July 19, 2024

The markets seem to have concluded that the Federal Reserve will cut rates twice between now and yearend with the first cut occurring in September, and that Donald Trump will be the next president with Republicans in control of both the House and the Senate. That may come to pass but, in our opinion, neither the economic nor the political assertions are a foregone conclusion. The market is getting ahead of itself. We will soon get our first look at second quarter GDP growth, followed by two employment reports and two more CPI and PCE deflator readings prior to the Fed’s September FOMC meeting. On the political front the Democratic National Convention will be held August 19-22. While the nominee seems increasingly unlikely to be President Biden, who will it be? Vice President Kamala Harris? Some other candidate? Who will that person select as their Vice Presidential running mate? The Democrats could select two people who might well be more competitive in November. Perhaps that does not affect the outcome of the presidential race, but it could influence control of the House and the Senate. A one-sided market bet, such as what seems to be occurring at the moment, is completely unwarranted. On both the economic and political fronts the future is as murky as any time in recent memory.

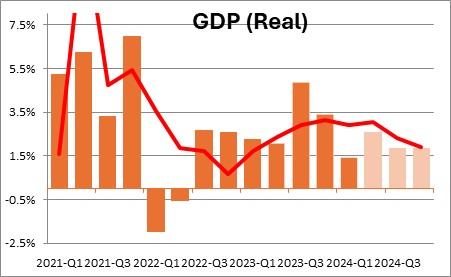

Starting with the economy, on Thursday we will get our first glimpse at second quarter GDP growth which is expected to be 2.5%. While that is a backward-looking number it would continue a string of generally stronger-then-anticipated GDP readings over the course of the past year. You will recall that the widespread expectation of a recession in the second half of last year was totally off base. The economy continues to defy expectations for the long-awaited slowdown. Virtually every economist, ourselves included, anticipates a second half slowdown. In our case to 1.7%. But the Fed should await more solid evidence than is currently available before cutting the funds rate.

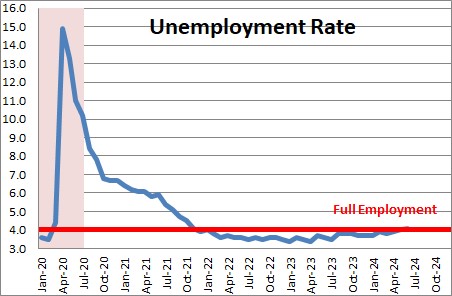

Following its meeting at the end of this month, the next FOMC gathering is September 17th and 18th. Two more employment reports are available between now and then. Will payroll employment gains continue to shrink? At the moment we look for an increase of 150 thousand in July. We expect the unemployment rate to decline 0.1% to 4.0% in that month. Fed Chair Powell has put renewed focus on the unemployment rate as a factor in determining the timing of the next rate cut. A decline to 4.0% in July would not be consistent with a September rate cut. But, as is always the case, our forecast could be completely off base.

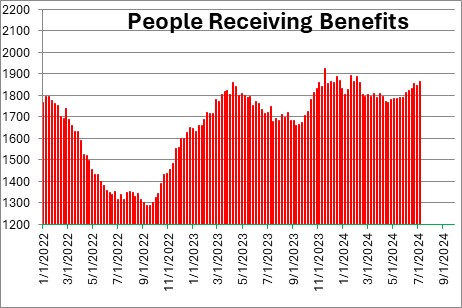

Thus far, the weekly data on the number of people receiving unemployment benefits are not suggestive of any significant softening in the labor market or a further increase in the unemployment rate.

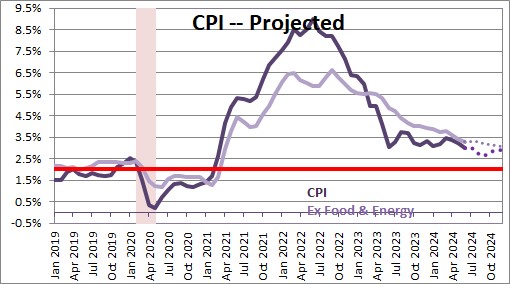

On the inflation front the core CPI has been slowing but, at 3.3% in the past year, remains far higher than the Fed’s 2.0% target. With a series of 0.2-0.3% gains each month in the second half of last year the year-over-year increases may not slow much between now and yearend. For what it is worth, we expect the core CPI to slip from 3.3% today to 3.1% by December. Is that enough evidence of a further slowdown in the inflation rate to warrant an early Fed rate cut? Not really.

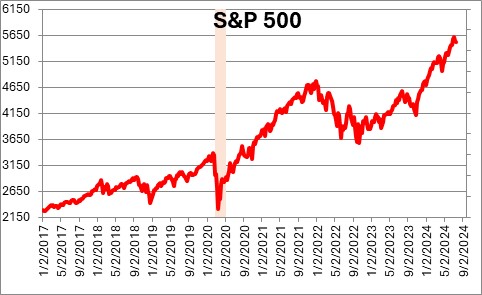

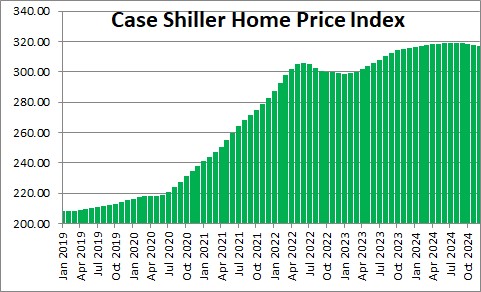

The Fed wants to correctly time its first rate cut. It does not want to prolong its high rate policy so long that the economy slows sharply or even falls into recession. That does not seem likely. The steady runup in both the stock market and home prices to record levels ensures that consumer net worth will also climb to a record high level which will almost certainly prevent that outcome. By the same token, a premature first rate cut runs the risk of re-invigorating the economy and preventing a further slowdown in inflation. That would destroy the Fed’s credibility as an inflation fighter. It needs further evidence of both a slowing economy and continuing improvement on the inflation front before lowering the funds rate. Why rush?

On the inflation front the attempted assassination of former President Trump and the outcome of the Republican National Convention suggest the possibility of a Republican sweep in November. While that is certainly a possibility, the Democrats can counter-punch. Press reports suggest that President Biden is close to bowing out of the race. But if not Biden, who? Kamala Harris? While perhaps a better candidate than Biden, it appears at the moment that she too would be soundly defeated by Trump. Beyond Biden and Harris there is a long list of potential candidates who might fare better than either of the other two. And while the top-of-the-ticket is important, the choice for Vice President is equally important. It seems to us that the American people would like something other than a Trump/Biden rematch. If the Democrats can put forward a couple of fresh faces would that alter the outlook for the November election? Who knows.

The reality is politics matter in determining economic policy. Right now we do not even know who the candidates are and the election is still four months away. No one, ourselves included, can confidently predict the economic outlook for 2025 and beyond. Big market bets at this point seem unwarranted. Meanwhile, the Fed should bide its time. If the economy slows and inflation continues to improve there is plenty of time to lower rates once those two things occur.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve, I’ve read comments from some analysts saying the payroll numbers are misleading because they don’t differentiate between FT and PT jobs. Can you shed some light on this? Thanks

Stephen, thank you for your clear-headed thinking on where we are now politically. The future is impossible to predict; so, we will see how things work out. Thanks again.

Darrel

Hi Roy. Sorry I missed your question earlier. It is true that the payroll employment data do not distinguish between FT and PT jobs. But the civilian employment data — which are used to calculate the unemployment rate — do make that distinction. The two series are derived from totally separate data streams. The problem is that they give widely different answers about what has happened to employment in the past year. Payroll employment (reported by employers) has risen 1.7%. Civilian employment (based on a survey derived by going around knocking on doors) has risen just 0.1%. Which is right? Typically, the two will vary from month to month, but over the course of time will give roughly even out. Not the case today. Most economists believe the payroll data are more accurate. Firms have no reason to lie about how many employees are on their payroll. Government workers going around knocking on doors asking about employment status may not always get truthful answers.

All that being said, the civilian employment data say that FT jobs are 83% of total employment. PT jobs are the remaining 17%. So the vast majority of jobs in this country are FT. However, over the course of the past year PT jobs have risen 7.2%. FT jobs have declined 1.2%. I would suggest that many of the jobs that have been filled in the past year have been filled with immigrants — legal and illegal. Those people might be working in typical part-time positions — gardeners, restaurant workers, retail stores, drivers, care givers. While many of these people would like FT employment, they may not have the skills required. It may also explain why average hourly earnings have been growing so slowly — giving more weight to these types of low paying jobs.

I hope this helps.

Steve

Hi Darrel. It really does seem to me that everybody is getting way ahead of the Fed. Job growth has slowed, but still at 160 thousand a month it is growing as fast as the labor force. That suggests that the unemployment rate is unlikely to keep rising and, at 4.1%, it still at full employment. The stock market and consumer wealth are at record high levels. Money market conditions are easier now than they were when the Fed started to tighten in March 2022. The core PCE deflator has slowed to 2.6% which is good, but between now and yearend it is likely to rise slightly(to 2.9%) rather than continue to slow. Everybody seems to think that the Fed will ease in September. Maybe. But I think they are being pre-mature. I see no reason to rush.

If they do ease in September, I wonder to what extent the move was taken more as a result of politics than economics. That pains me to say given all the years I spent at the Board of Governors of the Fed in Washington. But the Fed was about a year late in beginning its 2022 tightening initiative. Was that because they misread the situation and the underlying cause of inflation (which everybody else seemed to understand), or did politics keep them on the sidelines. I have had more questions about politics entering the equation under the current group than at any time in my career.

Best. Steve