May 24, 2013

What is the underground economy? Basically, we are talking about business activity that is not reported to the government . People who reside in that world are generally paid in cash. It includes folks engaged in illicit transactions like the drug dealing and prostitution. But also it includes an increasingly wide variety of people who are engaged in ordinary jobs such as yard maintenance, nannies, home repair, tutors, house cleaners, and pet sitters.

The existence of an underground economy is not new. It is also a very difficult concept to measure. Edgar Feige, an economist at the University of Wisconsin who has been studying the underground economy for 35 years says that the shadow economy is about $2 trillion today which makes it about double what it was in 2009. That means it has gone from 8% of GDP to 12% of GDP during that period of time.

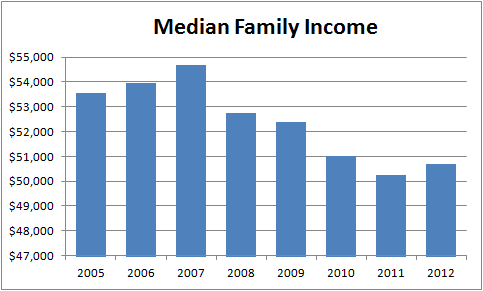

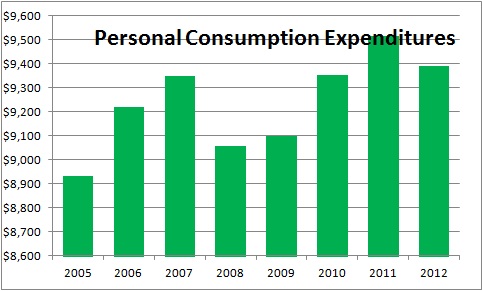

Growth of the underground economy can explain an important mystery about the current economy. The percent of Americans officially working has dropped sharply and median household income remains well below where it was in 2007.

But yet consumption spending is higher now than it was prior to the recession. How can that be?

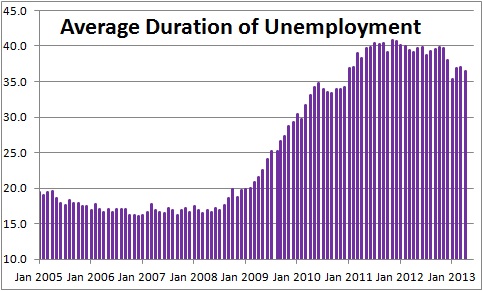

During recessions it is common for people to work on the side while collecting unemployment benefits to make ends meet. But given the severity of the recent recession and the sluggish nature of the recovery it appears that many more people have moved into this underground economy and they are staying there for increasingly lengthy periods of time.

For example, the average duration of employment today is about 37 weeks. While that is slightly shorter than it was at its peak, the reality is that the number of weeks the average unemployed worker has been jobless has not been this long since the depression. They have exhausted their savings. They are getting desperate. They will take any job that will pay them a few dollars – even if it is under the table.

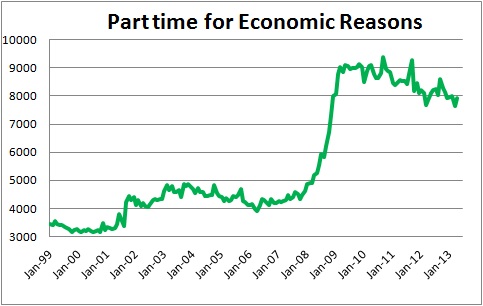

Many will work several part time jobs just to make ends meet even though they really want and need full time employment. Eight million people are in such circumstances today, double what it was prior to the recession.

Employers find that paying people off the books has some appeal as well. They can avoid paying benefits like health care or retirement. They do not have to pay their share of the payroll tax.

Because unemployed or underemployed workers can find some way to makes end meet, the increasing size of the underground economy can be helpful. The pain for these people is less acute than one might expect given the level of the unemployment rate.

However, the underground economic has important costs. First, there is the lost tax revenue. The IRS estimated that $500 billion of taxes were lost last year from unreported wages. When one considers that the budget deficit this year will be about $750 billion, the reality is that the deficit would be both considerably smaller and quite manageable if the IRS could capture some of this lost income. We would not need high tax revenues.

Second, firms that do not have to pay payroll taxes, workers’ compensation, or health care benefits to their off-the-books employees have a competitive advantage over those firms that do play by the rules. That is certainly not in the spirit of fair play.

Third, those people who are being paid in cash almost certainly do not get Social Security or health care benefits. When these workers or their families get sick and go to the hospital, other taxpayers foot the bill. When they go on welfare because they do not have Social Security the same thing will happen.

The underground economy has always existed and there can be little doubt that its size has increased considerably in the past several years although, admittedly, it is difficult to measure. And while there are short-term benefits for those people who have been without a job for a protracted period of time, its increasing size and the accompanying loss of tax revenue is an indication that the economy is not functioning as well as it should.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me