November 9, 2018

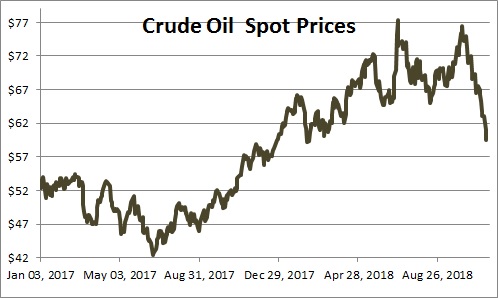

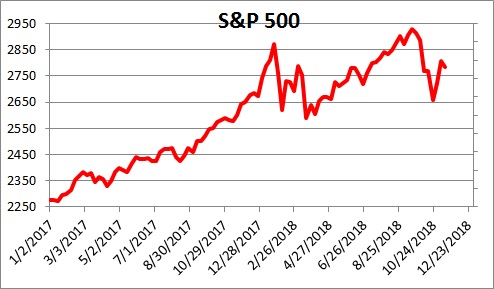

Up and down and …up again? The stock market captured everybody’s attention in October as fears emerged that the U.S. economy might be overheating along with worries about the pace of rate hikes by the Fed, the election, and trade. But the oil market has been on an even wilder ride. In mid-August oil prices dipped to $65 per barrel. By early October they soared 17% to $76. Since that time, they have fallen steadily to $59.50 — a drop of 22% in a single month. What in the world is going on and, more importantly, what’s next?

In late August and September, the run- up in crude prices appears to have been driven by robust 4.2% U.S. GDP growth in the second quarter, accelerating wage pressures, a fear of higher inflation, and the possibility of faster and/or additional Fed tightening than had been anticipated. Those same fears precipitated a 10% correction in the stock market as investors worried that the Fed’s rate hikes might short-circuit the nearly 10-year old expansion.

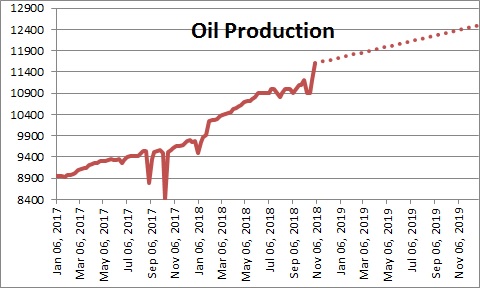

As oil prices rose, oil-producing countries turned on the spigot. OPEC countries, Saudi Arabia in particular, significantly increased production. U.S. shale oil drillers boosted output even more dramatically. U.S. production jumped 6.5% within a matter of weeks.

At the same time, global economic activity ratcheted downward. When Trump began imposing tariffs in February global investors quickly concluded that the U.S. was in a far better position to withstand a trade war than any other country around the globe. Foreign investment money flooded into the U.S. stock and bond markets. The dollar increased by 10%. The U.S. economy was on a roll. But the higher dollar negatively impacted emerging economies. Because they must pay for their imported raw materials in dollars, their cost of goods sold quickly jumped 10%. Currencies for emerging economies fell sharply. Their stock markets declined more than 20%, It became clear that GDP growth in emerging economies – China in particular – was going to slow. Indeed, in mid-October the IMF lowered its GDP forecast for emerging nations in 2019 by 0.3%.

With reduced demand and surging supply, oil prices collapsed. They fell 22% from a high of $76.50 in early October to $59.50 within a month.

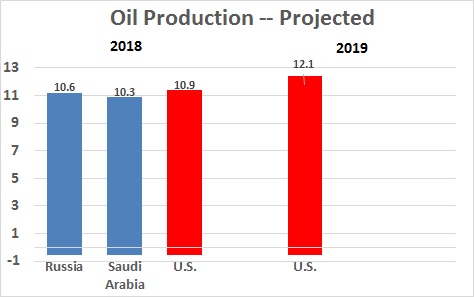

What is astounding about this process is the speed with which oil-producing countries can step on the gas when they choose to. That is certainly true for OPEC. Technological developments in the past seven years like fracking and horizontal drilling have not only made the U.S. a player in the global oil market, the U.S. became the world’s largest producer of crude oil in March of this year, surpassing previous industry giants Russia and Saudi Arabia. Furthermore, the Energy Department anticipates an additional 10% increase in U.S. oil output in 2019 which will further widen the production gap between the U.S. and the rest of the world. Production can adjust up or down by huge amounts in a hurry.

The political implications of this development are enormous. While OPEC countries will continue to have a significant influence on oil prices around the globe, they no longer will have the ability to cripple the global economy by sharply curtailing supply and lifting oil prices to $100 per barrel or beyond. The speed with which U.S. producers can adjust output has eliminated that outcome.

While inflation fears in the U.S. are on the upswing it is quite clear that in the near-term those price pressures will be alleviated by falling oil prices.

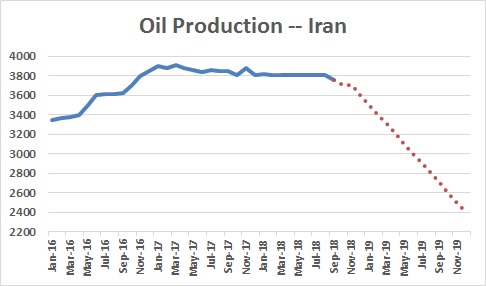

This may not be the end of the story. U.S-imposed oil sanctions on Iran went into effect on November 5. Iranian production has held steady in recent months at about 3.8 million barrels per day but with a hint of emerging weakness in September. Trump’s goal is to eliminate Iranian oil exports from the world marketplace. It is not clear the extent to which that will happen. Saudi Arabia has pledged to counter any Iranian shortfall, but much of its surplus capacity has been idle for a long period of time and may, or may not, be easily brought on line.

In our opinion, oil prices may well be approaching a near-term low point for several reasons. First, OPEC countries have already begun to talk about cutting production. Given the precipitous drop in prices U.S. producers could do the same thing. Second, Iranian oil exports could fall sharply. Third, global demand could be stronger than anticipated. The oil market has been on a roller coaster for the past six weeks, and it is not at all clear that the ride is over.

Stephen D. Slifer

NumberNomics

Charleston, S.C.

Follow Me