July 27, 2018

Economists generally believe that if Trump is pressuring the Fed not to raise rates in September that it will be more likely to do so to demonstrate the Fed’s independence from both the Executive and Legislative branches of government. That may make for interesting reading, but the reality is that Fed policy is determined by the FOMC’s reading of the economic tea leaves which includes an analysis of GDP growth, inflation, the labor market, economic growth overseas, the dollar, the stock market, and a wide variety of other economic indicators. Many years ago, I spent some time at the Board of Governors of the Fed in Washington and I cannot remember ever hearing the words “politics” or “election” mentioned in that room. The Fed’s rate decisions are based solely on its analysis of the economy. Period.

Typically, presidents refrain from speaking about monetary policy. But Trump, not surprisingly, feels no such constraint. What he said this time was actually quite mild. He was “not thrilled” because every time the economy strengthens “they want to raise rates again.” And, “I am letting them do what they feel is best.” Later in the interview he called Fed Chair Powell a “very good man”. However, it is unlikely that this is the last we will hear from President Trump about the Fed so stay tuned. Today’s mild rebuke could turn into something more biting in the months ahead.

The Fed was designed to be independent from political pressure for a reason. There are times that it needs to raise rates to curb inflation but, in a politically charged environment like the one that exists today, it would be virtually impossible to do so in the absence of that independence. The Fed’s Board of Governors consists of seven members – the Fed Chair and six other governors. Fed governors are appointed for 14-year terms so that an incoming president will not automatically be able to appoint governors who might support his or her policies. The board chair and the Fed governors cannot be fired once they are appointed so they can feel free to vote for higher interest rates if they are deemed necessary.

Currently, four of the six governors’ slots are vacant. Trump has nominated people to fill three of those slots, but they have not yet been confirmed by the Senate. In theory Trump could influence Fed policy by filling all four vacant slots with individuals that he believes will favor a low rate environment. But given that every president presumably favors lower rates, then every Fed governor that has ever been appointed should tend to lean in that direction. It simply does not work that way.

It is abundantly clear from the press release after every FOMC meeting, from speeches given by any Fed official, and from their testimony before Congress, that the Fed’s rate decisions are based on the economic outlook, not politics. Furthermore, the Fed’s rate decisions are usually unanimous. At its most recent meeting on June 13, for example, the Fed decided to raise the federal funds rate. The vote was unanimous. When you become a Fed governor you lose your political stripes and vote for the policy action most appropriate for the country. Those presumably low-rate-supporting governors evaluate the economic environment and choose the action that they deem most appropriate to fulfill the Fed’s goals of maximum employment and price stability. Politics does not enter the equation.

One wonders why President Trump chose to criticize the Fed now. What is he trying to accomplish? If the economy were teetering on the brink of recession, then perhaps the president might be justifiably concerned about the Fed raising rates too quickly. But right now, the economy is gathering momentum. In the six quarters since he has been in office GDP growth has averaged 2.7% compared to a 1.6% pace in the previous six quarters. That faster growth rate reflects his tax cats and his efforts to lighten the regulatory burden on corporations. Like him or not, it is hard to deny that the recent growth spurt is attributable to Trump.

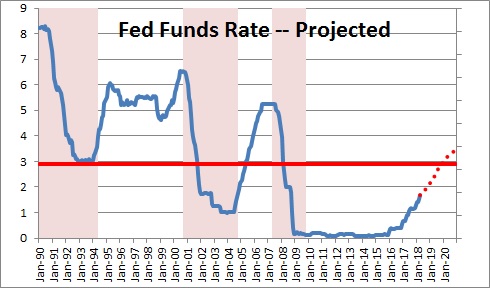

Furthermore, the Fed has announced its intended glide path toward higher rates through the end of 2020 and there is a strong consensus that those rate levels will allow the expansion to continue at least through that year. If that happens, Trump is virtually certain to be re-elected in November of 2020. President Clinton often noted, “It’s the Economy, Stupid”. By late 2020 the expansion will be in the middle of a record-breaking 13th year of expansion. As we see it, Trump should be praising the Fed for the good job it is doing in keeping the economy on track, maintaining inflation close to the desired 2.0% pace, and reducing the unemployment rate to its lowest level in 20 years.

The reason for the surprising unanimity amongst economists is that the level of short-term interest rates today is not high by any standard. While the funds rate has been rising gradually, the targeted level currently of 1.75-2.0% is still well below the 3.0% mark that the Fed believes is “neutral”, i.e., a rate level at which its policy is neither stimulating the pace of economic activity nor attempting to slow it down. The Fed does not plan on attaining that so-called “neutral” level until the end of next year. Furthermore, the 5.0% funds rate level that has typically induced a recession in previous cycles is not even on the Fed’s radar screen. So, if President Trump is concerned that the Fed is going to short-circuit the pace of economic activity any time soon, he perhaps ought to think again.

Stephen Slifer

NumberNomics

Charleston, S.C.

Stephen, if you can figure why Trump does anything, write a book and it will become a best seller. When we have a non-politician in the White House, anything obviously goes. I am pleased with the stock market and have real concerns about tariffs and the effects they may have. Hang on for the ride.

Darrel