January 5, 2017

The trick in economic forecasting is figuring out how much importance to attach to the data for any given month. And sometimes that requires examining a broad range of economic indicators rather than just one. So, as we start a new year perhaps it is worthwhile to sniff the air for possible threats to our view that the economy will perform well in 2018.

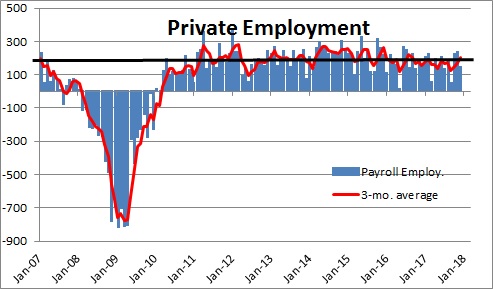

The December employment report was on the soft side with a reported jobs gain of 148 thousand. However, that follows much-larger-than-expected increases in October and November of 211 thousand and 252 thousand, respectively. Thus, the 3-month average increase in employment is now 204 thousand which compares to an average increase for the past twelve months of 171 thousand. Payroll employment, like every economic indicator, can be volatile from month to month. With the 3-month increase still quite solid there is no evidence of any emerging weakness in the labor market.

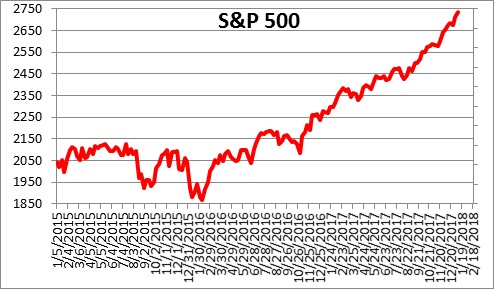

Then there is the stock market. It has picked up in early 2018 right where it left off last year. It has risen 3.5% since the beginning of December and reaches a record high level every couple of days. That will continue to bolster consumer and business confidence which should encourage both groups to spend freely in the early stages of 2018.

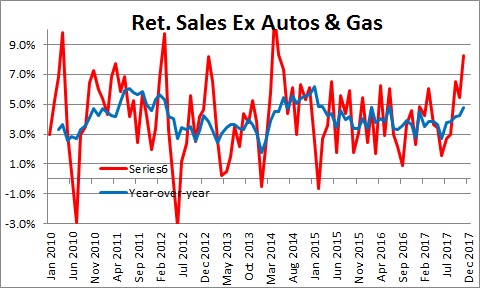

Thus far we only have retail sales data through November, but they appear to be on a roll. The overall retail sales data incorporate auto sales which can be volatile from month to month, and gasoline prices which can be distorted by price changes. Thus, most economists will look at “core” sales which exclude those two volatile categories. In the past year such spending has risen at a 4.8% pace. But with gains of 0.8%, 0.4%, and 0.9% in the September-November period such spending has skyrocketed to an 8.2% pace in the past three months. We do not yet know much about December, but car sales in that month climbed 2.0% to a 17.8 million pace, and retailers apparently registered particularly robust Christmas sales. Thus, there is no reason to believe that the pace of sales softened in the final month of the year.

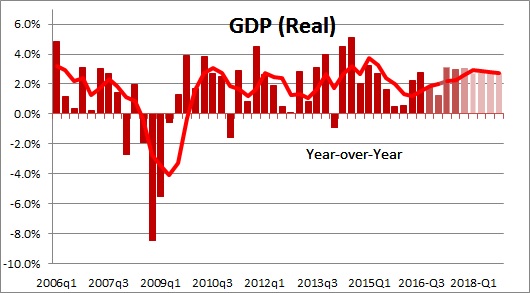

Putting all of this together we continue to expect fourth quarter GDP growth to increase 3.2%. Most estimates we have heard range from 2.9-3.9%. Thus, it is likely that GDP growth will register growth in excess of 3.0% for the third consecutive quarter. Our first look at that growth rate will be Friday morning, January 26. If that forecast is accurate, we feel quite comfortable in anticipating GDP growth for 2018 of 2.9%.

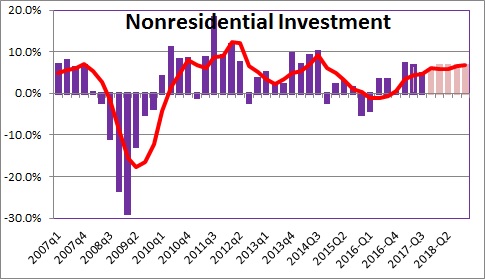

The recent acceleration in GDP growth is primarily attributable to business leaders’ decisions to spend more money on investment, whether that is on technology to enhance productivity or building a new factory. After languishing for three years investment spending surged in the first three quarters of last year to 6.0% pace and is expected to continue its enhanced pace in the fourth quarter. There can be little doubt that this pickup is a direct result of economic policy decisions. Business people anticipated early on that the proposed combination of cuts in individual and corporate income tax rates, an ability to repatriate overseas earnings at a favorable tax rate, and significant relief from the stifling regulatory environment, would significantly bolster GDP growth and corporate earnings in the months and quarters ahead. And now, of course, those anticipated policy changes have been enacted.

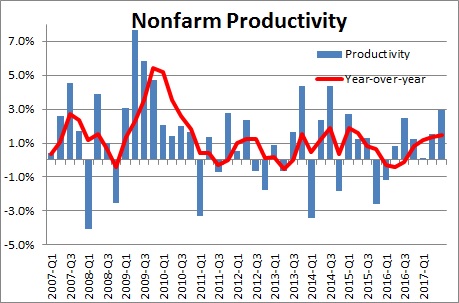

We have noted on many occasions that a pickup in investment spending will boost growth in productivity and that, too, seems to be happening. After barely growing for a couple of years, productivity climbed 1.5% in the second quarter of last year and a hefty 2.9% in the third quarter. The year-over-year increase has risen to 1.5%. Remember, in the past three years productivity growth averaged just 0.8% but it appears to be expanding more rapidly. As long as investment spending continues its upward trajectory, productivity growth will also grow more rapidly. And if that is the case, our economic speed limit is likely to climb from 1.8% today to perhaps 2.8% by the end of the decade. That means faster growth in our standard of living.

There is nothing new in the analysis just presented. But our job is to read to economic tea leaves and give you, our readers, a heads up when something surfaces that might short-circuit our particularly rosy economic climate. In our view the December employment report was nothing more than statistical noise. Everything else from consumer and business confidence, the stock market, investment spending, and GDP growth are starting out 2018 with as much momentum as they had in the final few months of last year.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me