April 10, 2020

When we think about the Federal Reserve, we typically think about the role it plays in setting interest rates. But increasingly its role as lender of last resort has become its primary objective. The economic damage in the second quarter of this year is unprecedented with GDP likely to fall 35%. Without the Fed’s aggressive bond purchases in the past month the damage would have been far greater.

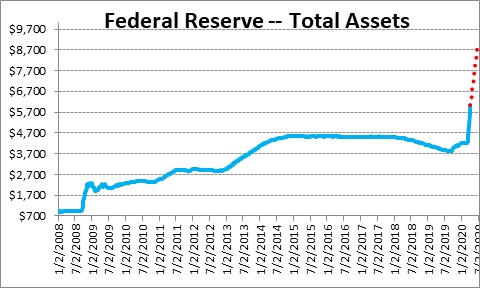

First, a brief history lesson. Following the collapse of Lehman Brothers in September 2008 credit was drying up. The country’s largest financial institutions rely on credit and routinely borrow billions of dollars daily. But following the demise of Lehman Brothers investors were increasingly unwilling to lend to them. The banking sector was on the verge of imploding. The Fed immediately launched a bond buying program. Its balance sheet exploded from $900 billion in mid-September to $2.2 trillion by the end of 2008. Given the relatively slow pace of recovery the Fed’s portfolio eventually climbed to $4.5 trillion. Without this aggressive action by the Fed and the Treasury at the end of 2008 and early 2009, there is little doubt that the economy would have plunged into a 1930’s type depression.

And now today. In the past four weeks the Fed’s balance sheet has risen by $1.7 trillion from $4.3 trillion in mid-March to $6.0 trillion — and it is just getting started.

This past week the Fed laid out plans to further boost liquidity. Here’s the game plan:

- Bolster the effectiveness of the SBA’s Paycheck Protection Program by supplying liquidity to participating financial institutions that choose to support small businesses.

- Ensure credit flows to mid-sized businesses not eligible for the SBA loan program by lending up to $600 billion through the Main Street Lending Program.

- Expand the size and scope of its purchases of corporate bonds by including (for the first time) purchases of some riskier debt by $850 billion.

- Help state and local governments manage their constrained cash flow by purchasing up to $500 billion of short-term notes from states and local municipalities.

These additional programs will likely boost the Fed’s balance sheet to $9.0 trillion by midyear.

All of this is necessary because the economy has stopped dead in its tracks. The measures taken by the federal government and many state governors since mid-March were designed to quarantine us at home for an as yet unspecified period of time. As a result, the entire food and beverage industry has shut down. Retail shops have closed. Airlines are flying at 10% of capacity. Factories are closing. Nearly 17 million workers lost their jobs in 3 weeks. Keep in mind that the economy lost a total of 8 million jobs in the 2008-09 recession. We have lost double that number in just three weeks. Unprecedented.

With their revenue stream shut off but bills still flowing in, business have been selling anything they can find to boost liquidity. They have been drawing on previously established lines of credit. But their available savings and lines of credit can only keep them going for a few weeks. More credit is required.

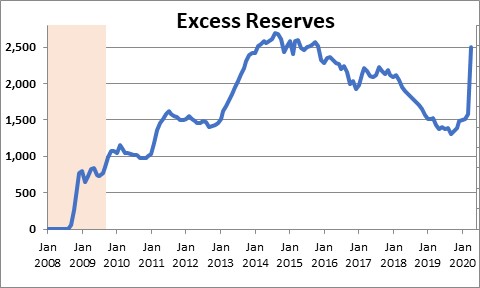

The Fed has leaped into action. It boosted its balance sheet by $1.7 trillion in the past four weeks primarily via purchases of U.S. government securities. When it purchases government securities the proceeds of the transaction are put into a bank’s “reserves” account at the Fed. Think of this as that bank’s checking account.

Excess reserves in the banking system have jumped from $1.5 trillion in February to $2.5 trillion. This measures the ability of the banking system to make additional loans. Banks are awash in funds just waiting to be lent to needy businesses.

Banks have already been busy. Their loan portfolios have increased by $600 billion in the past four weeks. To put that in perspective, total bank loans increased $450 billion in 2019. They have lent more in four weeks than they did all last year. The recent increase in lending has been almost exclusively to businesses. As indicated by the current $2.5 trillion level of excess reserves with more to come in the weeks ahead, banks have plenty of ammo to support further lending.

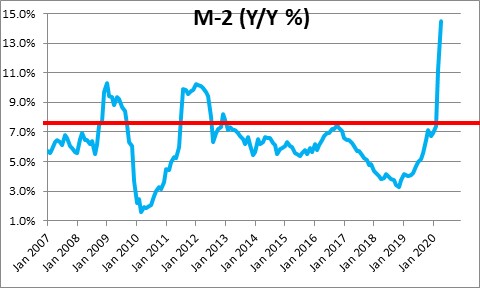

When banks lend to consumers and business, they put the proceeds into a checking account. At that point the money supply begins to grow. In the past four weeks the M-2 measure of the money supply has increased by $1.0 trillion. Those are funds that businesses can use to pay their workers, pay the rent, and keep the lights on.

The point of all this is that, to its credit, the Federal Reserves has stepped into the credit void to make sure that banks have adequate funds to lend to businesses to keep the economy functioning – however slowly – for a while. If the virus begins to show signs of slowing down in the second half of this month and May, some businesses will be permitted to re-open and the economy can begin a gradual recovery. The stock market senses this is about to happen as it has regained almost one-half of its previous decline. After having plunged 32% in five weeks, it is now just 17% below its mid-February high.

Stephen Slifer

NumberNomics

Charleston, S.C.

Excellent recap of past ,present and future! Thanks,steve