July 12, 2024

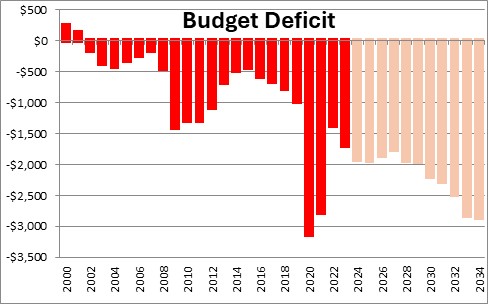

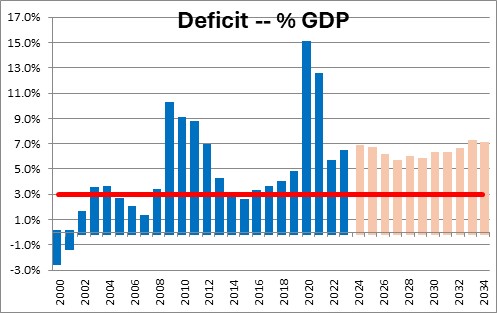

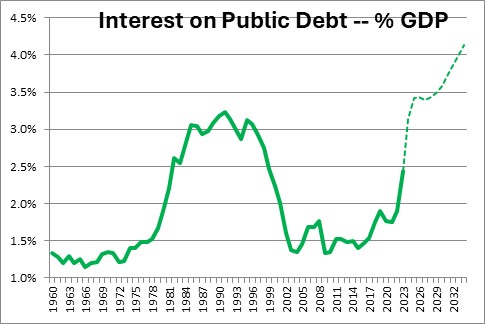

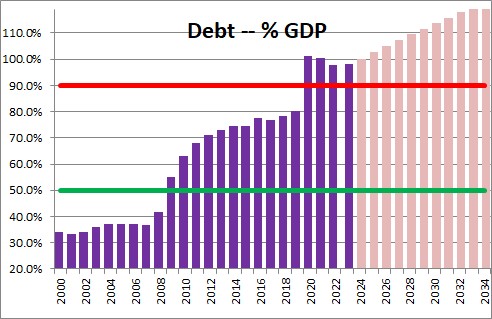

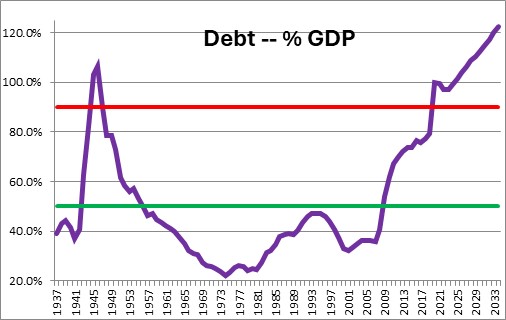

Last month the Congressional Budget Office revised (upwards) its estimate of the budget deficit for the current fiscal year to $1.9 trillion. The deficits thereafter climb steadily to $2.9 trillion by 2034. To put that in perspective, the 2034 deficit reaches 6.9% of GDP which is nearly double the 3.0% average deficit since 1960. To finance a deficit the Treasury must issue an equal amount of debt to pay its bills. As a result, debt outstanding as a percent of GDP climbs from 99% in the current fiscal year to 122% in 2034. As debt swells the interest paid on that debt will climb to 4.1% of GDP by 2034 which far surpasses the previous record of 3.2%. With no end in sight to gigantic deficits, that interest obligation will continue to climb and could reach 6.7% of GDP by 2053. This is not a sustainable situation. This year for the first time interest on the debt is bigger than the defense budget. Next year it will surpass Medicare. But nobody seems to care. Neither of the two candidates running for president ever mention the budget. They talk about inflation, immigration, the wars in Ukraine and Israel/Gaza, Russia, and China. The looming deficits are not on their radar. Meanwhile, the Social Security and Medicare Trust Funds are dwindling and will need help from the new administration to address those two thorny issues on top of all the other pressing problems. The odds of anything significant happening on the deficit front any time soon is virtually nil.

By the way, does anybody even remember how to write $1 trillion? In case you forgot it is:

$1,000,000,000,000.

That is a lot of money!

The budget deficits continue to climb but that is not new. Unfortunately, we are no longer talking about deficits of $1.0 trillion. Instead, the deficits will consistently be between $2.0-3.0 trillion every year from now through 2034.

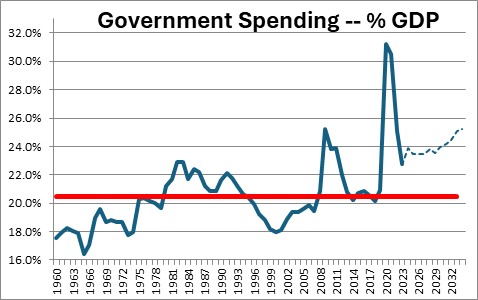

Economists typically look at these budget deficits as a percent of GDP. The deficit for this fiscal year is expected to be 6.7% of GDP. It will climb to 6.9% by 2034. Since 1960 these budget deficits have averaged about 3.0%. Thus, we are talking about budget deficits for the foreseeable future that are more than twice the size of the historical norm.

The combination of adding $2.0 trillion to the debt every year for the next decade and interest rates returning to a more normal level, means that the Treasury’s interest expense keeps climbing. Two years ago. Prior to the Fed’s tightening initiative in 2022 interest was 1.8% of GDP. That ratio has climbed to 3.1% this year. This means that the interest expense is now bigger than defense spending. Next year it will also be bigger than Medicare. And it just keeps on growing. The CBO estimates that interest will climb to 4.1% by 2034. Every 1.0% more spent on interest takes 1.0% away from spending elsewhere. That is not a sustainable situation.

Adding $2.0 trillion to the debt outstanding every year for the next decade also means that debt in relation to GDP climbs from 99% this year to 122.4%. Prior to COVID the debt/GDP ratio stood at 79%.

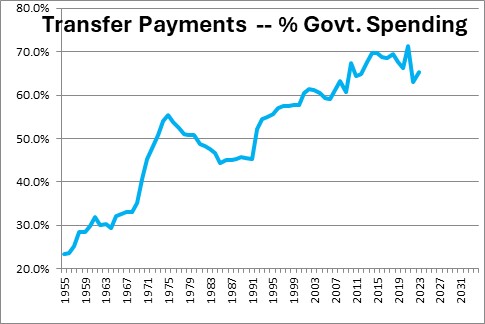

The debt/GDP ratio will soon surpass the 106% record set just after World War II. At that time the deficit was inflated by defense spending. Once the war ended defense spending declined and the ratio of debt/GDP fell back to its historical average. That will not be the case this time. So-called “entitlements” have become an increasingly large share of government spending. These are payments by the government to individuals and include such things as Social Security, Medicare, Medicaid, unemployment benefits, welfare benefits, and veterans benefits. These programs never end and payments are frequently indexed to inflation. As a result, government spending continues to climb and debt/GDP reaches a new record high level each year.

How did we get ourselves into such a pickle? Basically, we have allowed these “entitlements” to get out of hand. Back in the mid-1950’s such spending was 25% of all government expenditures. Today they represent two-thirds of every dollar spent. In those earlier times the government spent money on defense, education, and on economic infrastructure such as building highways, bridges, and public transit. In addition to protecting our country those categories of spending enhanced the ability of the economy to grow. But today government spending is dominated by income payments to individuals of one form or another. Is this really how we want the government to be spending our tax dollars? My answer is no. What’s yours?

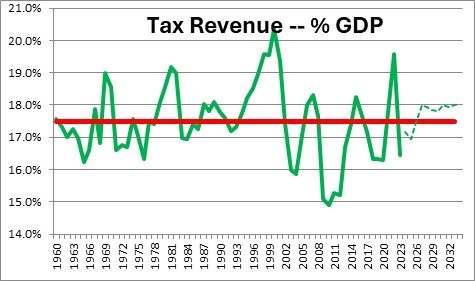

To address these steadily growing budget deficits our policy makers must either boost revenue or cut spending. According to the CBO tax revenues will average 17.7% of GDP during the next decade compared to a historical average of 17.5%. The problem is not on the revenue side.

In contrast, government spending will average 24% of GDP during the next 10 years compared to an historical average of 20.5%. Therein lies the problem. For our policy makers reducing spending, particularly spending on entitlements, is challenging. Cutting Social Security, Medicare, or Medicaid payments, for example, means lower income for somebody in your district. Doing so may well imply that you will be voted out of office at the next election.

Given the relentless increase in interest as a share of GDP, the current situation is unsustainable. Something has to be done. Hard choices have to be made and it will take a bipartisan effort to make that happen. Good luck with that. Unfortunately, it will probably take a crisis to spur our policy makers into action.

Stephen Slifer

NumberNomics

Charleston, S.C.

Wouldn’t pumping 2 trillion into the economy mean higher numbers? Old school thinking would be that we will need to pay the piper sooner or later, but in the meantime, better numbers and a robust economy.

How about revenue increases AND spending cuts? Citizens of our developed country pals fund their largess with significantly higher taxes. Getting by on-the-cheap is no longer sustainable.

I agree with both parts. The outsized budget deficits are boosting the economy currently. Federal government spending added about 0.3% to GDP growth last year. But perhaps more importantly, the money diverted into government securities to finance the budget deficit could have been used by the private sector for more productive purposes. And, yes, there will be an end game at some point.

Hi Pat. Yes we could have higher revenues. But you have seen the charts. Revenue as a % of GDP today is roughly in line with history. No reason it could not be higher. But doesn’t that turn us into a different type of economy? We have never been a country that takes care of its citizens from birth to death like many of our European counterparts and pays for that via very high taxes. (Having said that, it does appear that we are rapidly heading in that direction.) A solution (whenever it comes) will undoubtedly include higher taxes to some extent but, in my opinion, the bulk of the adjustment will be on the spending side. I thought the Erskine/Bowles solution in 2010 was a great way to go to get us on the right track. And that was a bipartisan solution! We had an opportunity to grab the brass ring and missed it. Obama said killed the bill because he thought it cut entitlements too much. I am having a hard time seeing how we could ever come up with a bipartisan solution in today’s polarized world.