November 23, 2018

The Fed’s Open Market Committee will meet December 18-19 and the discussion should be far more spirited than one might have imagined six weeks ago when a rate hike was virtually assured. As always, the Fed’s decision will be based on economic fundamentals. President Trump’s pressure on the Fed will not be a factor. As we see it, three factors have altered the economic environment.

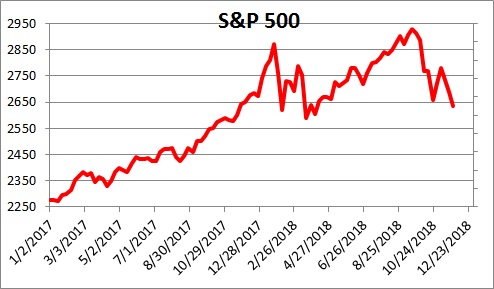

First, the stock market has fallen as investors worry about the future path of interest rates as well as economic weakness overseas — from China in particular. Thus far the S&P 500 index has fallen 10% which is generally regarded as a “correction”. Corrections occur regularly and do not carry heavy weight in the Fed’s decision-making process. Having said that, the Fed is certainly aware of the decline.

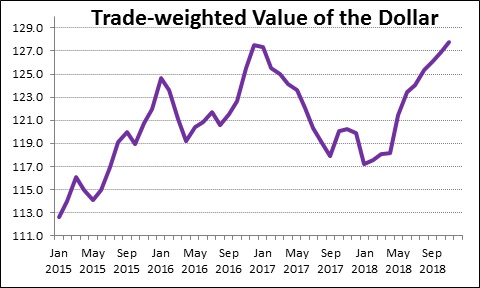

Second, growth overseas has slowed considerably in large part because of Trump’s tariffs and foreign investors’ fear about a global trade war. Because these investors have concluded that the U.S. is in a better position to withstand a full-blown trade war than anybody else, they have poured money into the United States since the initial tariffs were imposed back in February. As a result, the dollar has risen 9%.

An increase in the dollar crushes emerging economies. They must purchase raw materials for their manufacturing sector. But those raw materials are priced in dollars. An increase in the value of the dollar increases their cost of goods sold.

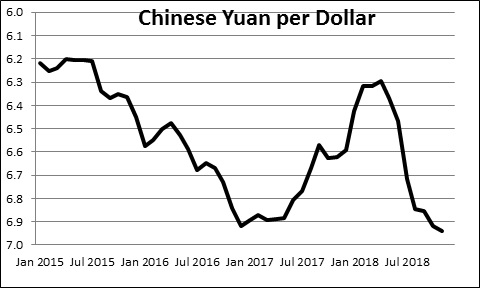

As a result, their currencies have plummeted. The Chinese yuan, for example, has fallen 10% to 6.95 yuan and has been prevented from falling below the psychologically important 7.0-yuan level only because of considerable central bank support.

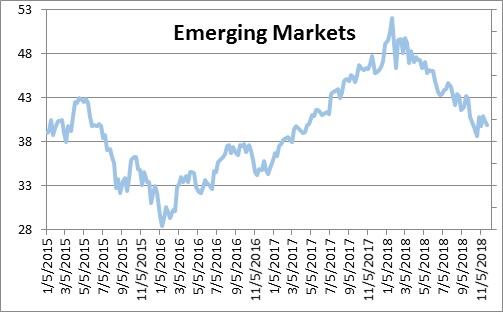

Fears of slower growth have taken a toll on the stock markets of emerging economies which have plunged 25%.

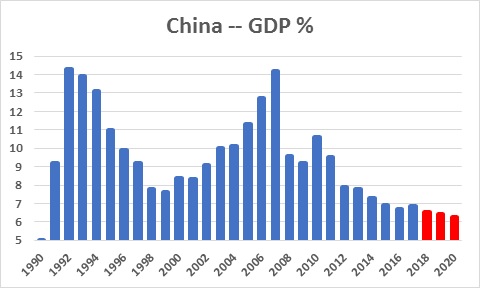

Indeed, signs of slower growth overseas have recently begun to emerge. Growth in China has slipped to 6.5% and the IMF projects even slower growth in 2019 and 2020. For most countries 6.5% growth would be impressive, but for China it would be the slowest pace since 1990. Stagnant growth in China is a particularly serious obstacle to growth in other emerging economies, but will be felt around the globe.

While the U.S. may be in better shape to withstand a trade war than other countries, it is not immune. We have shaved our 2019 U.S. GDP growth forecast by 0.2% to 2.8% as a result of a reduced volume of trade. It is reasonable to conclude that the Fed has done the same thing.

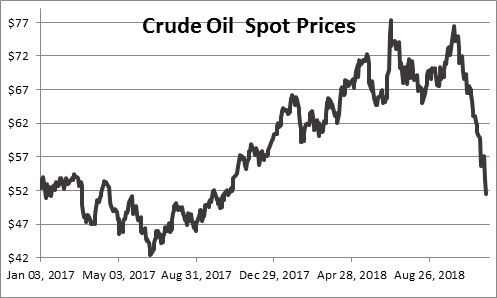

Third, oil prices have fallen by one-third since early October from $76 dollars per barrel to $51. At the very least the headline CPI is likely to decline 0.1% or so in both November and December. The precipitous, unexpected drop in oil prices should provide temporary relief on the inflation front.

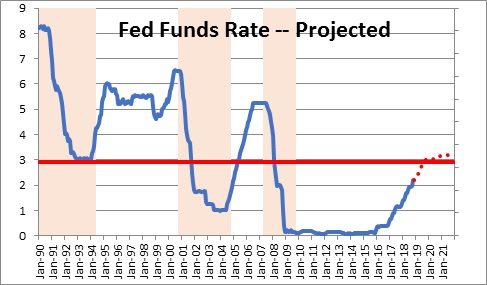

We believe at their gathering in mid-December FOMC members will choose to hold the funds rate steady in its current range from 2.0-2.25% rather than raise it again. Turmoil in the financial markets, slower growth in China, and falling oil prices suggest a rate pause would be appropriate.

Whether the Fed raises rates in December or not is, in some sense, irrelevant. The Fed is, appropriately, on a path to a neutral level for the funds rate which it believes is about 3.0%. Recent developments will not alter that view. A Fed decision not to raise rates in December would be welcome news for the markets. Even a decision to raise rates in December but seek a lower rate trajectory in the years ahead would be a positive outcome.

What about Trump’s pressure on the Fed, Fed Chair Powell in particular? Won’t that make the Fed more inclined to raise rates to emphasize its independence? We doubt it. In our experience Fed interest rate decisions are based on the economic fundamentals, not political pressure. It is unfortunate that Trump has chosen to wage war on the Fed, and some will undoubtedly see no rate hike as capitulation to the president’s wishes. But that will not be the motivation for the Fed’s decision. The economic outlook has changed, and the Fed should respond appropriately. Our best guess is that, one way or the other, the Fed will indicate its intention to boost the funds rate to its presumed neutral level of 3.0% by the end of next year and do very little thereafter. That is good news.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me