December 6, 2024

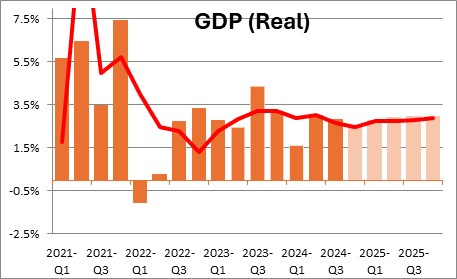

The 2025 outlook seems particularly bright characterized by 3.0% GDP growth, the unemployment rate steady at the 4.0% mark, additional slowing in the core inflation rate to 2.3% , and a further reduction in the funds rate from 4.75% today to 3.75% by the end of next year. This rosy outlook is benefitting from tailwinds that already exist or will likely be created by the new Trump administration. It will result in faster growth in our standard of living, enhanced corporate earnings, and a further run-up in the stock market. That is about as good as it gets.

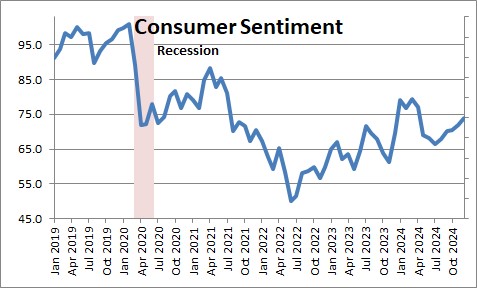

The consumer seems to be in particularly good shape. It is clear that Trump is going to shake things up in Washington with respect to taxes, tariffs, deregulation, deportation of illegal immigrants, and dramatic cuts in government spending and that uncertainty is weighing on the various measures of consumer sentiment which remain below their pre-recession levels.

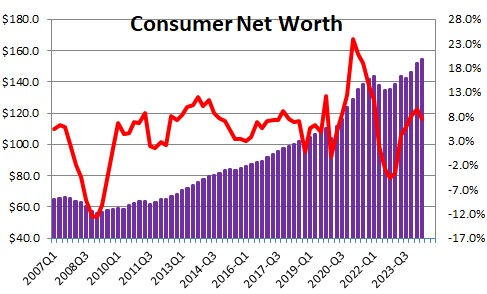

However, consumers continue to spend. The stock market is surging and home prices continue to climb. Those two factors have boosted consumer net worth to a record high level.

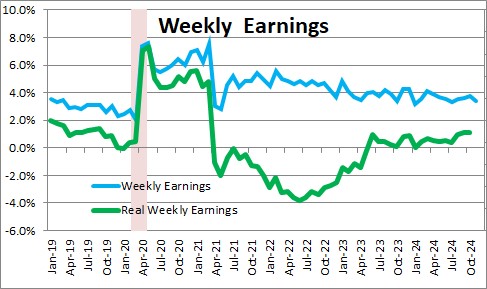

Furthermore, real earnings have begun to turn upwards. During the peak inflation years weekly earnings were rising by about 5.0%, but with inflation at 9.0% real weekly earnings were declining. Consumer purchasing power was being steadily eroded by inflation. Going into a grocery store today with $100 buys two bags of groceries. A year or so ago that same $100 would have bought three bags of groceries. Consumers have been forced to tighten their belts and find ways to stretch their paychecks. In mid-2022 the inflation rate began to fall and real weekly earnings turned upwards. Today weekly earnings are growing by 3.7% but inflation has dropped to 2.6%. As a result, real earnings are once again rising by about 1.0% which is lifting consumer spirits and boosting their purchasing power. Rising real earnings are the first tailwind propelling the economy upwards in 2025.

Trump seems to have a mandate to cut taxes. The 2017 tax cuts are scheduled to expire at the end of 2025 but these tax cuts are certain to be extended. Trump has also talked about eliminating taxes on “tips” and on Social Security earnings. Those two measures are far more controversial and may not make it past Congress. But any way one slices it, the tax cuts will be extended with perhaps some additional tax benefits in the final package. Tax cuts are tailwind number two.

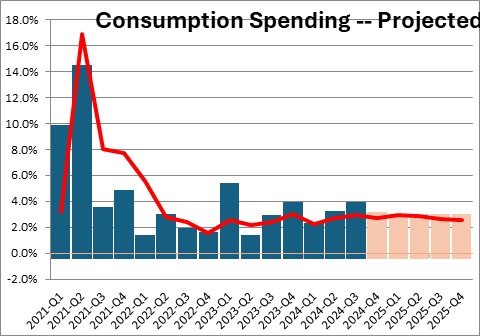

Given the above, we expect consumer spending to rise 2.6% in 2025.

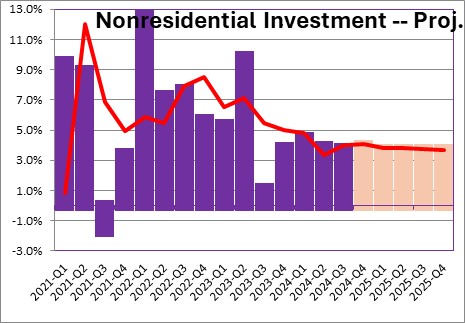

Investment spending has risen 4.0% in the past year. That growth has been largely attributable to technology which makes sense. The economy is growing rapidly. The labor market is tight. Firms need to boost output. If they cannot find additional bodies to hire, they turn to technology and that latest software program to help their existing employees become more productive. Firms have little choice. If they choose not to spend the money on technology, the competition will. Keep in mind that AI is just getting started. Virtually every firm on the planet is looking at ways to use this new technology and make their firm more productive. Expanded spending on technology is the third tailwind boosting the pace of economic expansion.

Then there is deregulation. This was a hallmark of Trump’s first term in office. Outdated, confusing, and overlapping regulations make running a business challenging. Firms need an army of lawyers and accountants to comply with these laws. Businesses of all sizes will benefit but particularly smaller firms who do not have the resources to fully understand the regulatory environment with which they are expected to comply. Deregulation will be the fourth major tailwind for the U.S. economy.

Now Musk and Ramaswamy are heading up the new Department of Government Efficiency. They are charged with the goal of shrinking the federal government. Ramaswamy has talked about firing 50% of the 3.0 million federal bureaucrats. While that goal may be difficult to achieve, clearly a significant reduction in the federal government headcount is coming. Some of the top-ranked government workers are very good at their jobs and will be welcome in the private sector. And shifting them from the inefficient government sector to the more productive private sector should boost productivity. Shrinking the size of the federal government is the fifth tailwind for the U.S. economy.

For this reason, we expect nonresidential investment to continue to climb at about a 4.0% pace in 2025.

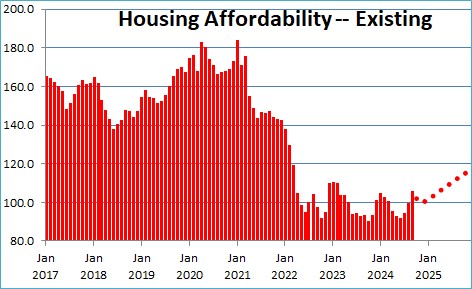

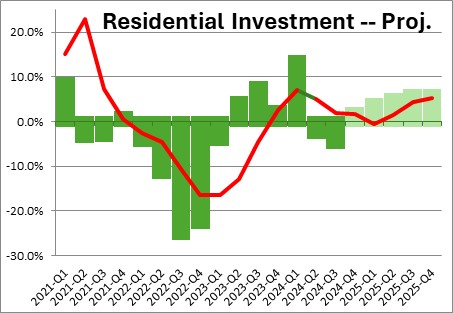

Residential investment and home sales have had a rough year. For the year as a whole residential investment rose 2.0% but 2025 should be more promising.

Housing affordability is determined by three factors – growth in consumer income, mortgage rates, and home prices. If the economy continues to crank out jobs and wages climb, consumer income will grow. The combination of a further slowdown in the inflation rate and additional cuts in the funds rate by the Fed will cause mortgage rates to fall from 6.75% today to 5.75% by the end of next year. Home prices have slowed and should climb by about 3.0% next year. As a result, housing affordability should increase steadily throughout 2025. Currently a median-income-earning household has just enough income to qualify for a mortgage on a median-priced house. By the end of next year that same median-income-earning household will have 15% more income than required. As affordability increases, home sales will climb.

We expect the residential investment portion of GDP to grow by 6.0% in 2025.

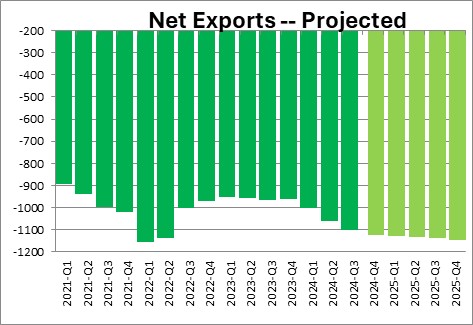

Trade is more complicated. As part of Trump’s “Make America Great Again” theme, he wants to bring jobs and production back to the U.S. In the past year, the U.S. economy has grown rapidly which means that imports grew rapidly. The rest of the world grew far less rapidly. Exports grew but more slowly than imports. Thus net exports, or exports minus imports, got progressively more negative and subtracted 0.5% from GDP growth.

At the same time Trump wants to halt the flow of illegal immigrants into the U.S. and wants to eliminate the amount of fentanyl being smuggled into the country. His solution is tariffs. He has talked about 25% tariffs on all goods imported from Canada and Mexico, and as much as 60% tariffs on goods from China. While eye-catching, it is abundantly clear that tariffs will not rise that much. A 25% tariff on goods from Canada and Mexico would be devastating for those two countries and would plunge them into a deep recession. That explains why Mexican President Sheinbaum indicated a sudden willingness to do more to stop the flow of illegal immigrants into the U.S. from Mexico. Prime Minister Trudeau arrived at Mar-a-Lago a couple of days later to discuss the situation. Nobody knows where this will end up but it is likely that the proposed stiff tariffs on Canada, Mexico, China, as well as other countries will be reduced or eliminated via concessions on other issues favorable to Trump.

The bottom line is that growth in both exports and imports will slow next year, and net exports will level off and neither add to nor subtract much from GDP growth in 2025.

Putting all of this together gives us a GDP forecast for 2025 of 2.9%. The consensus seems to be for a gain of about 2.0%.

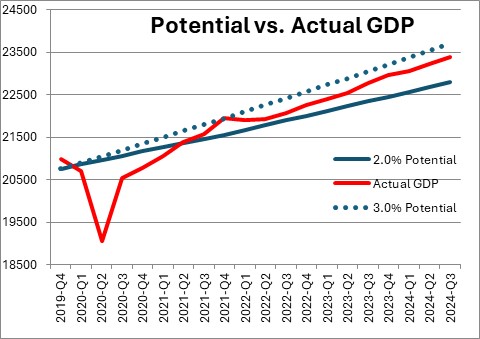

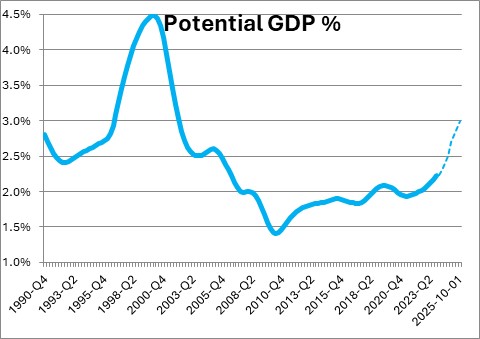

That is probably because others believe the economic speed limit is 2.0%. Grow more quickly than that and the inflation rate will rise. But the level of actual GDP grow has been well in excess of potential GDP for the past couple of years and yet the inflation rate has been steadily slowing. How can that be? We suggest that the economic speed limit, known as the economy’s potential growth rate, has risen from 2.0% to 3.0% (the dashed line).

Economists estimate potential GDP growth as the sum of the growth rate of the labor force (0.8%) and the growth rate of productivity (1.2%) and conclude that potential GDP growth today is 2.0%. But in the past six quarters productivity growth has accelerated to about 2.5%. As explained earlier, the labor market has been tight. Firms cannot hire enough qualified workers so they turn to technology to make their existing workers more productive and thereby boost output. And AI is in its infancy. If we assume that going forward productivity growth is 2.2% rather than the 1.2% pace assumed above, then potential growth has jumped from 2.0% to 3.0%. While some may remain unconvinced, consider the fact that in the mid-1990’s potential growth climbed at a rate in excess of 3.0% for six years. Why? Because the internet had just been introduced. A technological change boosted potential GDP growth for a protracted period of time. Why can’t the same thing happen now with AI? We believe that faster growth in productivity and potential GDP is the sixth tailwind lifting the economy in the coming year and beyond.

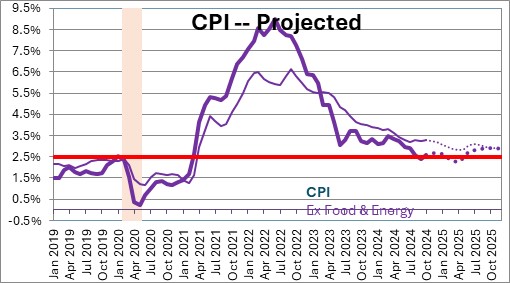

The CPI inflation rate has steadily slowed from its 9.0% peak in mid-2022 to 2.6%. The Fed is thrilled. When inflation began to climb it said that the increase in inflation would be temporary and, in fact, it has slowed from 9.0% to 2.6%. But when the Fed said that the rise in inflation would be “temporary” consumers thought that prices would eventually decline. If the price of gasoline climbs from $3.00 to $4.00, and somebody says that will be “temporary”, the expectation is that the price will eventually return to $3.00. Consumers are focusing on the level of prices. The Fed is focusing on the rate of growth of prices. Those are two very different concepts. The reality is that prices never fell. According to the CPI prices on average are 22% higher today than they were prior to the recession. That is why consumers are upset. Their purchasing power has been eroded by the run-up in inflation and those prices are never going to decline.

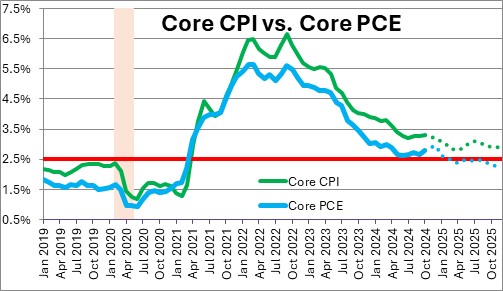

We believe that the inflation rate – the rate of increase of prices – is going to slow further. Indeed, we expect the core CPI to slow from 3.3% currently to 2.8% by the end of next year. We talk primarily about the CPI because everybody is familiar with it. But the Fed follows the less widely known core personal consumption expenditures deflator. Without going into the details of the two inflation measures, the difference in their growth rates is consistently about 0.5%. If the CPI slows to 2.5%, the core PCE should be about 2.0%. We expect the core PCE deflator to slow from 2.8% currently to 2.3% by the end of next year.

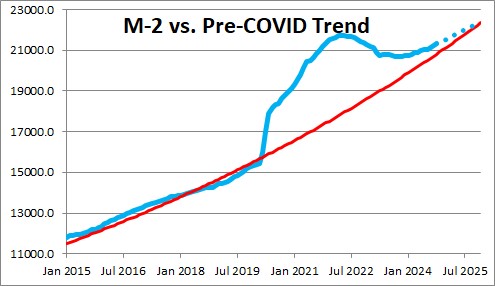

The primary reason for continuing disinflation is reduced growth in the money supply which is simply a measure of liquidity in the economy. It grows at roughly a 6.0% pace. When the economy tanked in 2020 the Fed purchased $4.5 trillion of securities. It kept buying long after the recession ended in April 2020 which provided the fuel for the run-up in inflation. The Fed did not stop buying securities until March 2022. At that point there was $4.0 trillion of surplus liquidity in the economy. No wonder we had an inflation problem! The Fed has since begun to shrink its balance sheet and has eliminated much of the surplus liquidity but, in our opinion, it was 1-1/2 years too late in starting that process. Because the Fed is still shrinking its balance sheet the remaining surplus liquidity should soon be eliminated which will allow the inflation rate to fall close to the desired 2.0% pace by the end of 2025.

A second factor contributing to the inflation slowdown is reduced growth in the rent component of the CPI, which accounts for one-third of the entire index, The rent component is calculated using home prices, but with a lag of about one year. Thus, the recent slide in home prices should keep the rent component of the CPI slowing through this time next year and reduce the inflation rate by perhaps 0.3%.

The upward shift in productivity growth should keep labor costs in check in 2025. Nominal wages are rising by about 4.0%, but with inflation likely to slip to 2.5% unit labor costs – or labor costs adjusted for the increase in productivity will climb by just 1.5%. An increase in labor costs of that moderate amount is perfectly consistent with a 2.0% inflation target.

Finally, Trump’s proposed tariffs could boost the inflation rate somewhat. As described earlier, the proposed eye-popping tariffs may simply be a tactic to force China, Mexico, Canada, and others to make changes in their own countries — like reducing illegal immigration, slowing the flow of fentanyl into the U .S., and increasing military spending. In the end we expect tariffs to boost the inflation rate next year by about 0.3%.

As we see it, the Fed will continue to reduce the funds rate in 2025 until it reaches what it considers to be a “neutral” funds rate. But nobody knows what level of the funds rate is actually neutral. The Fed today believes that the funds rate is neutral when it is about 1.0% higher than the core CPI. If the core CPI rises 2.5% (and the core PCE deflator 2.0%), then a neutral funds rate should be about 3.5%. If the inflation rate continues to slow in 2025, the Fed should be in a position to gradually reduce the funds rate from 4.75% today to roughly 3.75% by the end of next year which should be close to a neutral rate.

With GDP growth of roughly 3.0% and numerous tailwinds at its back, the economy appears to be in great shape going into a new year. Combining rapid GDP growth with a 4.0% unemployment rate, gradually shrinking inflation, and further rate cuts by the Fed, it should be a very good year.

Stephen Slifer

NumberNomics

Charleston, S.C.

Stephen, thank you for your optimistic view of 2025. Your analysis seems based in solid economic thinking, as usual. If one is to believe the pundits these days, the future looks grim. I really appreciate reading your comments because in the past you have always been right on the money.

I’ll be following your analysis as the months pass in 2025.

Take care.

Darrel

Thanks Darrel,

All the best to your and your family during the upcoming holiday season.

Steve