January 10, 2025

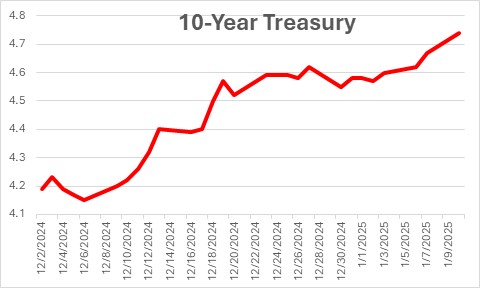

The yield on the 10-year note continues to climb. A month ago it was 4.15%. Today it is 4.74%. It has risen 0.6% in a month. We attribute the dramatic increase to some combination of three factors. First, it appears that part of the increase represents an upward shift in inflation expectations as recent data have generally been somewhat stronger than expected. Second, the bond market has seemingly begun to focus on the potential deluge of Treasury supply as President-elect Trump’s expected cuts in tax rates and increased spending proposals push budget deficits and debt outstanding to record high levels. Finally, during the holiday period bond market trading is always light and rates can shift dramatically without a lot of conviction. Our guess is that some combination of all these factors has contributed to the run-up in long rates and, in the weeks ahead, as the market’s worst fears are unrealized long rates reverse a significant portion of the recent run-up.

The yield on the Treasury’s 10-year note has risen from 4.15% in early December to 4.74%. A 0.6% increase in a month is very unusual and warrants some explanation.

Payroll employment rose 246 thousand in December and the unemployment rate fell 0.1% to 4.1%. While both numbers could be consistent with a somewhat faster pace of economic activity, most economists do not appear to have significantly altered their GDP forecasts for 2025. We continue to expect GDP growth of 2.9% in 2025. The consensus appears to be for GDP growth of perhaps 2.2%. We doubt that the recent run-up in long rates reflects fear of a more robust pace of economic activity.

Instead, we think that the increase is attributable to three other factors.

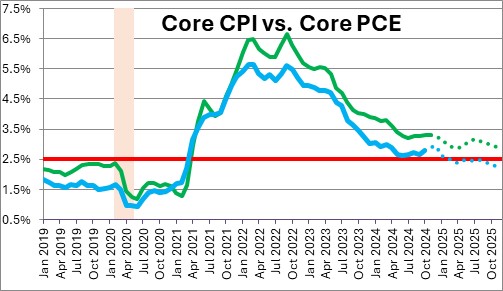

First, the increase could reflect an expectation for higher inflation in 2025 and beyond. Recent data on both the core CPI and the core personal consumption expenditures deflator, which declined steadily for roughly two years, have leveled off in the past six months. Many economists fear that, in contrast to the Fed’s expectation, the inflation rate will not shrink in the months ahead.

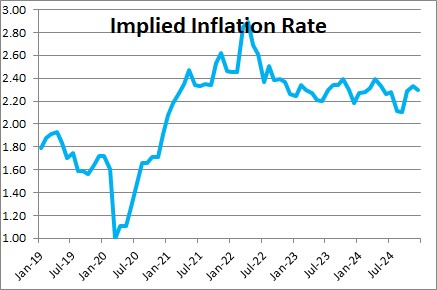

One way to measure the impact of higher inflation expectations is to look at the difference between the nominal yield on the 10-year Treasury note and its inflation-adjusted counterpart. That difference reflects the market’s expectation of the inflation rate for the next 10 years. The implied inflation rate has increased by about 0.2% in the past month from 2.2% to 2.4% which appears to have been a contributing factor to the increase in the 10-year rate. But when inflation expectations increase 0.2% and the yield on the 10-year jumps 0.6%, it is clear that something else is going on.

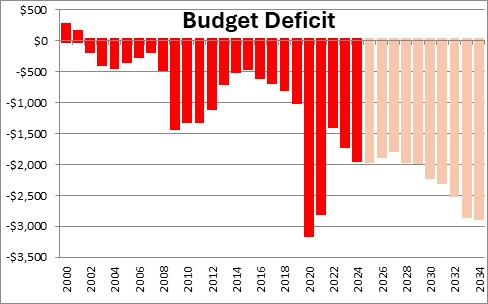

The increase in the 10-year could also reflect a fear that Trump’s extension of the 2017 tax cuts combined with exemptions for tips and Social Security income could sharply reduce tax revenues in the years ahead. Combining this with uncertainly regarding the tariffs he intends to impose on other countries and their likely retaliation clouds this issue. The Committee for a Responsible Federal Budget has estimated that Trump’s combined fiscal polies could $3 trillion to deficits over the next decade with the potential to add up to $6 trillion. The Congressional Budget Office’s official forecast anticipates an average budget deficit for the next decade of $2.2 trillion. That is before taking into consideration any of Trump’s proposed fiscal policy changes. The CRFB’s estimates of the impact of Trump’s fiscal policy would boost those annual deficits to $2.5-2.8 trillion. Increased supply is a legitimate concern for the markets and almost certainly has contributed to the recent increase in long rates.

Finally, we know that bond trading is light during the holiday period. Traders and fund managers have largely closed their books by the beginning of December. With fewer than normal players in the bond market, rates can swing sharply on very little volume.

It is hard to pinpoint the reasons for the 0.6% increase in the yield on the 10-year note during the past month but heightened inflation expectations, fear of increased Treasury supply, and a reduced volume of bond trading during the holiday period have probably all contributed to the increase. Our sense is that going forward we will find that the economy is continuing to expand at a 2.5-3.0% pace, inflation gradually edges its way lower, and long rates decline from their current 4.7% level to 4.1% or so by yearend.

Stephen Slifer

NumberNomics

Charleston, S.C.

Off topic, but I tried to send you an email and it bounced. Not sure if it’s an error or what, but thought you should know.

Hi Jeffrey. Just saw this. Surprising. Not sure what the problem was. Try me at steveslifer@outlook.com