March 7, 2025

The chaotic nature of the Administration’s implementation of tariffs, immigration policy, and federal government layoffs is creating considerable uncertainty for consumers and business leaders. Thus far the economic damage has been minimal, but if it persists consumers are not only likely to feel nervous they might actually pull back on their pace of spending. Employers may do more than shorten the length of the workweek for existing employees. They might actually start to lay off some workers. This heightened uncertainty is not good for the economy. If it continues it will translate into reduced growth and higher inflation. Trump claims that the economy is experiencing some short-term pain in exchange for long-term gain. But will that really be the case?

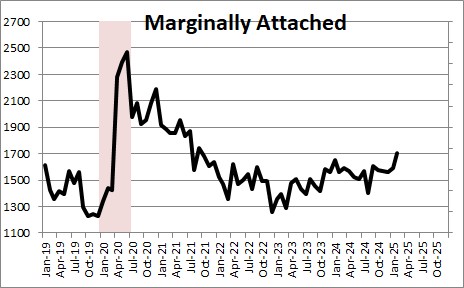

The headline figures from the employment report for February – 151 thousand new jobs and a small 0.1% increase in the unemployment rate were roughly in line with expectations. But buried in the details were signs of weakness. First of all, part time employment increased sharply in February while the number of full time workers declined. At the same time, there was a big jump in the number of workers that say they were seeking a full time position but were only able to find part time employment.

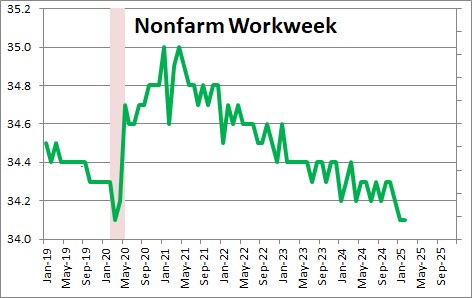

Also in the employment report the workweek was unchanged in February at 34.1 hours, but it fell 0.1 hour in each of the two previous months and is currently well below the 34.4 hour mark that existed prior to the recession.

It appears that employers are concerned about an economic slowdown in the months ahead. They have chosen to reduce the hours worked of their existing employees, and when they need to hire someone they only offer them a part time position rather than a full time job. Firms have been reluctant to lay off workers thus far, but if the uncertainty continues and consumers begin to cut back on their pace of spending, businesses may be forced to lay off workers in the months ahead.

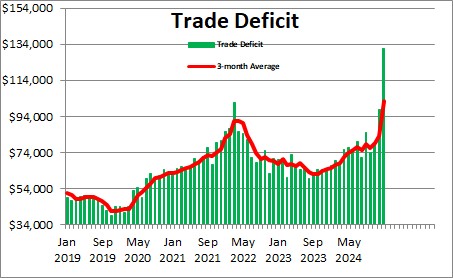

In the trade report for January imports surged as businesses raced to import necessary production materials ahead of the tariffs. As a result, the trade deficit jumped by $33 billion in that month to a record $131.4 billion. But, presumably, the imports in January replace imports that would have been made in subsequent months which suggests the trade deficit will shrink in the months ahead. But because the trade deficit enters into the calculation of GDP, the Atlanta Fed’s GDP Nowcast for the first quarter is negative 2.4%. By way of contrast, the NY Fed’s GDP Nowcast for the same quarter is +2.7%. That is quite a difference. For what it’s worth we are looking for first quarter GDP growth of 1.5%. Take your pick. The point is that economic uncertainty is causing business to alter their behavior in ways that we have never seen before which make it difficult for economists, business leaders, and consumers to fully understand what is happening.

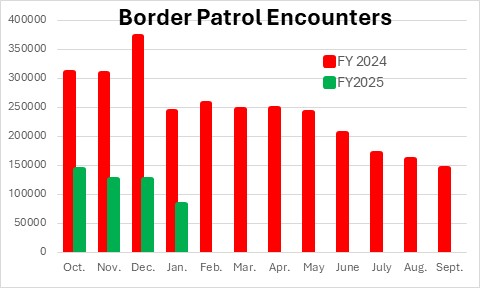

Trump’s stated reason for imposing tariffs on goods coming from Mexico and Canada in the first place was to stem the flow of fentanyl into the U.S. But border encounters have plunged in recent months. For example, the 81 thousand encounters in January are one -third of the 242 thousand encounters in January 2024. Trump could claim victory and choose to eliminate the tariffs against Mexico and Canada. But he is not doing that. It appears that tariffs are not being used simply as a bargaining chip to attain better terms of trade but, instead, are being used as a bullying tactic to compel those two countries to bow to the president’s wishes. While the imposition of tariffs may hit Mexico and Canada harder than the United States, make no mistake the U.S. will experience slower growth and higher inflation as a result.

In the end the combination of tariffs, deportation of immigrants, and laying off of federal government workers has made every American nervous. Business are uncertain whether they should hire additional workers. Rational investment decisions cannot be made given the degree of uncertainty. Workers can no longer be certain they will have a job in three months. And it is not just federal government workers. Think about government contractors, manufacturing firms, construction workers, retail employees. Everybody is nervous. Every sector of the economy is under attack. The question is whether the short-term pain will result in long-time gain.

For now, we expect GDP growth of 1.5% in the first quarter and 2.5% growth for the year. The unemployment rate will end the year at its current level of 4.1%. The core CPI inflation rate will edge its way lower from 3.3% today to 3.1% by yearend. And the Fed may cut the funds rate by 0.25% to the 4.0% mark by yearend. But for this relatively positive economic outlook to be realized, we need less chaotic policy making from our leaders in Washington.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve, here is an example what I was asking about last week concerning the validity of data you use to determine the state of the economy.

https://www.washingtonpost.com/opinions/interactive/2025/government-data-trump-deletion/?itid=hp_opinions_p001_f015

Thanks,

Taylor

I read this. See my other note to you.

Steve