January 18, 2010

The economy continues to show signs of life. Third quarter GDP growth came in at an anemic, but still positive, 2.2% pace. Fourth quarter growth should be about 3.5%. The stock market has rebounded sharply. The housing sector has leveled off. And the financial markets have stabilized. However, the economy is still not producing jobs, and 10.0% of the work force is unemployed.

It is important to recognize that a significant portion of second half growth was attributable to government programs designed to stimulate the economy. For example, in the past year the Fed has purchased $900 billion of mortgage backed securities. That action helped to push 30-year mortgage rates to a record low level of 4.5%, which was exactly what the Fed intended when it implemented the program. But the Fed has indicated that it intends to cap its buying of such mortgages at $1.25 billion, and it expects to complete the remaining purchases by the end of March. As the Fed slows down and eventually halts its buying, 30-year mortgage rates are going to rise. If they rise from 5% to 6%, for example, monthly payments will climb $150 per month to $1,500. In order to afford the 5% mortgage, borrowers would need family income of about $54,000 per year. To afford a 6% mortgage, borrowers would need annual income of $60,000. Some buyers are going to be forced out of the market.

Another life support program offered by the government is the $8,000 tax credit for first time homebuyers and a $6,500 tax credit for some repeat buyers. But both of these programs are scheduled to end relatively soon — the $8,000 tax credit at the end of April; the $6,500 credit at the end of June.

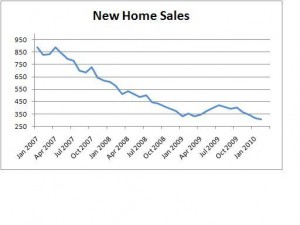

Thus, the housing sector is going to hit with a double whammy in the spring – higher mortgage rates, and the end of the tax credits for first time homebuyers. Without a doubt much of the apparent strength in housing during the fall reflected the appeal of both 4.5% mortgage rates and the tax credit. Look what happened to new home sales when homebuyers thought the program was going to expire at the end of November. Home sales had climbed from a 350 thousand pace in the spring to 400 thousand during the summer and fall, only to fall right back to 350 thousand in November. And that was only with the expected expiration of the tax credit. Now couple that with mortgage rates of 6% instead of 5%. It is not a pretty picture, particularly if one factors in the likelihood of additional foreclosures. The longer the unemployment rate stays high, foreclosures will continue to climb as unemployed workers eat through their savings. While none of this portends a collapse in housing, it certainly emphasizes how difficult it will be to muster much improvement.

Clearly, the government could extend these programs for another six months or so. But that raises two very important issues. First, at what point does the government need to step away and let the economy fly on its own? We cannot have an economy supported by the federal government forever. Second, can we afford to extend these programs? The budget deficit for this fiscal year is likely to be about $1.3 trillion or roughly the same as it was last year.

If all of this is not enough, throw into the mix the fact that the Census Bureau is expected to hire one million temporary workers over the course of the next couple of months to take the 2010 census. So look for inflated employment numbers every month between now and April, and be sure to adjust the published figure for the change in federal government hiring. But then all of those people get laid off by the end of May. The census, therefore, is acting as yet another temporary government stimulus program which should allow additional time for the economy to heal. Time for consumers and small business to pay down debt. Time for corporations to take advantage of cost savings and productivity gains to bolster earnings. And time for banks to raise additional capital and improve their balance sheets. By June the economy should be in a better position to fly.

Follow Me