August 12, 2016

This is an economics column not a political column. However, the two candidates running for president are advocating widely divergent economic policies. To make an informed choice on November 8 we need to understand the differences. Today we will focus on Donald Trump’s economy policy recommendations. This is not about Trump and his personality. People either love him or hate him. So be it. We want to focus on what he is actually proposing for the economy. Next week we will provide the same analysis about Hillary Clinton’s economic policy.

For the most part Trump’s economic policy suggestions will stimulate the pace of economic activity, particularly investment spending.

He plans to simplify the income tax code by reducing the number of tax brackets from seven to three – 12%, 25% and 33% — which lowers the top bracket from 39% currently to 33%. Most Americans spend hours completing their tax return or hire an accountant to do it. Simplification of the tax code will allow all of us to make more effective use of our time. He has not said so, but I presume that along with his proposed simplification of the tax code certain tax deductions will no longer be allowed.

He plans to eliminate the wealth tax otherwise known as the “death” tax. Currently, individuals pay tax on their income as it is earned, and then their heirs pay taxes a second time on the wealth that is left once the taxpayer dies. Economists have complained about this death tax for years.

Trump wants to lower the corporate tax rate from 35% currently to 15% and apply that rate not just to corporations but to all businesses in America. Small business owners today pay taxes on their profits at the much higher individual tax rate which means any income in excess of $115,726 is taxed at a rate in excess of 30%.

He will allow corporations to repatriate profits earned overseas to the U.S. at a 10% rate. At the current 35% rate many corporations choose to leave their earnings abroad. This measure will allow them to bring that money back to the U.S. to invest as they see fit. The lower business tax rate will also discourage companies who might have been thinking about moving their operations overseas to remain in the United States.

Finally, he will allow businesses to immediately expense new business investments rather than depreciate them given a complicated depreciation formula which varies depending upon the type of asset.

Some argue that these proposals will result in a drop in tax revenue which will translate into higher budget deficits. We strongly disagree. We contend that such measures will unambiguously stimulate growth, generate new jobs and create income, which will boost tax revenue and counter the lower tax rates.

Some suggest that these policy changes that favor the rich. Once again, we disagree. They will favor the U.S. economy which will create jobs and benefit all Americans.

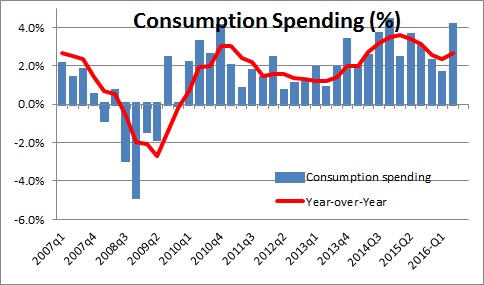

The biggest economic problem today without a doubt is the lack of investment spending. Consumers are spending freely which is not surprising given sizable job gains every month which boost income, a record high level for the stock market which boosts net worth, and record low interest rates,. Consumption spending has been steady at a 3.0% pace for some time and is showing no sign of slackening.

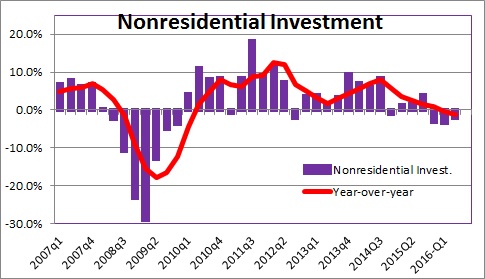

But investment spending has been nonexistent for the past two years even though business leaders are experiencing many of the same positive factors that are bolstering consumer spending – a respectable pace of economic activity, record low levels for corporate interest rates, stock prices that have never been higher, near record corporate earnings, and a mountain of cash sitting on the sidelines. They would rather hire new workers than spend money refurbishing their factories and assembly lines, or invest in the latest productivity-enhancing technology. So why aren’t business leaders choosing to invest? A couple of reasons.

First, our sense is that the current 35% tax rate is far too high given an average corporate tax rate overseas of 23%. Firms choose not bring the money earned overseas back to the U.S. to be taxed at the 35% rate. Similarly, the 35% corporate tax rate encourages companies to shift their headquarters overseas where tax rates are lower. This is the so-called” corporate inversion” process. These two factors result in fewer jobs created in the United States and reduced corporate earnings which weighs on stock prices.

Second, businesses today, small business owners in particular, have complained about the often overwhelming regulatory burden for years. Trump wants to change this. He points out that the Federal Register is now more than 80,000 pages. He is proposing a temporary moratorium on new federal agency regulations, and will ask every federal agency to prepare a list of regulations which are unnecessary, do not improve public safety, and needlessly kill jobs. These developments seem to address another problem that is at the heart of the lack of investment spending in this country.

Trump’s trade policy, however, is misguided. He wants the U.S. to get out of NAFTA and the Transpacific Partnership (TPP) because, in his view, these trade agreements have reduced the number of jobs created in America. We do not buy that. Job losses in the factory sector began long before NAFTA because unions boosted wages to a point where manufacturers in the U.S. could not compete with goods produced more cheaply in Asia. Job losses in manufacturing continue today in large part because technology has replaced many factory jobs –not NAFTA. Economists are unanimous in their belief that an open economy and free trade will help an economy grow more quickly. In addition to which all American consumers benefit from the lower prices on imported products whether we are talking about cars, computers, electronic products or apparel.

The U.S. should go after China with respect to intellectual property rights and government subsidies for selected industries. But we should not withdraw from trade agreements to accomplish that objective. Nor should we be talking about building a wall between the U.S. and Mexico. The world is going global whether Mr. Trump likes it or not. If we withdraw from the international arena, U.S. firms will be at a competitive disadvantage relative to firms in every other developed economy on the face of the earth. Asia is the fastest growing region in the world. Do we really want to turn our back on the markets for those countries? That makes no sense. Unrestricted trade with other countries is unambiguously positive for the pace of economic activity in the U.S., and it helps to keep inflation in check.

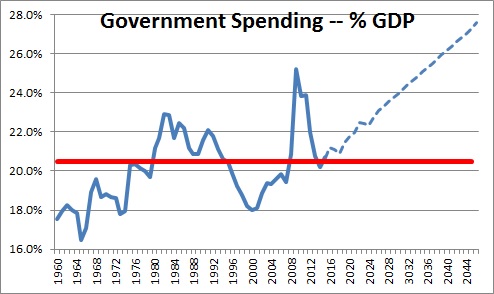

What we did not hear from Trump is what he plans to do with respect to government spending. If he really wants to help the U.S. economy grow more quickly he should sharply curtail government expenditures. As baby boomers continue to age, Social Security and Medicare payments will soar. The budget deficit will once again exceed $1 trillion by the end of this decade. Government spending as a percent of GDP will climb to an unprecedented level within a decade. As we see it, the government sector has gotten far too big and, in the process, is diverting funds which could be used more effectively by the private sector.

The bottom line is that by focusing on measures which will encourage businesses to invest, Trump’s economic policies generally are positive and will significantly boost economic activity. Today’s potential growth rate of about 2% could, if these plans are adopted, very well head back towards 3% which will more quickly raise our standard of living.

Stephen Slifer

NumberNomics

Charleston, S.C.

What about his proposals for trade? How would he reduce our debt? What will he do to help the farming or tourism industries that rely on manual labor (which citizens do not want to do?)

Thanks for this, Steve. Look forward to your Clinton analysis. I’d also be interested in any thoughts you have on Gary Johnson’s positions, particularly on a VAT tax with some kind of pre-bate for the poor.

Hi Jim,

I tried to point out that his trade proposals were really misguided.

“Trump’s trade policy, however, is misguided. He wants the U.S. to get out of NAFTA and the Transpacific Partnership (TPP) because, in his view, these trade agreements have reduced the number of jobs created in America. We do not buy that. Job losses in the factory sector began long before NAFTA because unions boosted wages to a point where manufacturers in the U.S. could not compete with goods produced more cheaply in Asia. Job losses in manufacturing continue today in large part because technology has replaced many factory jobs with machines. Economists are unanimous in their belief that free trade will help an economy grow more quickly. In addition, all American consumers benefit from the lower prices on imported products – think cars, computers, electronic products or apparel.”

I know most economists think his lower taxes would boost the deficit. I am not so sure. The one piece of the economy that has been lagging in the recovery has been investment and his policies seem to be focused on things that will boost investment spending. If we can get investment spending back on track and boost growth, hopefully, that will counter the impact of a lot of the tax cuts. Also, I have not seen anything that he has proposed re: cutting expenditures. If he really wants to help the economy he would get a lot of mileage by cutting some of our entitlement spending.

Finally, you mention the tight labor market and that we cannot get enough farm workers or people to work in the hospitality sector. I agree. His notion of building a wall to China is clearly not the route to go. Given that we are losing the baby boomers in the labor force, we need more immigrants. I know immigration policy is a hot button today. But surely our policy makers can find a way to encourage immigration but improve our screening procedures.

Thanks for taking the time to comment. Hope to see you in December.

Steve

Hi Pat,

I don’t know a lot about Gary Johnson’s policies. But some of the quotes on his website seem a bit extreme. Most of his quotes are old, so I am not sure I quite understand where he is now. But he is really focused on the national debt and at one point was talking about balancing the budget within a couple of years. He intended to do that by cutting entitlements — and defense. I agree with the former, but not the latter. And while I am all for cutting the deficit, I don’t necessarily want it to go to zero. Rather, I prefer a deficit that is steady at about 3% of GDP. I did not see anything on his website about a VAT (but perhaps I just missed it). It could work. A lot of countries have them. I think I prefer the continuation of a much simpler income tax. Broader the base, disallow a lot of the current deductions, cut rates and only have a few tax brackets (something along the lines of what Trump is proposing).

Then he talks about abolishing the Fed. I think that would be a REALLY bad idea. However, you have to understand I have a definite bias given that I spent the first 10 years of my career at the Fed. Without the Fed our only policy would be fiscal policy which puts our only tool to alter the pace of economic activity in the hands of the politicians. Ouch!

Having said all that, I am tempted to vote for him because of my personal distaste for either of the other two candidates. I guess you could call that a protest vote. I have talked about Clinton and Trump’s economic polices, but unless something dramatic happens in November we are going to end up with the same old divided government we have had which probably means none of those policies I talked about will happen.

In any event, thanks for taking the time to comment. All the best.

Steve