May 23, 2025

All of a sudden the issue of tariffs has yielded to concern about budget deficits, debt, and rising interest rates. The catalyst for the change in focus was the combination of the credit rating downgrade of Treasury debt by Moody’s, and the 2025 budget bill passed by the House. Economists have been warning about an unsustainable path for deficits and debt for years. Because the issue has not yet created a financial crisis, it faded into the background. Until now. This problem is not going away, is getting worse, and could easily trigger a financial crisis at some point. Unfortunately, fiscal responsibility is not a hot topic in Washington these days.

Some economists have argued that because everybody already knows that the United States has a huge debt problem this past week’s action by Moody’s was not news. That is true to some extent. After all, S&P downgraded U.S. Treasury debt in 2011 and Fitch did the same thing in 2023. This past week Moody’s simply followed the lead of the other two credit rating agencies. While the problem may have been well known, people were not thinking about it. Now they are. The downgrade by Moody’s highlighted the problems of ever-growing budget debts and rapidly escalating Treasury debt outstanding.

Economists believe that policy makers should run a budget deficit by cutting taxes and boosting spending when the economy slips into recession to help it recover. But in good times they should then run a budget surplus to reduce the amount of debt outstanding. It has not worked that way. The last president to actually produce a budget surplus was Bill Clinton. He did so for four years from1998-2002 .

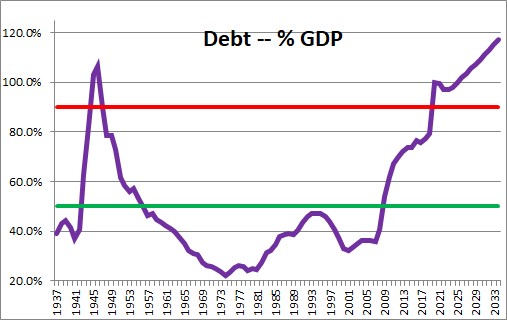

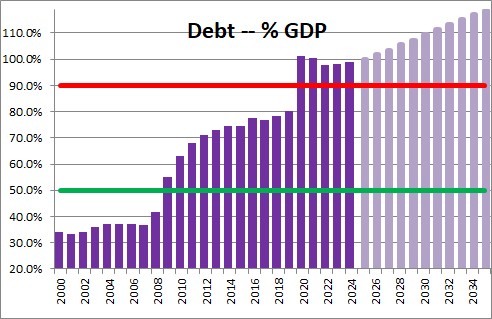

Exponential growth in debt began in the wake of the 2008-2009 recession. Prior to that time the debt to GDP ratio was 35%. By the end of that recession it had climbed to 55% and it has been rising steadily since. Economists suggest that a ratio of around 50% is sustainable.

Obama made an attempt to get the fiscal situation back on track in 2010 by appointing the bi-partisan Simpson-Bowles Commission. Nine Republicans and nine Democrats were charged with improving the fiscal situation in the medium term and achieving fiscal sustainability over the longer run. Surprisingly, the Commission reached an agreement. In the end, Obama rejected its recommendations because it cut entitlements too much. That was unfortunate. In the fifteen years since, nobody in Washington has expressed any serious concern about the rising debt burden.

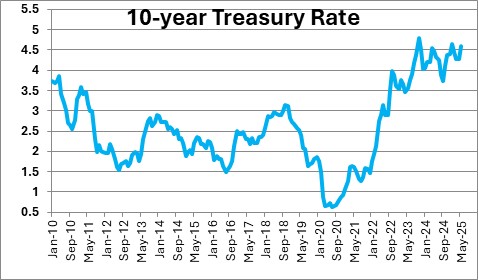

The downgrade by Moody’s is not just some academic exercise for economists. It has real-world consequences. This past week the yield on the U.S. 30-year bond traded above 5.0% and the yield on the 10-year climbed to 4.5%. This means that mortgage rates will return to the 7.0% mark. Corporations will be forced to pay higher rates for any long-term borrowing they require to finance investment. Rising rates will filter through the entire economy and slow growth.

On the heels of the debt downgrade by Moody’s, the Congressional Budget Office released its estimate of the impact of making Trump’s 2017 tax cuts permanent. The Committee for a Responsible Government indicated that the legislation would add $3.1 trillion to the debt outstanding over the coming decade. The fact that the revision was large does not mean that its earlier forecasts were way off the mark. When the CBO does its 10-year budget forecasts it is required to assume that current legislation remains in place. Its prior estimates assumed that the tax cuts would expire in 2025. The House budget bill makes those tax cuts permanent. That change accounts for the bulk of the additional $3.1 in debt outstanding between now and 2035.

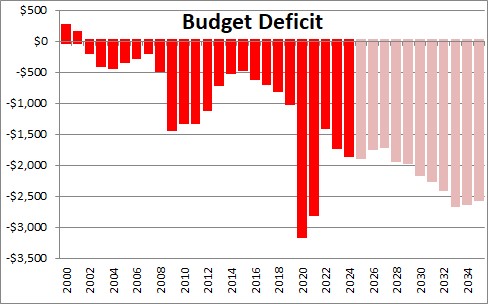

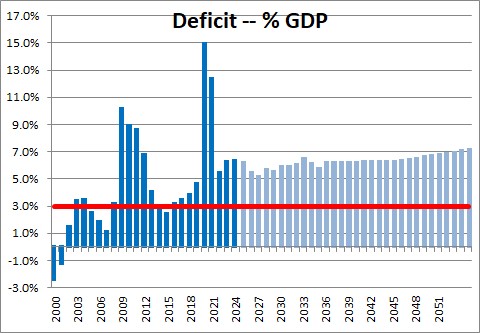

This additional debt comes on top of an already deteriorating fiscal situation. In January the CBO suggest that budget deficits would continue to grow steadily throughout the entire 10-year budget horizon.

Because the Treasury has to issue debt in the same amount as the budget deficit every year to pay its bills, the amount of debt outstanding continues to grow. As a result, the ratio of debt outstanding to GDP should reach a record-breaking 118% by 2035. The prior record was 106% at the conclusion of World War II.

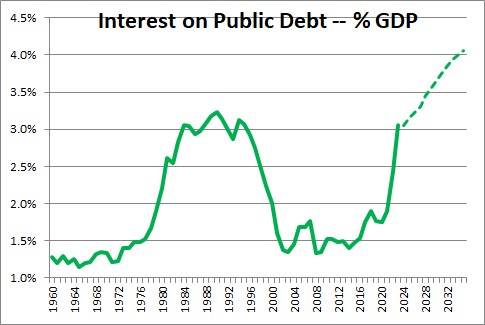

But budget deficits and debt may mean little to most Americans. Perhaps by focusing on the interest expense the issue may finally hit home. In January the CBO suggested that interest on the public debt as a percent of GDP would climb to a record 4.1% of GDP. The additional interest expense highlighted by the CBO in the budget analysis released this past week would boost that number to 5.2% of GDP by 2035. This is not sustainable. Every dollar spent on interest is one dollar less spent elsewhere in the budget for defense or infrastructure or education.

Finally, there is the issue of recessions. The CBO builds its forecasts assuming steady 2.0% GDP growth for the next ten years. It does not incorporate any recessions into its analysis. The most recent recession ended in April 2020 so the economy has been expanding for the past five years. Since 1960 the average expansion has lasted 6-1/2 years. The longest expansion on record was the one short-circuited by COVID in 2020. That lasted ten years. Thus, it is almost certain that the economy will dip into recession at some point between now and 2035. When it does, the deficits will climb dramatically as tax revenues shrink and government spending surges. It happens every time. Consider the chart below and the explosion of the budget deficits in the 2008-2009 and 2020 recessions. It will happen again when the next recession hits and the debt situation described above will get worse.

In our opinion, the budget situation is an accident waiting to happen in the form of an eventual financial crisis and the markets are correct in focusing on the problem. Our leaders in Washington need to realize that this is not a sustainable situation. Given the slim majority for the Republican party in the House of Representatives, it is unlikely that the Senate will be able to make substantial changes to the bill passed by the House earlier this week. Another year passes with little progress.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me