February 11, 2022

There still seems to be a belief that the Fed will quickly bring inflation back to the 2.0% mark within a couple of years. Maybe. But not without a recession. The Fed obviously does not want that outcome. But how exactly to bring inflation back under control without one? Our bet is that the Fed tightens policy slowly, in which case inflation remains elevated for years to come. The money supply is so far above where it should be that it will take years for it to return to a level that will stem the inflation run-up. Oil prices have soared to $90 per barrel. They are not coming down. Food prices have soared. They are not coming down. Then there is the wage problem. There is such a shortage of workers that firms are eagerly offering higher wages to get the workers they need. For workers, real earnings are declining. They are pushing hard for higher wages to keep pace with the faster rate of inflation. Where to find the additional workers to short-circuit this process? The shortage of rental housing is so acute that rents are rising rapidly. That is not going to end until builders can crank out enough apartment units to make rental units more readily available. But where do builders find bodies? We are not looking for a recession any time soon. But we are suggesting that the notion of a quick return to 2.0% inflation is grossly misguided. If that is the case, bond yields are going to climb significantly. We expect them to be 3.6% by yearend versus 2.0% currently.

Currently, the bond market believes that over the next ten years inflation will average 2.5% (as measured by the difference between the nominal yield on the 10-year note versus its inflation-adjusted counterpart). A couple of years of 4.5% inflation followed by eight years of 2.0% inflation would produce that result. The markets still believe that the Fed can make that happen. And it could. But not without raising rates sharply and rapidly. We expect seven 0.25% rate hikes this year. That would boost the funds rate to 1.75% by yearend. But we also expect inflation to be 5.6%. Thus, the real funds rate at yearend would be -3.8%. A significantly negative real rate is not going to slow down the economy. Nor is it going to be sufficient to bring inflation back to the 2.0% mark. Not in 2022. Not in 2023. And probably not in 2024.

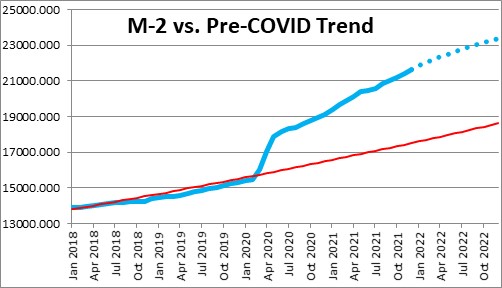

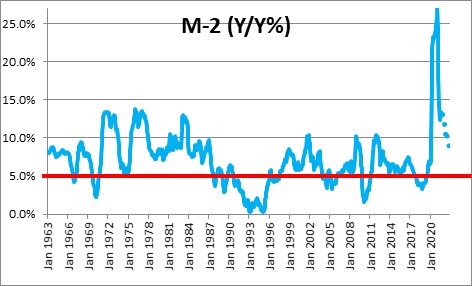

The primary reason we never believed that the run-up in inflation was temporary is because of exploding growth in the money supply. As of December, the level of M-2 was $4.8 trillion above the level consistent with its trend growth rate of 6.0% That represents $4.8 trillion of surplus liquidity that is readily available to consumers and businesses to spend.

The Fed could counter this problem by shrinking the money supply. The problem is that the Fed has never allowed that to happen. There was one period back in the early 1990’s where money growth basically got to 0%. That is as slow as it has ever been. But if the Fed allows 0% growth in the money supply, it will not return to its trend level until the end of 2025. Against that background it is difficult to see how inflation will return to the Fed’s 2.0% target any time soon.

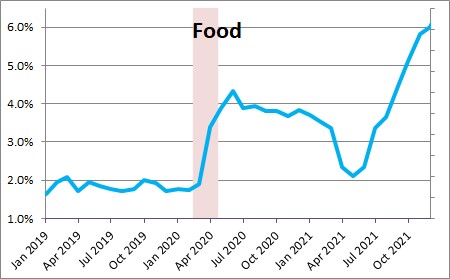

Economists love to exclude food and energy prices when they talk about the inflation rate because they are volatile and can quickly rise but soon thereafter just as rapidly retreat. Not this time. In the past year food prices have risen 6.0% as drought conditions curtailed the supply of fresh fruit and vegetables as well as feed stock for beef, pork, and chicken. Maybe these conditions will change as the year progresses, but commodity prices for food continue to climb which will get soon get passed through to consumers in the grocery store. There is no relief anywhere in sight.

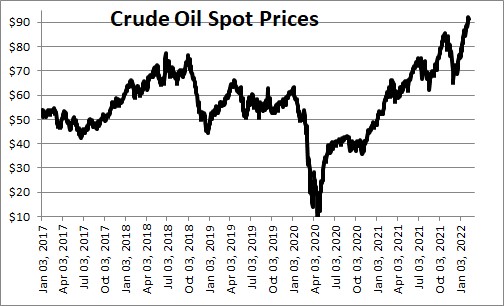

Energy prices have soared as crude oil prices have surged above the $90 per barrel mark. They are not going to retreat any time soon.

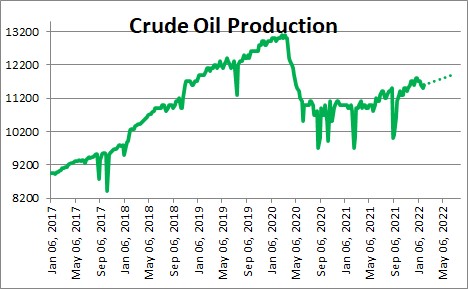

Crude oil production at 11.6 million barrels per day remains far less than the 13.0 million pace prior to the recession. And the Energy Information Administration expects production to remain far below that rate at least through the end of 2023 (at which time it is expected to be 12.6 million barrels). Why is this happening? Basically because the Biden team is doing everything in its power to curtail the production of fossil fuels.

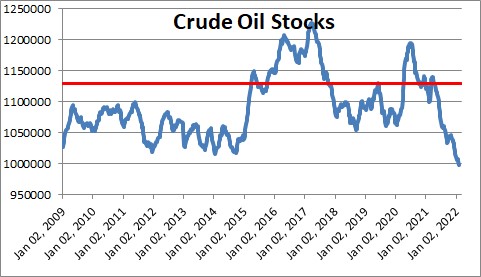

This reduced pace of U.S. oil production has pushed crude oil inventories to their lowest level since 2008. Think oil prices are coming down any time soon? Think again.

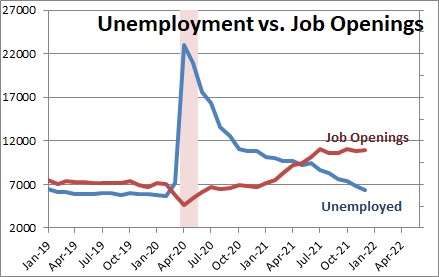

Another serious problem in bringing inflation back under control is the labor market. Job openings exceed the number of unemployed workers by 4.6 million. Qualified workers are in extreme short supply. So where to get those required workers?

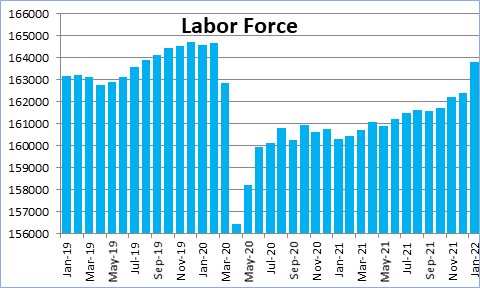

The labor force is currently 0.9 million workers smaller than it where it was prior to the recession. But a number of workers have retired in the interim. It is hard to see how enough workers can be found amongst the available labor pool. It could be filled by increased immigration, but politically that sounds like a nonstarter.

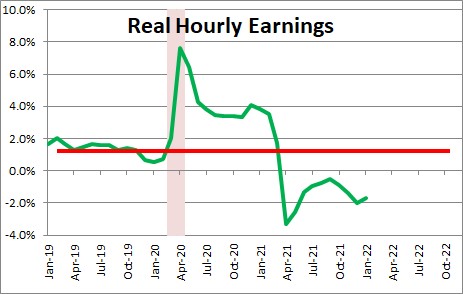

Thus, employers will continue to dangle higher wages in front of prospective employees. Hourly wages have risen 5.7% in the past year, but inflation has risen even faster and, as a result, real wages have declined by 1.7%. Workers and unions have noticed and are aggressively seeking wage hikes to counter the higher inflation rate. If inflation this year is likely to be 5.6%, then wage hikes need to exceed the 6.0% mark to boost real wages back into positive territory. But wages are two-thirds of a firms’ overall costs. If wages rise 6.0%, employers will attempt to raise prices to counter the higher labor cost. Think inflation is coming down any time soon?

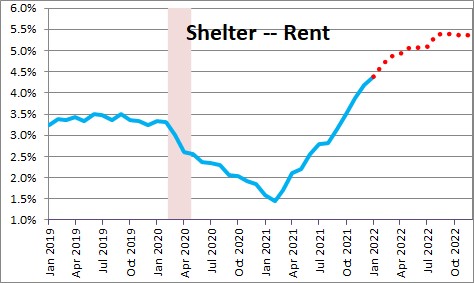

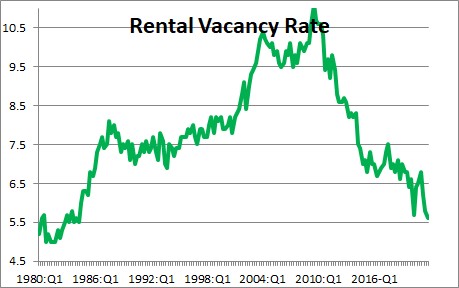

Finally, in the housing market the shelter component of the CPI – basically rents – has risen 4.4% in the past year and has been accelerating. This situation is going to get worse as the year progresses because there is an acute shortage of rental properties.

The vacancy rate amongst rentals is 5.6% which happens to be the lowest since the mid-1980’s. No wonder rents are rising! This solution is only going to be rectified when builders can ramp up the supply of both single-family and multi-family homes. But where, exactly, are they going to find the workers to do that? It is hard to imagine this rent situation can get under control any time soon. That is a big deal because housing is one-third of the entire CPI. We expect rents to rise 5.4% in 2022.

The basic problem is that the hole is too deep. The Fed grossly inflated the money supply and, under the mistaken idea that the run-up in inflation was temporary, it has made no effort to shrink its balance sheet and curtail growth in the money supply. As a result, the inflation genie is out of the bottle. It can get inflation back in check without triggering a recession, but not any time soon.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me