September 6, 2024

The employment report for August was the icing on the cake. The labor market continues to cool. The Fed is going to lower the funds rate at its FOMC gathering on September 18. It will most likely be a 0.25% cut to the 5.0-5.25% range. But some economists suggest the initial cut could be 0.5%. But in some sense, who cares? The important point is that this is the beginning of an extended period of rate reductions by the Fed that should continue through the end of 2025. That is hardly news. The markets have been salivating over the possibility of lower rates since last fall. The markets have priced in not just the likely three rate cuts between now and the end of this year, they anticipate several additional cuts in the funds rate in 2025. Whether the Fed cuts the funds rate by 0.25% or 0.5% later this month is largely irrelevant. September 18 is merely the beginning of a protracted period of rate cuts which, over time, should lower the funds rate from 5.25-5.5% today to the 3.0% mark eventually.

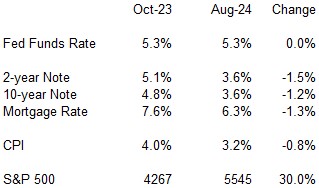

Market rates peaked in October 2023. Between then and now the core inflation rate has slowed considerably. Most economists expect disinflation to continue for some time to come and the inflation rate to return to the Fed’s 2.0% target by late 2025 or early 2026. As a result, the market has begun to anticipate the time when the Fed would finally begin to cut interest rates. Both short- and long-term interest rates have fallen dramatically since the fall of last year. The yield on the 2-year note, for example, has declined 1.5% in that period of time. The yield on the 10-year note has fallen 1.2%. The 30-year mortgage rate has dipped by a comparable amount. But the funds rate has not budged. It was 5.3% a year ago. It remains at 5.3% today. But that is about to change. Fed officials have essentially confirmed that the long-waited Fed easing initiative will begin later this month.

Could the Fed have moved sooner? Perhaps. But it wanted to be sure that disinflation would continue for some time to come. For that to happen, it needed to see some softening from the relatively robust pace of 4.2% GDP growth of in the second half of last year and 2.2% in the first half of this year. GDP growth is in the process of cooling to1.5% or so in the second half of 2024. At the same time the unemployment rate has risen 0.5% in recent months to 4.2%. The time has come.

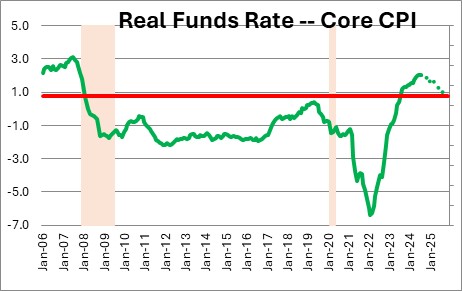

The best way to determine the degree of tightness of monetary policy is to examine the real, or inflation adjusted, funds rate. With the nominal funds rate remaining steady at 5.3% but the core inflation rate declining, the real funds rate has risen sharply since October of last year. With the funds rate currently at 5.3% and the core CPI at 3.2%, the real funds rate is the difference between those two numbers or 2.1%. Thus, Fed policy has tightened in the past year even though the nominal funds rate has not changed.

The Fed thinks its policy is neutral when the funds rate is 0.8% higher than the inflation rate. If the Fed has a 2.0% inflation target, then the funds rate in the longer term should be 2.8%. Today’s funds rate of 5.5% is not even close to neutral. Given the likelihood of slower GDP growth, a rising unemployment rate, and a steadily slowing inflation rate, the time has come. The fed funds rate futures market envisions a 3.0% funds rate by the end of next year. We expect it to be 3.5% at the end of 2025. In June the Fed indicated that it expected the funds rate to be 4.1% at the end of 2025. But at that time it also envisioned just one rate cut between now and yearend. That has almost certainly changed. Thus, the previously expected 4.1% funds rate is sure to be lower when we get the Fed’s revised summary of economic projections later this month.

The point if all this is that funds rate is going to fall a long ways between now and the end of 2025. The markets have known this for a while. Now it is the Fed’s turn to join the party.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me