June 25, 2024

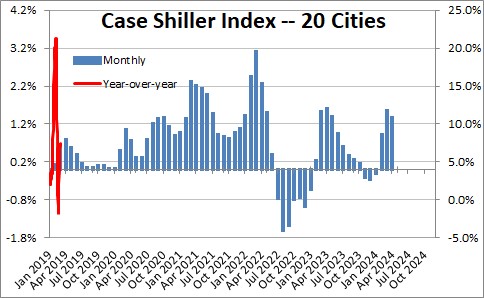

The seasonally adjusted Case Shiller Index of Home Prices in 20 cities rose 1.4% in April after having risen 1.6% in March. The rate of increase in home prices has slowed from double-digit gains in 2021 and 2022 to 7.2% currently.

Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P DJI said, “For the second consecutive month, we’ve seen our National Index jump at least 1% over its previous all-time high. 2024 is closely tracking the strong start observed last year, where March and April posted the largest rise seen prior to a slowdown in the summer and fall. Heading into summer, the market is at an all-time high, once again testing its resilience against the historically more active time of the year.”

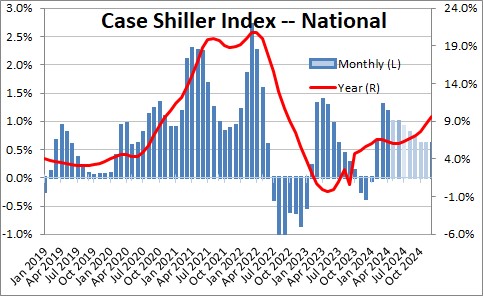

The more inclusive index of home prices at the national level rose 1.2% in April and 1.3% in March. This index has risen 6.3% in the past year. We expect this index of national home prices to rise more slowly in the months ahead.

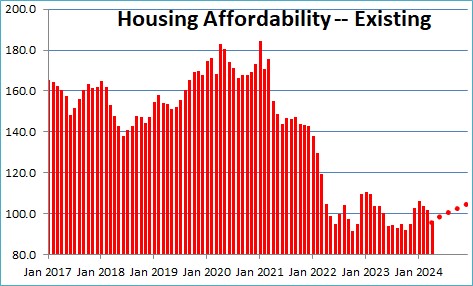

What about housing affordability? There are three pieces to this equation. First, as noted above, home prices should continue to rise but at a slower rate in the second half of the year.

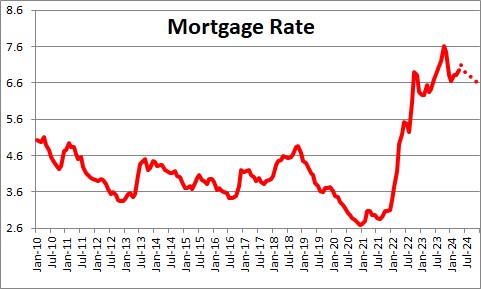

Second, mortgage rates are currently at 6.9%. We believe that mortgage rates should decline to about 6.6% by the end of 2024 as inflation continues to subside.

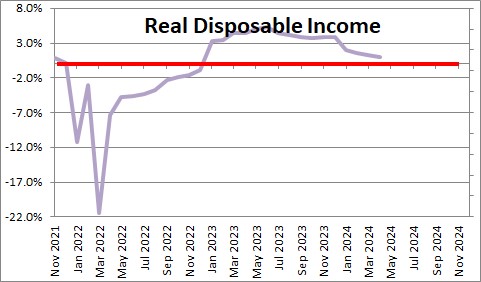

Third, job gains and wage hikes are boosting consumer income although inflation is eroding the nominal increase in income. Real disposable income has been slowing in recent months and has risen just 1.0% in the past year.

The housing affordability index came in at 95.9 in April which means that potential buyers had 4.1% less income than was necessary to purchase a median-priced home. With income continuing to rise slowly, with mortgage rates declining, and prices rising slowly, housing affordability should increase somewhat in 2024 which should put some spark into both new and existing home sales.

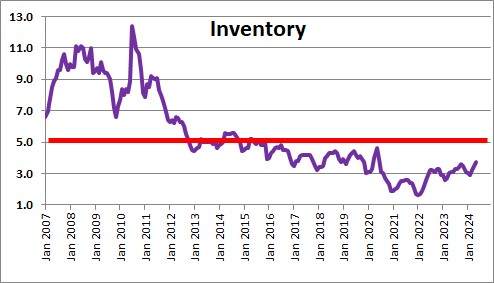

The supply of existing homes available for sale is near a record low level. However, as builders step up the pace of production the supply of available homes should increase somewhat as the year progresses. If that is the case, home prices should rise more slowly later this year.

We expect 2.8% GDP growth in the second quarter followed by 1.5-2.0% in the second half of the year. The ratio of consumer debt to income remains very low. The economy keeps cranking out jobs and wages keep rising slowly which should boost consumer income and spending. Mortgage rates are likely to fall somewhat in the months ahead. The stock market is at a record high level. The Fed will initiate an easing cycle later this year, probably close to yearend.

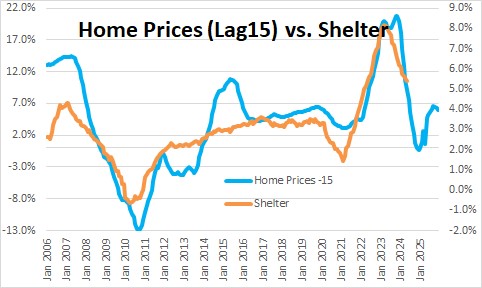

The shelter component of the CPI seems to closely track the Case Shiller change in home prices with a lag of about a year. As a result, the shelter component of the CPI which has increased 5.4% in the past year should slow further as the year progresses, which should allow the core CPI to resume its slowdown.

Stephen Slifer

NumberNomics

Charleston, SC

Steve – To what extent do the accelerating housing prices affect overall inflation?

Hi Frank,

Home prices are an asset and are treated as a capital investment. So we cannot look at housing prices and easily figure out what is happening to inflation. The CPI is a measure of inflation and what goes into the CPI is a measure of rent. In fact, rents are about 1/3 of the entire CPI. If rents are on the rise, that feeds directly into that measure of inflation.

The Census Bureau does a quarterly survey on homeownership. Amongst the many things they report are “Asking Rent — Vacant Rentals”. I cannot show you the chart using WordPress so I will send it your e-mail address. In the four-quarter period ending in the third quarter rents had risen 15.8%. But yet in the CPI rents have risen just 1.9%. But remember that in the CPI they knock on doors and ask people how much their rent is, and they survey the same unit every six months. So given that method of calculation rapid rent increases may take a while to get captured.

Bottom line is, rents are going up. But expect them to rise more slowly than the rapid increases in home prices. If they have risen 1.9% in the most recent 12-month period they should be higher — 2.5% perhaps — in 2021.

Hope this helps.

Steve