August 30, 2024

Economists have a nagging concern that the economy could be teetering on the brink of a recession. They note several potential difficulties. Consumers are worried about the outcome of the election and the possibility of higher tax rates in the years ahead. Real income for consumers has declined as inflation has eroded their purchasing power. Home sales have yet to emerge from the doldrums as affordability has priced many first time buyers out of the market. The Fed is worried about further deterioration in the labor market. Those are all legitimate concerns. But two powerful forces are going to keep the economy expanding at a reasonable pace for years to come – a substantial decline in interest rates, and rapid growth in productivity as AI spending raises the economic speed limit. We are projecting GDP growth of 2.5% next year which seems to be well above the consensus which is about 1.5%.

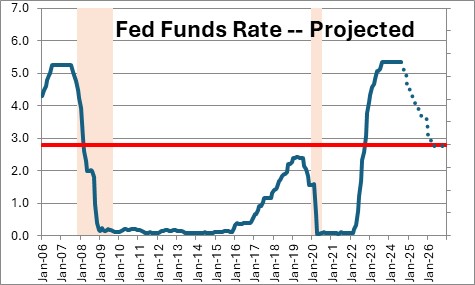

The market has focused on the Fed’s rate cuts between now and yearend. Most everybody expects three 0.25% cuts between now and December. That would reduce the funds rate from 5.3% currently to 4.6% by the end of the year. But that is the tip of the iceberg. Assuming inflation continues its descent towards the Fed’s 2.0% targeted pace, the funds rate will continue to slide in 2025 and 2026. The Fed believes the funds rate is neutral when it is 2.8%. A series of ten 0.25% rate cuts will drip-feed the economy for years to come.

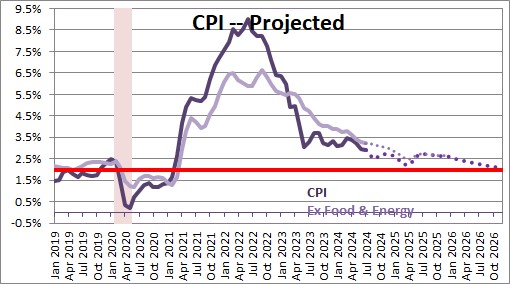

Meanwhile, the core CPI inflation rate should continue to shrink from 3.2% currently to the desired 2.0% pace at some point in 2026.

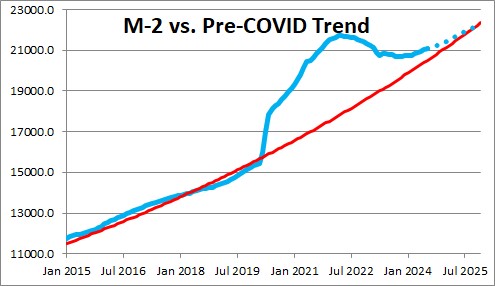

The lengthy period of disinflation has been caused by the Fed eliminating excess liquidity in the economy by steadily shrinking its balance sheet. It provided nearly $4.0 trillion of excess liquidity in 2021 which give rise to the initial runup in inflation. Considerable liquidity has been eliminated but there is about $0.6 trillion of excess liquidity remaining. If the Fed continues to shrink its balance sheet the remaining surplus should disappear by yearend. That process will pave the way for the inflation rate to continue is descent towards the holy grail of 2.0% by 2026..

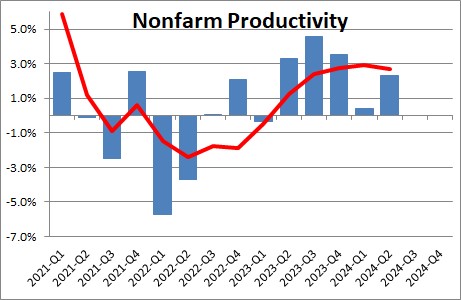

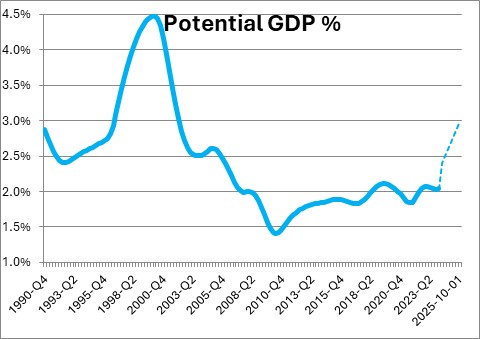

Even more important we believe that an acceleration in the rate of growth of productivity as AI allows firms to boost output without an increase in headcount will boost potential GDP growth. Many firms continue to grapple with a shortage of workers. As a result they are turning to technology — AI in particular – to increase output without an increase in headcount. And it has been paying off. Productivity growth has surged. In the 10-year period prior to the 2020 recession productivity growth averaged 1.2%. In the past year it has accelerated to 2.7%. That is not an accident. It reflects an intentional decision by management to spend money on technology to embrace AI and what it promises to achieve. That process is underway but is still in its infancy. Hence, productivity should continue to grow rapidly in the quarters ahead.

That takes us to potential GDP which is the fastest rate of growth that the U.S. economy can achieve without giving rise to inflation. Economists estimate that growth rate by adding the growth rate of the labor force to the growth rate of productivity. Currently those two numbers are estimated to be about 0.8% and 1.0%, respectively. Hence, potential GDP growth today is estimated to be 1.8%. But if productivity growth climbs to 2.2%, then potential GDP growth should hit the 3.0% mark. That may sound almost incomprehensible. But in the 1990’s when the internet became widely available potential growth soared above 4.0% for an extended period of time. There is little chatter today about faster growth in productivity and potential growth accelerating. In our view, those two factors should play a significant role in forming expectations about future GDP growth.

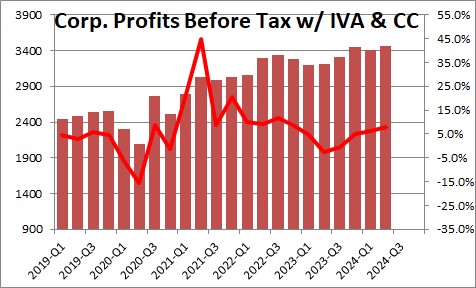

We believe that because of this recent acceleration in productivity, corporate profits have been climbing. They slowed in 2022 and 2023 when the Fed was raising the funds rate. But they have grown 8.0% in the past year, and if the Fed soon begins to lower the funds rate profits are likely to grow even more quickly.

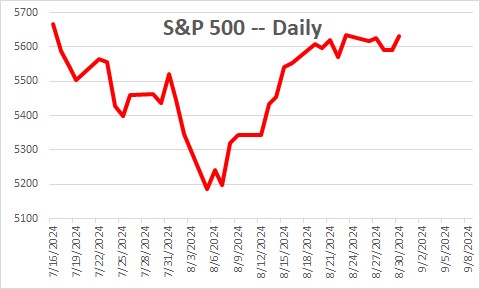

Given all of the above it is not surprising that the stock market quickly shrugged off its early August blahs and is now within 0.5% of an all-time record high level. The stock market seems to have figured out that the combination of robust GDP growth, subdued inflation, substantial declines in interest rates, and a much faster growth rate of productivity, are going to enhance earnings growth for the foreseeable future.

Stephen Slifer

NumberNomics

Charleston, S.C.

Stephen, While the majority of the pundits see recession right around the corner, it is refreshing to read your analysis of the data that takes us in another direction. I am buoyed up with your positive analysis. AND, you are always right. Thank you.

Darrel

Thanks for your kind comments Darrel. Economic forecasting is a very humbling career path. Sometimes you are in the groove. But the world is constantly changing and those economic tea leaves that pointed the way forward in the past may not be as indicative of the future path today as they were then. That makes the job both challenging and frustrating, but it also makes it fun.

Steve