February 17, 2012

A recently released Bureau of Labor Statistics report indicated that union membership edged lower in 2011 to 11.8%. The study also found, not surprisingly, that unions continue to secure sharply higher wages for their members relative to their non-union counterparts. Indeed, the unions’ success in attaining higher wages, particularly amongst government workers, has attracted unwanted attention that over time may further weaken the importance of unions.

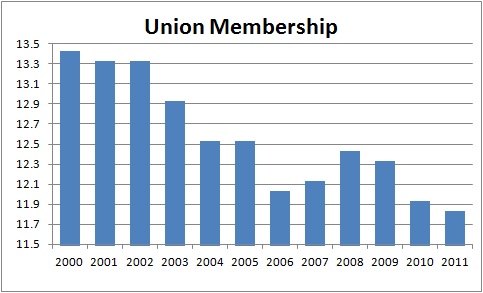

Union membership has been steadily declining for more than 65 years. Shortly after World War II one-third of the work force belonged to unions. That membership rate slipped to 25% by the mid-1970’s, and stands at 11.8% today. There are a variety of reasons why this has occurred. More intense global and domestic competition has undoubtedly played a role. Companies today are simply unwilling, or in many cases unable, to accede to union demands. Automation in the manufacturing sector has been a factor as machines have taken over the tasks previously done by workers. The economy has shifted away from manufacturing and more towards services where unions traditionally have been less successful. Finally, younger workers do not feel the need to be represented by a union. Amongst the 16-24 year old crowd, membership is a paltry 4.4%. It rises steadily for every age bracket, and reaches a peak amongst the 55-64 year olds at 15.7%. Unions may have served a purpose in days gone by, but their usefulness in today’s world is less obvious.

The number of employed workers in the U.S. is currently 125 million of which 85% are in the private sector. The unions have been notably unsuccessful in attracting private sector workers as just 6.9% were members of a union in 2011 – matching an all-time record low level established in 2010.

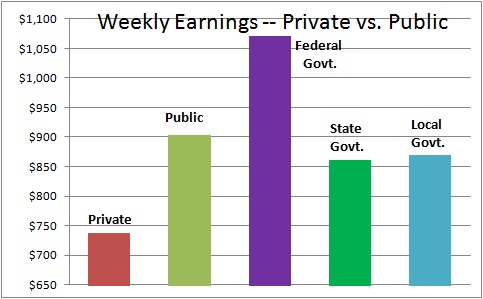

Union penetration of the public sector is another story as 37% of government workers belong to a union – 28% at the Federal level, 31% of state workers, and 43% of local government employees. How have the unions been so successful amongst government workers? Part of it may be attributable to a perception that government employees are underpaid and in need of union support to get their fair share of the pie. Nothing could be farther from the truth. Private sector weekly earnings in 2011 were $729. Their public sector counterparts were 23% higher at $895. Amongst those government workers, Federal government employees fared the best with weekly earnings of $1,063 which is 46% higher than their private sector counterparts. State and local government workers tipped the scale at $852 and $861, respectively. Don’t pity government workers. They are doing just fine!

The superior earnings amongst public sector workers is largely accounted for by two factors – health care and pension benefits. The typical government employee does not make any contribution whatsoever to his or her health care. A recent Kaiser Foundation study found that the average family’s health care cost is $13,375. If that burden were split equally between the worker and the government, public sector wages would decline by $130 a week if they had to pay for health care. Then there is the pension plan. Government workers can typically retire at 80% of their peak earnings – often at an early age. A private sector employee can only dream of such a generous retirement package. These generous benefits have been attained largely through union efforts.

But now those generous health care and pension benefits are under attack. During the recession tax revenue plunged and state and local government entities faced difficult choices to balance their budgets. Some laid off thousands of teachers, police, and firefighters. Others asked workers to take time off without pay. And still others decided to take on the unions and reduce employee benefits by forcing workers to contribute to their health care and retirement packages. It is hard to do otherwise when the evidence shows such a wide discrepancy between public and private sector earnings. Many taxpayers suffered layoffs or saw their wages cut and benefits reduced during the recession. They expect their politicians to vigorously attack the generous health care and pension packages of government workers which had not been touched.

Some states, like Wisconsin, passed controversial curbs on the bargaining rights of public sector employees. Wisconsin saw union membership amongst state workers fell almost one percentage point in 2011 from 14.2% to 13.3%. Other states which have been battlegrounds for organized labor like Indiana, which is poised to enact a right-to-work law banning unions from collecting mandatory dues from workers, and Ohio, where an effort to impose union curbs on public workers similar to the legislation passed in Wisconsin, showed little change in union membership this past year. In South Carolina, the NLRB sued Boeing and threatened to close down its newly opened Charleston plant because, it contended, Boeing’s decision to relocate to South Carolina was based primarily on the state’s lack of unionization. The NLRB ultimately dropped the case. During 2011 the unionization rate in the state continued its decline from 4.6% to 3.4%.

Union presence was weakest in North Carolina, where just 2.9% of workers were union members, followed by South Carolina (3.4%) and Georgia (3.9%.

On the other end of the spectrum three states had union membership rates above the 20% mark – New York (24.1%), Alaska (22.1%), and Hawaii (21.5%).

The intense focus on expenses amongst consumers, business people, and government entities has shed considerable light on the extremely attractive health care and pension benefits unions have been able to secure for their members. In today’s economy where virtually every private sector worker in the past four years has experienced layoffs, reduced wages, or cuts in benefits, state legislatures are now asking government workers to participate in that belt tightening.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me