May 10, 2024

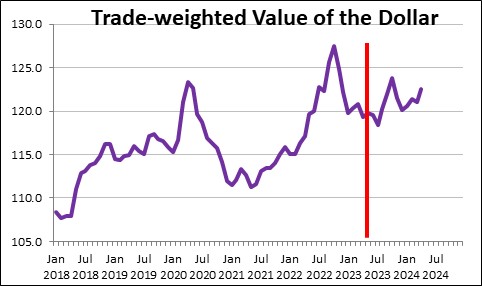

First quarter GDP growth was weaker-than-expected at 1.6% compared to an expected 2.5% pace. Part of the shortfall was from the trade component which subtracted 0.8% from growth in that quarter. The strength of the dollar has often been cited as the culprit. But be careful. The dollar has been strong relative to the Japanese yen and the Chinese yuan, but has changed little elsewhere. Also keep in mind that the trade component represents only about 10% of GDP. Thus, changes in the value of the dollar are not the primary determinants of growth in the U.S. economy — domestic spending is the dominant factor. in the end, the trade component of GDP is volatile on a quarterly basis and can distort the reading for any particular quarter, but will typically have little impact on GDP growth for the year as a whole..

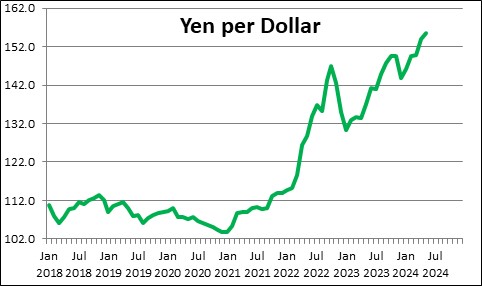

When one talks about “the dollar” they often cite, in particular, the value of the dollar vs. the Japanese yen. Or they may refer to the Chinese yuan. The value of the dollar has appreciated significantly against those two currencies in the past year. But the reality is that our biggest trading partners are the European Union, Mexico, and Canada, with China and Japan holding down the fourth and fifth positions. The exchange rates between our top three trading partners has been relatively stable in the past year.

Hence, when all is said and done, the trade-weighted value of the dollar has risen only 2.6% in the past year. As a result, the trade component of GDP known as “net exports” has subtracted a miniscule 0.1% from GDP growth in the past year. Trade can significantly alter GDP growth for any given quarter, but for it to have a meaningful impact on growth for a year the dollar change will have to be far more significant. Keep in mind, too, that the trade component of GDP represents only about 10% of GDP. Domestic growth determines the other 90%.

Having said all that, the appreciation of the dollar vs. the yen has been impressive. The yen has been steadily losing value for the past three years. This is because the Japanese economy has experienced no inflation in recent years and GDP growth has been virtually non-existent. That is not a situation that appeals to investors and, as a result, the yen has been falling steadily. In fact, in January 2021 there were 103 yen to the dollar. Today there are 155. The Japanese currency has lost half its value in the past three years! The change in this exchange rate in recent years is better described as yen weakness rather than dollar strength.

Similarly, the dollar has strengthened (or perhaps more accurately the Chinese yuan has depreciated) by 14% from 6.3 yuan to the dollar in early 2022 to 7.2 today. This is because the Chinese economy has been struggling. The IMF expects GDP growth in China to be 4.6% this year and then steadily slow to 3.4% by 2028. This is far below the 6.0-7.0% growth rates that existed from 2015 to 2019 (before the pandemic). The Chinese population is aging. The housing sector is collapsing. Investors have decided there are more attractive investment opportunities elsewhere.

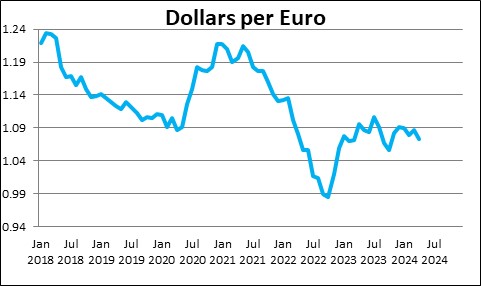

While the dollar’s strength against the Japanese yen and the Chinese yuan has been impressive, it is important to remember that one-half of our trade is done with the E.U., Mexico, and Canada. The exchange rates between the Euro and the Canadian dollar relative to the U.S. dollar have been largely unchanged for the past year. Shown below is the dollar/Euro exchange rate. The Canadian dollar vs. the U.S. dollar chart looks essentially the same – little change in the past year.

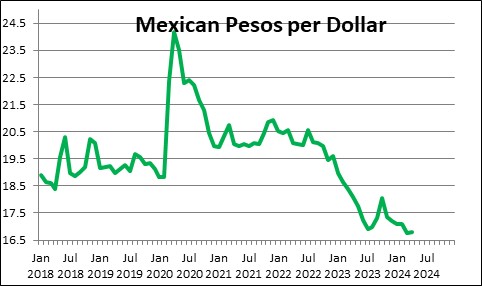

The dollar has actually depreciated 7.0% relative to the Mexican dollar in the past year. In May of 2023 there were 18.1 Mexican pesos per dollar. Today there are 16.8. Thus, the drop in the value of the dollar versus the Mexican peso counters much of the appreciation of the dollar versus the yen and the yuan.

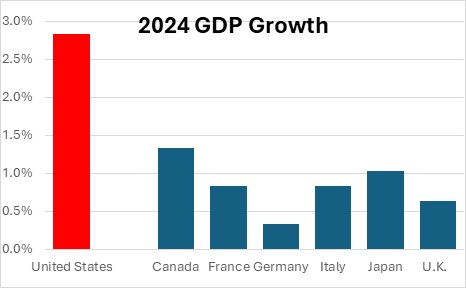

While changes in exchange rates relative to specific countries has been fairly dramatic, the bottom line is the trade-weighted value of the dollar has risen only 2.5%. One does not have to be a rocket scientist to see why. The U.S. economy is doing well and seems likely to continue doing so. Every other economy within the G-7 is struggling. The IMF projects U.S. GDP growth this year of 2.7% which is more than double the likely growth of any other major country.

As a result, the dollar may continue to climb somewhat in the months ahead, but its impact on the trade sector should be relatively small. Given that trade only represents about 10% of GDP its impact on the overall economy should be negligible.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me