May 31, 2019

The markets believe that the Fed will cut rates twice by this time next year. The federal funds rate currently is in a range from 2.25-2.5%. However, the December 2019 federal funds rate futures contract stands at 2.06%; the June 2020 contract is 1.77%. Thus, the markets envision some combination of slower GDP growth and lower inflation that will convince the Fed that it needs to lower rates to re-invigorate the economy and/or boost inflation. We are having a tough time with that scenario.

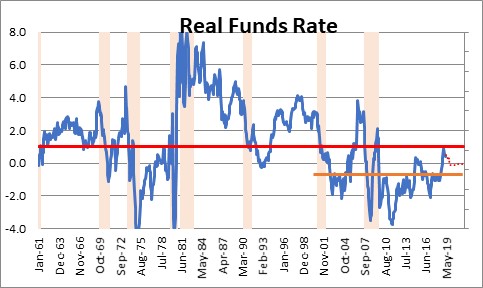

The best way to gauge whether the funds rate is too high is to determine a “neutral” level at which it will neither stimulate nor retard economic activity. The Fed calculates that by looking at the “real” funds rate, or the funds rate adjusted for inflation, over a very long time span. Over the past 50 years, through good times and bad, the “real” funds rate has averaged 1.0%. Thus, the Fed believes that for its policy to be “neutral” it should put the funds rate 1.0% higher than its 2.0% inflation target or 3.0%. For years the Fed has talked about a 3.0% funds rate as being a neutral rate.

But there is nothing magic about using a 50-year average. If one were to select a more recent, shorter period from 1990 to date – which incorporates four business cycles – the real funds rate averaged 0.5%. From 2000 to date the average drops farther to -0.5%, but that period incorporates only two business cycles. Thus, the all-important “neutral rate” seems to be falling. The Fed is not going to be comfortable using a calculation that incorporates only two cycles, but four cycles might be realistic. In that case, a 0.5% real rate combined with a 2.0% inflation rate would suggest the neutral rate has slipped to 2.5%. Perhaps for this reason the Fed currently believes a “neutral” funds rate is somewhere between 2.5-3.0%. Its current funds rate objective of 2.25-2.5% is slightly below the low end of its neutral rate range. If that is true, it will be difficult to convince Fed officials that the current level of the funds rate is “too high”.

Keep in mind also that over the past year GDP growth has averaged 3.2%. It is kind of hard to argue convincingly that with GDP expanding at that pace that lower rates are necessary to stimulate the pace of economic activity.

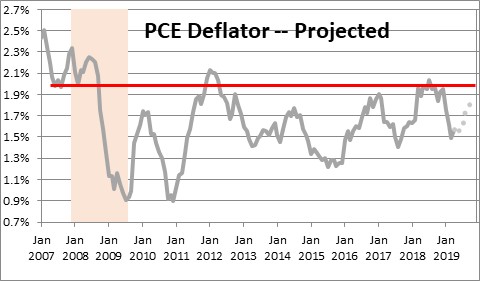

The other part of the story for those economists that are advocating lower rates is that the Fed’s targeted inflation rate in the past year, the so-called “core” personal consumption expenditures deflator, has risen 1.6%. It has generally been below its 2.0% target for the past decade, although it was at or very close to the 2.0% target for most of last year.

However, the recent increase in tariffs on goods imported from China could boost the inflation rate in the months ahead. We import $540 billion of goods from China. That represents 2.5% of GDP. A 20% tariff on those goods could, therefore, boost the inflation rate by 0.5%.

For this reason, we believe that the core PCE deflator will accelerate in the second half of this year which will boost the inflation rate for 2019 as a whole to 1.9% and cause it to quicken farther to a 2.3% pace in 2020. If that is the case, the notion that the Fed must lower rates to lift inflation back to the 2.0% target completely falls apart.

Our sense is that as the year progresses the markets will be surprised on the upside by relatively robust GDP growth and higher inflation. We are looking for GDP to increase 2.6% this year. The Fed thinks potential growth is still 1.8% so, from its perspective, a 2.6% pace is not only steamy but likely to boost inflation. At the same time, we expect the core PCE deflator to gradually accelerate in the second half of the year and climb from 1.6% today to 1.9% by yearend, and then accelerate to 2.3% in 2020.

As the inflation rate begins to accelerate long-term interest rates should climb as well. The yield on the 10-year note of 2.3% today is likely to climb 0.5% by yearend to 2.8%. With the funds rate at 2.4% the yield curve would, once again, have a positive slope of 0.4%.

We believe the Fed will do exactly what it has said it is going to do – wait and see what happens. If the economic situation unfolds the way we expect, the Fed will have little incentive to alter rates in either direction for the foreseeable future. Keep in mind that at their meeting on March 20, of the 17 Fed governors and Federal Reserve bank presidents, eleven thought the funds rate at yearend would be 2.25-2.5%, four voted for 2.5-2.75%, and two thought it would be 2.75-3.0%. Not a single FOMC member or Reserve Bank president thought rates would be lower by yearend. For the Fed to actually cut rates the economy will have to weaken considerably and the inflation rate must continue to slide. That is not going to happen.

Stephen Slifer

NumberNomics

Charleston, SC

Stephen!

Do you have the feeling the tariffs will add to inflation?

Thanks.