December 11, 2020

The most surprising aspect of the economy in 2020 was the extraordinary rebound in growth following the quarantine-induced collapse in economic activity in the second quarter. Jobs growth consistently outpaced expectations which caused the unemployment rate to fall at a breathtaking pace from 14.7% in April to 6.7% by November. Fueled by 2.7% mortgage rates the housing market accelerated to the fastest pace of sales in more than a decade. Enhanced by the $1,200 tax refund checks in the spring, consumers spent at a pace faster than they did during the decade-long expansion that ended in March. Economic growth in 2021 will be further boosted by another soon-to-be-passed virus-relief/stimulus package.

One of the principal worries in this past year was when a vaccine would be available and whether people would be willing to take it. Now we know. A vaccine is already on its way. And with three former presidents and Dr. Fauci willing to take it, concern about its safety should soon disappear. The rapid spread of the virus in the past month could cause a temporary growth slowdown early in the year as some cities and states choose to re-implement stay-at-home orders, but robust growth is expected thereafter. The stock market seems to agree with this relatively optimistic outlook and has surged to a series of record high levels. American consumers and businesses have proven once again to be remarkably resilient in the face of adversity.

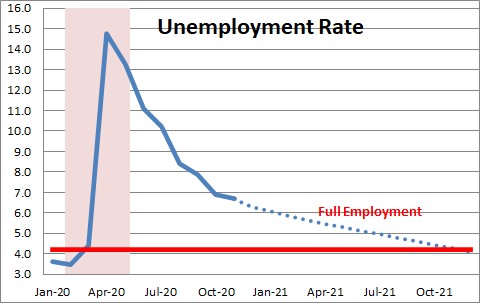

Following a mind-boggling loss of 22 million jobs in the two-month March/April period, the U.S. economy recovered 12 million of those jobs in the next seven months. As a result, the unemployment rate fell much more rapidly-than-expected from 14.7% in April to 6.7% by November. Its speed of descent was astonishing. In June, the Fed believed that the unemployment rate would be 9.3% at the end of the year. By September they lowered that estimate to 7.6%. It is currently at 6.7% in November and should reach the 6.5% mark by yearend. The Fed has more than 1,000 of the smartest economists in the business and they completely missed the mark this year. Consumers spent more freely than expected which required businesses to keep hiring. People worried about the election and when a vaccine might become available, but their concern did not seem to impact their willingness to spend, nor did it retard businesses willingness to hire. Hats off to both American consumers and businesses.

While GDP should return to its pre-recession level soon, perhaps as early as the first quarter of next year, the unemployment rate will be slower to do so. However, it will reach full employment much sooner than is currently expected. In September, the Fed said that it did not expect the unemployment rate to fall to its full employment level of 4.0% until the end of 2023 – three years from now. That forecast is way off the mark. We look for the unemployment rate to hit that mark by December 2021 – two years ahead of the Fed’s time table. We believe that the Fed and most private sector economists continue to underestimate the ability of Americans to adapt to adversity.

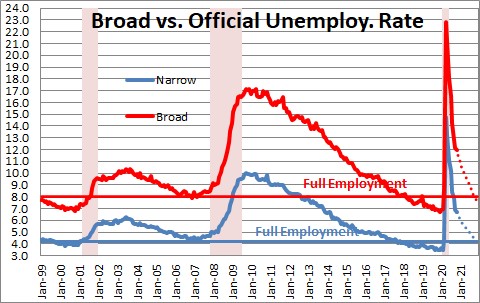

Some economists suggest that many unemployed workers (restaurant workers and former hotel employees in particular along with retail workers) will become so discouraged that they simply give up looking for a job and drop out of the labor force. But those workers are captured in a broader measure of unemployment called U-6. Like the official measure it, too, has fallen rapidly since the recession ended and now stands at 12.0%. That seems high. But because it is a much broader measure of unemployment, its full employment threshold is also higher, probably about 8.0% which is where it stood going into the recession. If we are correct, both measures will drop to their full employment levels by the end of next year.

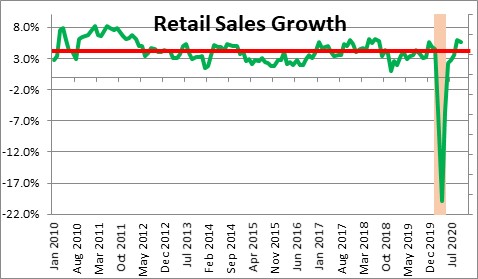

Like most economic indicators, retail sales collapsed during the recession. But in the subsequent seven months, fueled by the proceeds of their $1,200 tax refund checks, spending surged and sales are now faster than they were in the months prior to the recession. Indeed, in the past year — which includes both the drop in retail sales during the recession as well as the subsequent rebound — retail sales have risen 5.7%. In the recent decade-long expansion retail sales rose, on average, 4.3% annually.

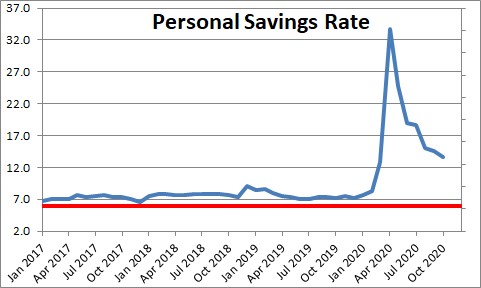

Consumers have not cowered in the wake of the pandemic and the recession. They spent freely and are going to keep spending. The $1,200 tax refund checks boosted income in April. With the economy essentially in lockdown they had no place to spend that additional income and, as a result, the savings rate soared from around 6.0% normally to 33.7% in April. As the economy reopened it has fallen to 13.6%. But 13.6% is still a very high level and consumers have plenty of ammo to spend in the months ahead if they choose to do so.

With the savings rate at 13.6% consumers have $2.7 trillion of savings. If the savings rate were normal at 6.0%, savings would be $1.2 trillion. This means that consumers today have surplus savings of $1.5 trillion – funds that are available for them to spend. Prior to the recession, consumer spending rose $0.7 trillion in 2019. Thus, the current level of savings can support consumer spending for the next two years. Consumers appear poised to spend rather than hang onto their surplus savings.

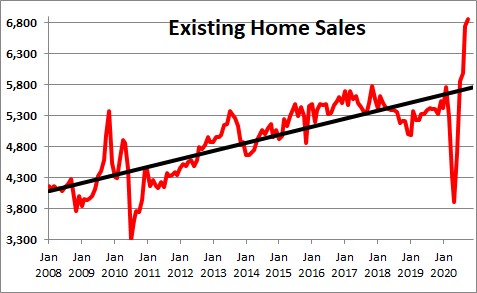

One of the things they have been choosing to spend their money on is housing. Indeed, the economic rebound has clearly been led by housing. Existing home sales have surged to 6,800 thousand which is the fastest pace since 2006. The average time between the listing of a home with a realtor and its actual sale is just 21 days – the shortest period of time ever. At the same time, the number of homes on the market is about one-half of what realtors need. Any way you slice it, housing is hot. And if more homes were available for realtors to sell, sales would likely be 7,500 thousand rather than 6,800 thousand.

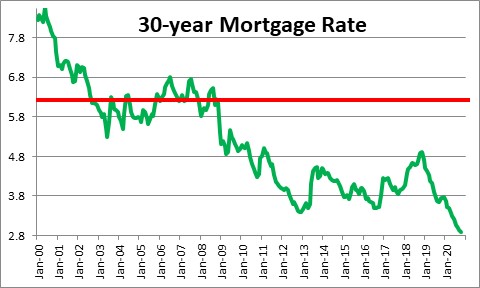

Why is housing on fire? Easy. At 2.9% the 30-year mortgage rate is the lowest on record. That rate is attracting buyers in droves. In addition, in the past nine months workers have found they can work from anywhere and are exiting large, expensive rentals in big cities and purchasing less expensive homes in the suburbs and in resort communities like Lake Tahoe, the Jersey shore, and the mid-Atlantic beaches. With rates likely to remain extremely low for at least another year, housing will remain hot throughout 2021.

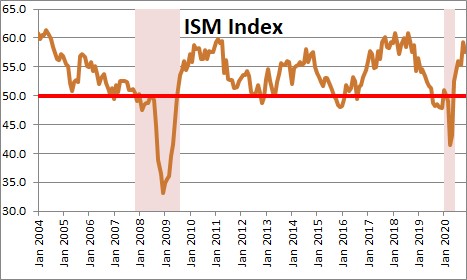

Now, consider the manufacturing side of the economy. The Institute for Supply Management each month publishes an index which reflects the pace of economic activity in the manufacturing sector. This index has climbed rapidly in the past seven months and its October level was the highest since September 2018.

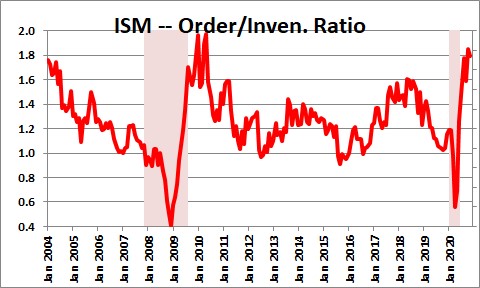

The index consists of a number of sub-components such as orders, production, inventories, and employment. The overall index is being fueled by the orders component which is at its highest reading since January 2004. Meanwhile, production is being constrained by supply difficulties. Manufacturers and their suppliers are operating in reconfigured factories, but absenteeism, short-term shutdowns to sanitize facilities, and difficulties in hiring workers are causing strains that will likely curtail manufacturing growth early next year. Thus, orders are flowing in. Production is increasing but at a considerably slower pace. As a result, both manufacturers and their suppliers are drawing down inventories to satisfy as much of the demand for their goods as they can. In fact, if one takes the ratio of the orders component to the inventories index, it is at the highest level in a decade. Manufacturers need to significantly boost the pace of production to satisfy demand. The rising backlog of orders will keep the factory sector humming for months to come.

In the spring nobody knew how quickly a vaccine might be available. Now we know. One vaccine will start being distributed this month and others will follow in the first half of the new year. It typically takes 10 years for a new vaccine to be developed, tested, and approved. That time table has been compressed into a single year. Some suggest that the availability of the vaccine has been pushed forward solely for political reasons. Nonsense. Science made this happen. Given their ability to map the human genome, scientists were quickly able to identify the specific gene that was the cause of the problem. Once isolated, it became much easier than in the past to find a vaccine that would halt its ability to spread. We all owe thanks to those biomedical engineers that compressed the normal vaccine development process from ten years to one. Even more astounding is the fact that the vaccines available thus far have proven to be more than 90% effective which compares to the ordinary flu vaccine which is 40-60% effective. Technology saved the day.

Some people worry that the American people will be afraid to take the vaccine, or not know which vaccine is the safest. But if three former presidents, President-elect Biden, and Dr. Fauci are all willing to take the vaccine, it is hard to believe that the fear factor will linger for long.

So let’s review the evidence. Every month businesses continue to hire workers and the unemployment rate falls. While the economy is not back to full employment it should be there by the end of 2021. We do not know what the Fed thinks, but the end-of-year unemployment rate is already a full percentage point lower than it expected in September. Surely, its time table for achieving full employment is much sooner than December 2023. As jobs are created, consumer income will continue to rise and provide fuel for additional spending. Such spending will be supplemented as consumers draw down their surplus savings. If mortgage rates remain close to their current level the housing sector will thrive in 2021. And as more workers become available and COVID-19 diminishes in importance, the manufacturing sector can step on the gas and boost production to satisfy demand. Finally, one vaccine is available currently and others will follow in the months ahead. No wonder the stock market has set sequential record high levels every couple of weeks.

Then, add to the mix another fiscal stimulus/virus relief government spending package which is in the works. With President-elect Biden, Democrats, Republicans, incoming Treasury Secretary Janet Yellen, and Fed Chair Jerome Powell all pushing for such a package its passage is inevitable. Exact dimensions and composition are being negotiated. If a package is passed in December it should be regarded as an interim bill to be followed by an even larger package once the new president takes office. We currently expect a 5.5% rate of GDP expansion in 2021. Additional government spending could boost that estimate. While a stimulus package will enlarge the budget deficit and increase U.S. Treasury debt outstanding, those adverse consequences will have to be dealt with later.

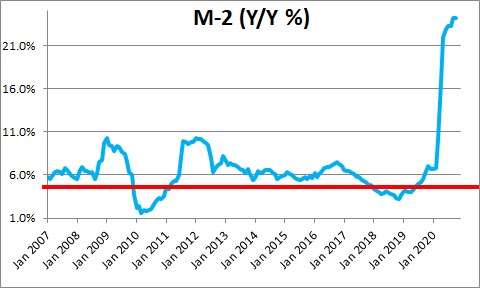

On the inflation side, a dramatic acceleration in the rate of growth in the money supply should boost the inflation rate in 2021. Fueled by Fed purchases of U.S. Treasury securities in the spring, money growth has surged from a 6.0% pace prior to the recession to 24% — a pace not seen since 1983.

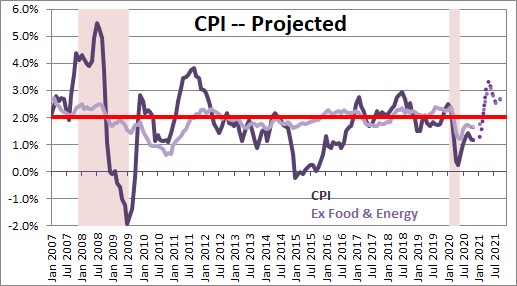

Such rapid growth in money will not only provide fuel for consumers to spend and businesses to expand, but will likely boost the inflation rate next year. We look for the core CPI to increase from 1.7% this year to 2.7% in 2021. The Fed will ignore this moderate pickup in the rate of inflation. Indeed, in the short-term it wants inflation above its 2.0% target to make up for its shortfall in earlier years.

COVID could dent growth in early part of the year but a vaccine will soon slow its rate of spread. At the same time the economic fundamentals described above appear solid. Thus, any GDP slowdown early in the year should be viewed as temporary. The level of GDP is not yet back to where it was prior to the recession. But it is closing the gap quickly and could reach that level in the first half of next year. The unemployment rate is not yet back to full employment but it is moving in that direction quickly and should reach it by the end of 2021. The economy continues to mend quickly and the economic outlook appears bright.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me