August 17, 2018

President Trump has been pre-occupied with the trade deficit. To reduce its size he initially imposed stiff tariffs on steel and aluminum. The Chinese and the Europeans retaliated. Then came 25% tariffs on another $35 billion of Chinese goods. The Chinese retaliated. Now he has proposed a 10% tariff on an additional $200 billion of Chinese products. He has expanded the trade war to Turkey. The tit-for-tat tariffs continue. We did not support his tactics. We preferred a more focused attack on China which accounts for one-half of our trade deficit. However, as time passes it has become clear that the U.S. economy is gathering momentum while economies elsewhere are getting slammed. Tit-for-tat tariff hikes are not working for the rest of the world. How much more pain can they stand? Our sense is that as their economies weaken, they may well show up at the bargaining table sooner rather than later and, eventually, the world economy will end up closer to a true free trade environment than it was a few months ago.

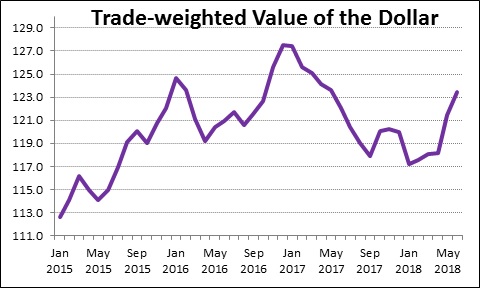

As new tariffs have been imposed economists believed that while the U.S. economy might get dinged, other country’s economies would suffer a far worse fate. This perception has led to a significant 6.0% run-up in the value of the dollar since the end of March as foreigners have poured money into the U.S. stock market and other dollar-denominated investments.

This means that the currencies of our trading partners collectively have declined 6.0%. The yen and the euro have fallen by about that amount, but currencies of emerging economies have been crushed. The Chinese yuan, for example, has weakened 10% from 6.3 yuan to the dollar a few months ago to 6.9 yuan. Other emerging economies have experienced similar currency weakening — Russia, Malaysia, Turkey, South Korea, India, Brazil, and Argentina amongst others. Some of these countries are getting hit directly by the Trump tariffs. Some are being slapped by sanctions. Still others are getting crunched by their association with China which is an important trading partner for them.

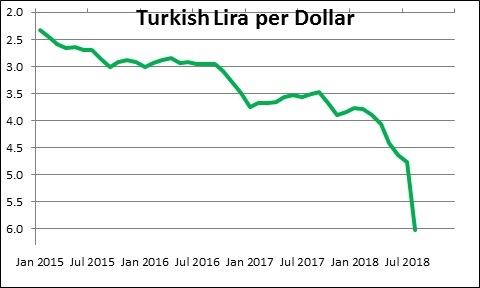

Perhaps the most dramatic currency decline has been in Turkey. A few months ago, the Turkish Lira was 3.8 per dollar. Today it is 6.0 – a decline of almost 60%. President Trump’s doubling of the rate of tariffs on steel and aluminum imports from Turkey were the catalyst for the meltdown, However, the battle seems more political than economic as Turkey has detained an American pastor on espionage charges. Nevertheless, the tariffs have spooked currency markets around the globe. The precipitous slide in the Turkish Lira has also exposed underlying problems in the Turkish economy which for years has relied heavily on foreign capital for investment. It has let its money supply grow too quickly and, as a result, inflation has recently climbed from 11% to 15%.

Concerns about Turkey’s financial woes have spread throughout the European banking system which, once again, seems overexposed to debt issued by an economy with shaky economic fundamentals. However, Turkey is not going to create a financial crisis in Europe or anywhere else. Its economy is simply too small. It is roughly the size of Florida. It is hard to envision a country of that size igniting serious contagion problems.

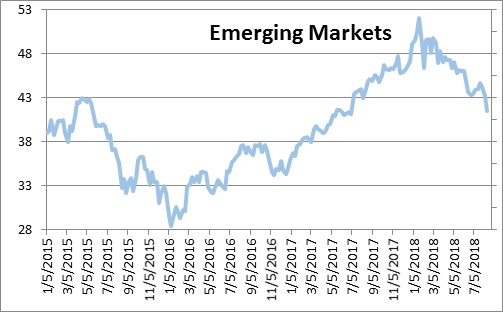

Currency weakness has caused stock markets of emerging economies to fall by double-digits. Why? Largely because they all have significant amounts of dollar-denominated debt outstanding. As their own currency weakens, they need more local currency to get the dollars required to make payments on their dollar debt.

The broad-based nature of these falling stock markets can be seen in the iShares MSCI Emerging Markets Index which has fallen 20% since reaching a peak in mid-January. This index includes the stock markets of more than 20 emerging countries including China, India, Taiwan, South Korea, Indonesia, Malaysia, Turkey, South Africa, Brazil, and Mexico amongst others.

The combination of falling currencies, plunging stock markets, and higher inflation are a precursor of economic woes ahead for all these countries.

Contrast that to the United States. Second quarter GDP growth came in at an impressive 4.1% pace. GDP has risen 2.8% in the past year. Third quarter growth seem likely to be about 3.5%. Each month the economy generates 200 thousand jobs. The unemployment rate is at 3.8% and has not been lower since 1969. The S&P 500, Dow Jones Industrial Average, the Russell 2000, and the NASDAQ stock indexes are within an eyelash of record high levels. Consumer confidence is the highest it has been since 2004. Small business confidence has reached its loftiest level since July 1983.

The divergence in the economic outlook between the United States and the rest of the world has widened dramatically. Funds have been flowing into the U.S. from Europe and Asia which have bolstered the stock market, reduced the 10-year note yield, and strengthened the dollar. So, how will countries in Europe, Asia, and the emerging world respond? Clearly angered by Trump’s tariffs, thus far they have chosen to impose tariffs of their own which have been matched by still more tariffs from the U.S. That is not working. If anything, it has made the problem worse.

During the past six months other countries have begrudgingly recognized the benefits of doing business with the United States. It strikes us that a better solution would be for them to sit down with the U.S. and negotiate some sort of trade agreement. The U.S. and the E.U. have already agreed to stop the trade war and bargain. Steps in that direction seem to be underway with China. We believe that as negotiations spread the world will eventually move much closer to the “free trade” model described in economic textbooks with few tariffs and a level playing field for all. That would be a good thing.

We readily admit that we opposed Trump’s trade tactics, preferring a targeted approach directed towards China. But could it be that his across-the-board tactics are working?

Stephen Slifer

NumberNomics

Charleston, S.C.

Thanks for the unbiased insights, Steve.

Thanks Pat. Sometimes it is difficult to tune out the political chatter and focus on what is really happening out there.

Steve