September 7, 2018

The markets fear many things one of which is the shape of the yield curve. The yield curve is simply the difference between long-term interest rates and short rates. That sounds like something that only an economist could love. But it matters – to economists and to you. Why? Because if it inverts it could be a sign that a recession is rapidly approaching. Why that is the case? Is it likely to happen any time soon? Rest easy. That long-awaited recession will not be on our doorstep until 2022 at the earliest.

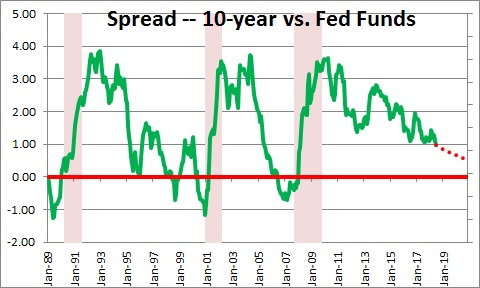

Today the yield on the 10-year bond is 2.9%. The overnight federal funds rate is 1.9%. Subtracting one from the other, long rates are 1.0% higher than short rates. That means that the yield curve has a positive slope which is the case about 99% of the time. Some economists use different short-term interest rates to make the comparison. Some like to look at the difference between the 10-year bond and the 2-year note. Others think that it is better to use the 10-year bond and the 3-month bill rate. Pick whatever short-term interest rate you want. They all tell the same story.

Why does the yield curve typically have a positive slope? Because long-term securities are riskier than short-term ones. The long-term bond holder must wait longer for the repayment of principal, If the bond holder must sell a bond prior to maturity they might have to sell it at a reduced price. To compensate for this risk, long-term bonds almost always pay higher interest rates than short-term instruments.

Why does the yield curve invert? Typically, it happens because the Fed has tightened too much. Perhaps the economy is overheating. Perhaps inflation is picking up rapidly. If the Fed falls behind the curve it must raise rates quickly to catch up. But the economy does not respond to higher interest rates for at least a year. As a result, the Fed often goes too far, and the economy slips into recession. Historically, the yield curve inverts about one year prior to the onset of recession. That is why economists attach so much significance to an inverted yield curve.

What has been happening lately? The yield curve has been flattening for the past nine years. In June 2009 when the recession ended long rates were 3.5% higher than short rates. Today the difference has shrunk to 1.0%. Most economists fear that additional Fed tightening later this year and next will raise short rates by 1.5% and cause the yield curve to invert. They conclude that a recession is brewing by 2021. Sorry. We don’t buy it.

In our world there are two necessary conditions for a recession.

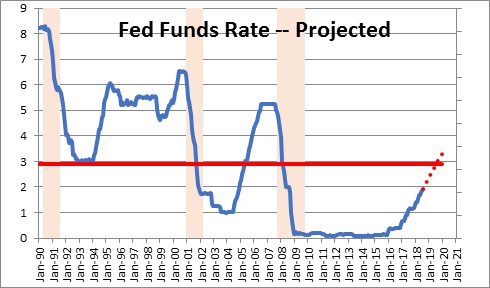

- The Fed raises the funds rate to 5.0% or higher.

- The yield curve inverts.

Most economists believe that Fed policy is neutral – it is neither stimulating the economy nor trying to slow it down – when the funds rate is about 3.0%. Today it is 1.9%. If the Fed tightens six more times between now and the end of next year in 0.25% increments, the funds rate will have risen to 3.4% which makes it just slightly higher than neutral.

But the economy does not swoon just because the funds rate reaches neutral. In the past 50 years the U.S. economy has never gone into recession until the funds rate is above 5.0%. For example, going into the last recession the Fed raised the funds rate to 5.25% before the economy succumbed. The funds rate was even higher going into earlier recessions. Thus, 5.0% is a pretty good place for us to begin a recession watch. If at the end of 2019 the funds rate is 3.4%, we are not even close to the 5.0% danger point.

What about the yield curve? Won’t it invert if the Fed tightens raised short rates by another 1.5%? Probably not. Think of the 10-year note as the average of a series of ten 1-year notes purchased back-to-back. Thus, it becomes clear that if the Fed raises short-term interest rates, long-term interest rates will rise as well. Second, bond holders are sensitive to the inflation rate. If inflation rises, the amount they will get paid at maturity will be worth less than if inflation had not risen. If the inflation rate rises between now and the end of next year, the yield on the 10-year note should rise as well.

At the end of next year, we believe the funds rate will be 3.4%. The yield on the 10-year note will have risen from 2.9% today to 4.0%. Hence, the yield curve will have a positive slope of 0.6% (compared to a positive slope of 1.0% today). The yield curve will be flatter, but it will not invert. Thus, neither condition necessary for a recession will have been achieved. The funds rate will be at 3.4%, still way below the 5.0% danger point. And the yield curve will still have a positive slope of 0.6%. A recession will not happen in that world.

Let’s go out one more year to the end of 2020. What might that world look like? Let’s assume that the Fed raises short rates four more times in that year and boosts the funds rate to 4.4%, still below the 5.0% danger point. We expect the yield on the 10-year note to be 4.8%. The yield curve will have a positive slope of 0.4%. Still no danger of recession.

Make no mistake. The yield curve matters. A lot. And when it inverts because Fed policy has become too tight, we will be warning about an imminent recession. But if the yield curve inverts later this year it will be inverted for the wrong reason. With the funds rate at 3.3% Fed policy will not be too tight. Rather, the curve will be inverted because bond holders have pushed long rates below short rates. Right now, foreign investors are piling into the United States because of dueling tariffs. They believe that the U.S. will weather a trade war better than anybody else. That makes dollar-denominated assets – both stocks and bonds – extremely attractive. Historically, the yield on the 10-year note averages 2.2% higher than the inflation rate. Over the next 10 years market participants expect the inflation rate to average 2.1%. So, based on history, we would expect the yield on the 10-year note to be 4.3%. It isn’t. It is 2.9%. If the yield curve inverts any time soon, it will be because long rates are too low, not too high. That does not sound like a warning shot to us. Rest easy. Clear sailing until 2022.

Stephen Slifer

NumberNomics

Charleston, S.C.

Outstanding analysis, will read this again at the end of next year! Thanks for your insightful knowledge, Stephen!