September 27, 2024

This past week we got the annual benchmark revisions to GDP and the income data. GDP growth did not change appreciably, but income growth for the past year doubled from what had been reported previously. That changes the outlook. Prior to the revision it appeared that consumers could not sustain their current pace of spending. That is no longer true. It is also true that in the past year GDP has risen 3.0%. And despite the steamy pace of GDP expansion, the core CPI inflation rate has slowed from 4.4% to 3.3%. This suggests that the economy’s potential growth rate or economic speed limit is not 1.9%. Instead, it appears to have climbed to at least 3.5%. And if all of that is true, then a “neutral” level for the funds rate is not 2.9% as the Fed seems to think at the moment, but probably in a range from 3.5-4.0%. If the economy can expand at a 3.5% pace without giving rise to inflation why in the world is the Fed racing to ease?

Earlier this month the Federal Reserve reduced the federal funds rate by 0.5% from 5.3% to 4.8%. It also indicated that it intended to gradually reduce the funds rate to its longer-run equilibrium rate of 2.9% by 2026. But is the end point for the funds rate still 2.9%? We do not think so.

This past week we learned we GDP grew 3.0% in the past year. The widely followed Atlanta Fed GDPNow forecast for the third quarter is 3.1%. Thus, GDP growth is being sustained at a supercharged rate. There is no hint of a slowdown. Prior to the revision the income data were climbing slowly. Gross domestic income had grown 1.3%. But now through the miracle of revisions GDI has grown 3.5% in the past year. That is a monstrous revision that changes everything.

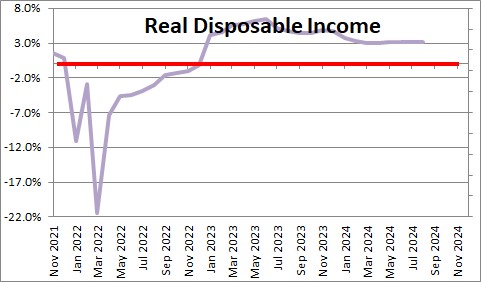

Prior to the revision it appeared that consumer spending would have to slow. Income was rising far more slowly than spending. That is no longer true. Real personal consumption expenditures have risen 2.9% in the past year. Real disposable income has risen 3.1%. Consumers can easily sustain a 2.9% pace of spending forever. If the consumer is not on the cusp of a dramatic cut in spending, why is the Fed easing?

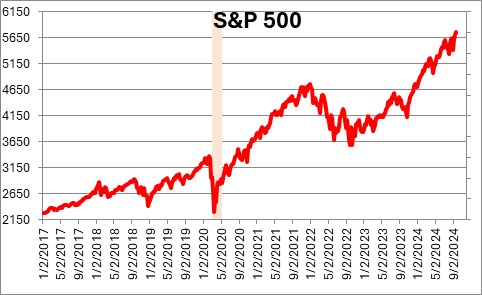

At the same time, the stock market continues to sizzle. It has risen 34% in the past year and is at a record high level. That seems puzzling if the economy is poised for a slowdown. But as part of the GDP revision corporate profits were revised upwards substantially . Prior to the revision corporate profits had risen 8.0% in the past year. Post revision corporate profits rose 10.8% and that growth rate is accelerating. That, too, seems to fly in the face of a need for substantial Fed easing.

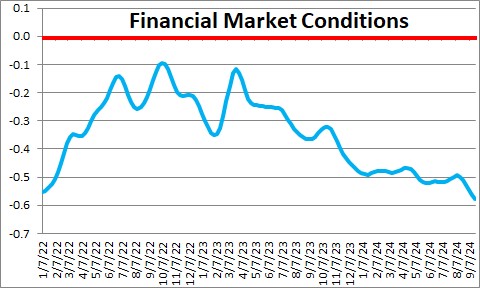

Meanwhile, the Federal Reserve Bank of Chicago publishes an index of financial market conditions. It attempts to quantify credit market conditions, leverage, and risk. Positive readings have historically been associated with tighter-then-average financial conditions, while negative values have historically been associated with looser-than-average financial conditions. At -0.58 It is lower than it has been at any time since November 2021.

All of this makes us wonder what the end point is for the funds rate. The Fed suggests that it is 2.9%. To reduce rates from 5.3% initially to 2.9% means that monetary policy was far too tight initially and a dramatic, rapid cut in rates was necessary. But exactly how tight was monetary policy? As noted earlier, GDP growth in the past year has been a speedy 3.0%. Gross domestic income has risen at an even faster 3.5% rate. The stock market is at a record high level. Financial market conditions are relatively loose. The economy seems to be doing just fine. So perhaps a 5.3% funds rate was not that restrictive after all and the funds rate does not need to be 2.9% to be “neutral”. We suggest that a neutral funds rate today is much higher, say 3.5-4.0%.

Unfortunately, the neutral funds rate is not observable. Economists can run models based on history and make an educated guess. But it is just that – a guess. While the median forecast at the Fed currently is 2.9%, the range of forecasts stretches from 2.4-3.8% which highlights the degree of uncertainty. The Fed can only tell if it is getting close by observing the many economic indicators that are available. Right now those indicators remain robust and suggest that the neutral rate may be 3.5%-4.0%.

And maybe that makes sense. If the economy can grow at a 3.0% pace and the inflation rate slows from 4.4% to 3.3%, then the economy’s potential growth rate is not 1.9% as many believe at the moment, but something far higher. In the past year the labor force has risen by 0.4% while productivity has risen 2.7%. If one adds those two growth rates one could conclude that the economy’s potential growth rate has risen to 3.1%. Given GDP growth of 3.0% in the past year and a slowing inflation rate, it seems fairly obvious to us that potential growth rate has climbed and is likely in a range from 3.0-3.5% — not 1.9%.

And if that is the case, the neutral funds rate is not 2.9%. We would side with those Fed officials who think it is somewhere in the 3.5-4.0% range. If that is close to the truth a rapid, prolonged period of rate cuts does not seem warranted. Another 0.5% cut in November to the 4.3% mark seems to fall into the too-much, too-soon category.

Stephen Slifer

NumberNomics

Charleston, S.C.

Stephen,

Very interesting analysis. Thank you so much for your brilliant conclusion.

Darrel