others argue that Fed bashing will cause the Fed to raise rates more quickly to demonstrate the Fed’s independence. Rubbish! It makes nice press, but the Fed does not work that way.

However, the president’s comments make the markets nervous and, therefore, are not helpful. The markets are dealing with considerable uncertainty right now. Between rising interest rates, third quarter earnings, the upcoming election, trade, the state of the global economy, and a rift between the U.S. and Saudi Arabia, the markets have plenty to worry about. Questions about the Fed’s independence and integrity should not be on the list.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me