April 29, 2025

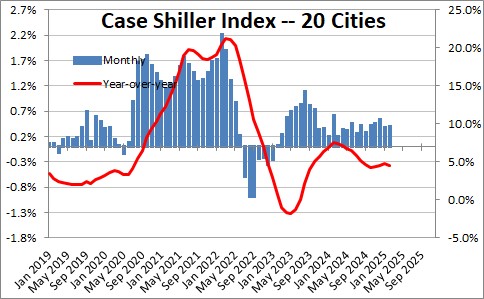

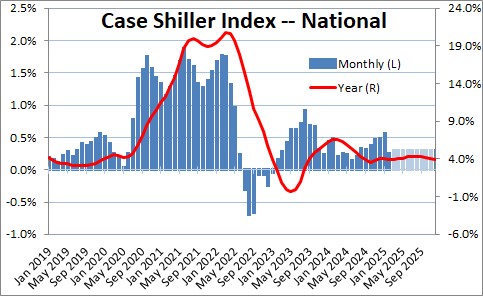

The seasonally adjusted Case Shiller Index of Home Prices in 20 cities rose 0.4% in both January and February. Prices have risen 4.5% in the past year.

The National Index which is a slightly broader measure of home price increases rose 0.3% in February after climbing 0.6% in January. The year-over-year increase for this series is 3.9%.

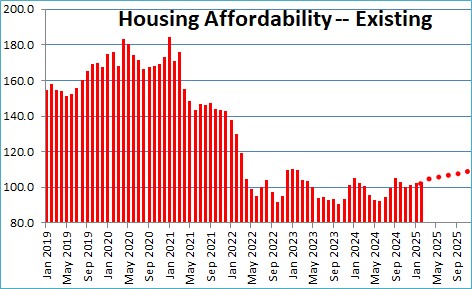

What about housing affordability? There are three pieces to this equation. First, as noted above, home prices should rise slowly in the months ahead.

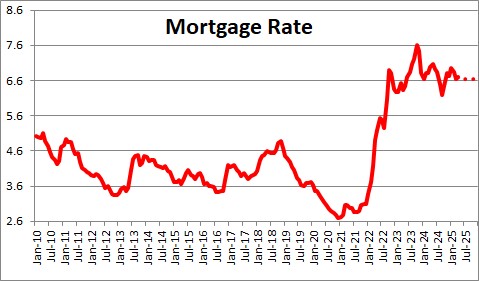

Second, mortgage rates are currently at 6.8%. We believe that mortgage rates should decline to 6.5% by the end of 2025 as inflation slows a bit farther.

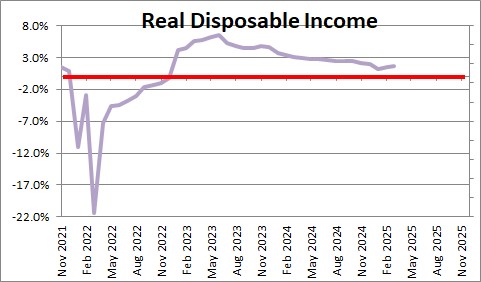

Third, job gains and wage hikes are boosting consumer income. Real disposable income has climbed by 1.7% in the past year.

The housing affordability index came in at 102.2 in February which means that potential buyers had 2.2% more income than was necessary to purchase a median-priced home. With income continuing to rise slowly, mortgage rates declining, and prices about unchanged a median income earning family should have 15% more income than required to purchase that median-priced home by the end of this year. That should put some spark back into both new and existing home sales.

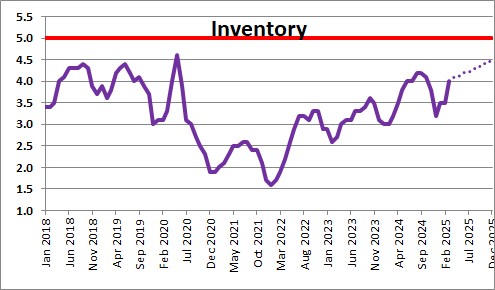

After reaching a record low level, the supply of existing homes available for sale has begun to climb and is now at 4.0 months. As builders step up the pace of production the supply of available homes should increase somewhat as the year progresses. If that is the case, home prices should be relatively unchanged in the months ahead.

After falling 0.3% in the first quarter, we expect GDP to grow by 2.5% in the second quarter and 1.9% in 2025. The ratio of consumer debt to income remains very low. The economy keeps cranking out jobs and wages keep rising slowly which should boost consumer income and spending. Mortgage rates are likely to fall slightly in the months ahead.

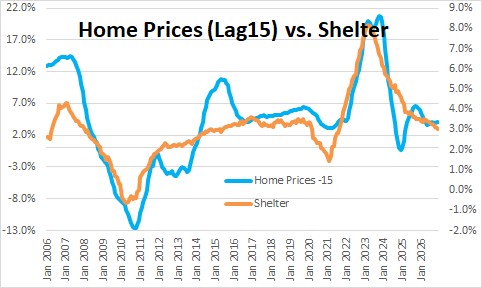

The shelter component of the CPI seems to closely track the Case Shiller change in home prices with a lag of about a year. As a result, the shelter component of the CPI which has increased 3.9% in the past year should slow further as the year progresses to perhaps 3.5% by yearend, which should allow the core CPI to resume its slowdown.

Stephen Slifer

NumberNomics

Charleston, SC

Steve – To what extent do the accelerating housing prices affect overall inflation?

Hi Frank,

Home prices are an asset and are treated as a capital investment. So we cannot look at housing prices and easily figure out what is happening to inflation. The CPI is a measure of inflation and what goes into the CPI is a measure of rent. In fact, rents are about 1/3 of the entire CPI. If rents are on the rise, that feeds directly into that measure of inflation.

The Census Bureau does a quarterly survey on homeownership. Amongst the many things they report are “Asking Rent — Vacant Rentals”. I cannot show you the chart using WordPress so I will send it your e-mail address. In the four-quarter period ending in the third quarter rents had risen 15.8%. But yet in the CPI rents have risen just 1.9%. But remember that in the CPI they knock on doors and ask people how much their rent is, and they survey the same unit every six months. So given that method of calculation rapid rent increases may take a while to get captured.

Bottom line is, rents are going up. But expect them to rise more slowly than the rapid increases in home prices. If they have risen 1.9% in the most recent 12-month period they should be higher — 2.5% perhaps — in 2021.

Hope this helps.

Steve