January 28, 2022

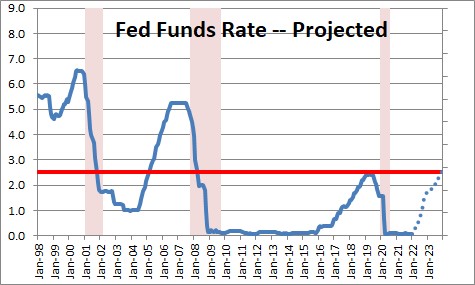

What a week! The pace of economic activity in the winter months is being buffeted by the rise and expected fall in COVID cases and by miserable weather in December and January. These two factors will shift growth from month-to-month but should not significantly impact the trend rate of expansion. Then there is the stock market. The Dow Jones Industrial Average fell only slightly during the week, but that masks three consecutive days when the intraday swing exceeded 1,000 points. That was breathtaking. It made a weekly drop of 200 points feel more like 2,000. The catalyst for the stock market angst was the Fed and how quickly it intended to raise rates and shrink its balance sheet. At the post FOMC press conference Powell indicated that the Fed is more worried about inflation than it had expressed previously. It is about time. We thought the Fed should have started raising rates in the middle of last year. As a result, we now anticipate seven rate hikes in 2022 (versus the four increases we had expected previously) which would lift the funds rate to 1.75% by yearend. If the funds rate is neutral at 2.5% Fed policy will still be accommodative by yearend so it is not in any danger of inadvertently triggering a recession. It hopes its more aggressive action will keep inflation expectations in check.

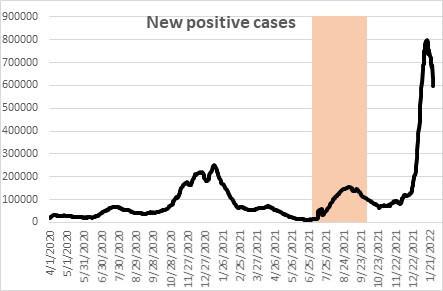

The dramatic rise in COVID cases in late December and throughout January prevented some people from going to work either because they had contracted COVID and could not go to work, or had been exposed to someone with COVID and were forced to quarantine. But immunologists as well as data from other countries suggest that the number of new COVID cases should soon begin a rapid descent which may already be underway. If that is the case, GDP growth will rebound quickly. Thus, COVID shifted growth from December and January to subsequent months.

The weather turned miserable in mid-December which caused thousands of flight cancellations and zapped plans to see Grandma during the holidays. The weather has improved only slightly thus far, but warmer weather is not far distant. Like COVID, the weather has shifted growth from December and January to later months. These factors disguise the true current pace of economic activity.

Then there is the Fed. It has now provided some hints of what it intends to do in the future. At the press conference Powell told us that a rate hike could occur at any FOMC meeting. That is different. In the past rates would typically climb by 0.25% every quarter. With seven FOMC meetings left in 2022 the funds rate could end up at 1.75% by the end of this year. That is a rapid pace of tightening. But even so, the Fed considers its policy neutral when the funds rate is 2.5%. The Fed is taking its foot off the accelerator more quickly than the market had been assuming – but it is not about to hit the brakes.

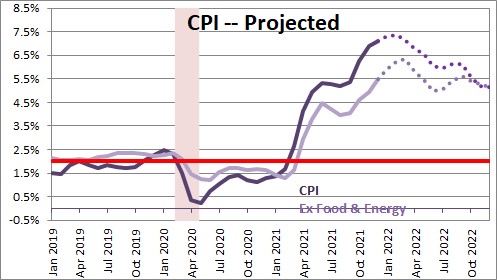

A more rapid pace of tightening is, actually, a welcome development. At its meeting in December the Fed suggested that the funds rate would only reach 2.1% by the end of 2024. Its policy would still have been accommodative three years from now. That is crazy. The economy is essentially at full employment as measured by a 3.9% unemployment rate. GDP is not far from where it would have been if the recession had never occurred. And inflation is roaring. Against that background the continuation of wildly stimulative monetary policy for three more years would be a recipe for even faster inflation. The core CPI rose 5.5% in 2021 and is showing no sign yet of slowing down although many economists expect some relief later in the year. For what it is worth, we expect this core rate of inflation to rise 5.2% in 2022. If the Fed gets its act together a more meaningful slowdown might occur in 2023.

Given growth in the economy and the level of the unemployment rate, a policy stance that has the funds rate below its neutral level of 2.5% makes absolutely no sense. It should already be at – or higher than – the 2.5% neutral level.

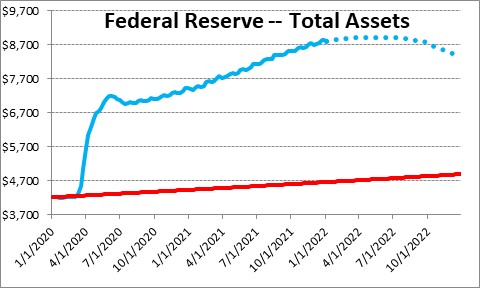

The other way the Fed has provided liquidity to the economy in the past two years is via its purchases of U.S. government and U.S. Treasury securities. Its portfolio has risen $4.6 trillion from where it was prior to the recession. The Fed indicated that it will run off some of its asset holdings via attrition as securities mature, but it will not initiate that process until its rate hikes were underway. That sounds like it might begin in July. If so, its portfolio might shrink by $0.6 trillion by the end of the year. That would still leave it $3.5 trillion higher than it should be, which means that there is still $3.5 billion of surplus liquidity still sloshing around in the economy. The Fed needs to shrink its balance sheet much more quickly if it wants to tame inflation. It created this awkward situation for itself by not raising rates and shrinking its balance sheet sooner.

Given more aggressive Fed tightening than we thought previously, we have reduced projected GDP growth in 2022 from 4.9% to 4.0%. With no slack in the economy, 4.0% growth far surpasses potential growth of 1.8% which means that the inflation rate should remain elevated. We expect it to slow only slightly from 5.5% in 2021 to 5.2% this year.

Between COVID and the weather, the Fed, not to mention political events like a Russian invasion of Ukraine and an upcoming U.S. congressional election which could reverse Democrats control of the House, the Senate, or both, there are plenty of things for the stock markets to chew on for the foreseeable future. Hang on. It is likely to be a bumpy ride.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me