March 25, 2022

We do not expect a recession any time between now and the end of 2023 largely because real interest rates will remain negative, and because there remains considerable excess liquidity in the economy. Other economists are more concerned, but nobody is expecting a recession. But what if we are wrong? The Fed is raising interest rates quickly and will soon begin to shrink its balance sheet. At some point that action will begin to bite. What indicators should we look at to give us some early warning that the economy is about to head downwards? Here are six of our favorites.

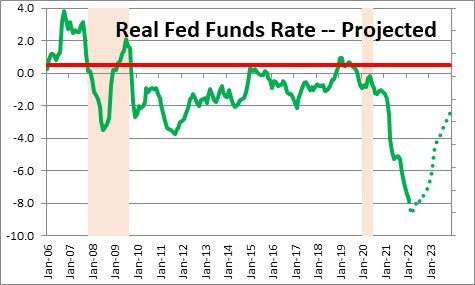

Real interest rates. Keep your eye on real interest rates, not the nominal level. Consider the following. Back in the late 1970’s the prime rate was 20% but the corporate tax rate was 50%. That firm was not paying 20%, after tax it was paying 10%. With inflation soaring at 12% the firm’s real, after-tax cost of borrowing was -2.0%. As stupid as it might have appeared it paid the firm to borrow at the 20% rate because it could write off so much against taxes and pay it back with cheaper dollars. The lesson is to keep your eye on the real level of interest rates not the nominal rate. With the funds rate today at 0.25% and the year-over-year increase in the CPI of 7.9%, that real funds rate is -7.6%. At the end of 2023 we expect the funds rate to be 3.75%, and we expect the CPI to increase 6.2%. Almost two years from now the real funds rate is still likely to be -2.5%. The real funds rate needs to be positive to have any chance of slowing the pace of economic activity. Even the Fed believes this. With an inflation target of 2.0% it believes a neutral funds rate is 2.5%. In other words, it believes that a real rate of 0.5% is what is required to balance supply and demand. Negative real rates will keep the economy humming.

Stock market. The economy does not dip into recession without first having experienced a significant drop in stock prices. The problem is that the stock market tends to give a lot of false signals. While we always keep an eye on the stock market, we also want confirming evidence from other economic indicators. Currently, the stock market is not flashing a warning. After nearly two years of rapid ascent the combination of inflation fears and the war between Ukraine and Russia has made investors nervous. The S&P 500 recently declined about 12% from its end of year peak. In stock market jargon that is usually characterized as a “correction” which occurs regularly during any expansionary period with no particular economic significance. The S&P has since recovered one-half of that decline and is now just 5% below its record high. No sign of a problem here.

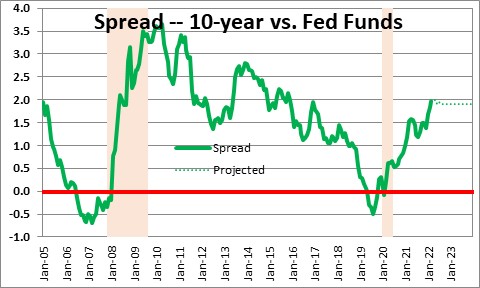

Yield Curve. The yield curve is always an excellent recession predictor. Once the curve inverts, a recession almost inevitably follows a year or so later. But which spread to use? We use the difference between the yield on the 10-year note and the Federal funds rate. Right now with the yield on the 10-year at 2.3% and the funds rate at 0.25%, the spread is +2.0%. Hardly a sign of impending doom. In any event, the Fed is well aware of the problems caused by an inverted curve, so if it gets close to inverting the Fed will almost certainly slow its pace of tightening.

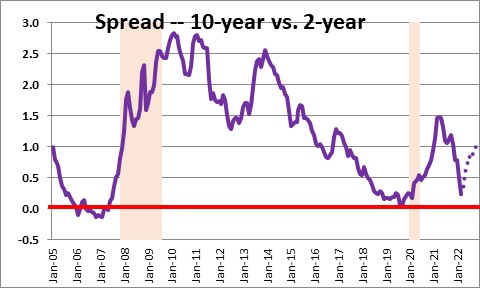

Some economists prefer the difference between the rates on 10-year and the 2-year. With the 10-year at 2.3% and the 2-year at 2.1% the difference is +0.2%. That is much closer to inverting, but the market has priced in a huge amount of Fed tightening over the next two years. Our sense is that this spread is more likely to widen in the months ahead rather than shrink further.

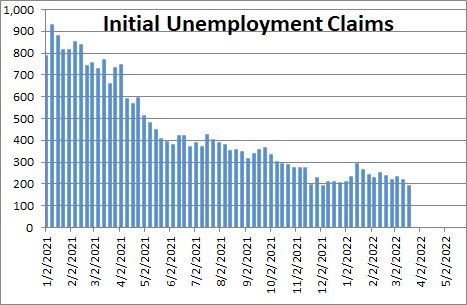

Initial claims. This is a measure of layoffs. The idea is that if firms begin to worry about a recession some will begin to lay off workers. If initially only a few firms do so, claims will rise while payroll employment will continue to climb. It is not until claims have risen steadily for a while that payroll employment begins to fall. Thus, initial claims are a leading economic indicator; payroll employment is a coincident indicator. The first month that payroll employment drops is typically the beginning of the recession. Right now claims are the lowest they have been in the past 50 years. Job openings are at a record high level. Firms are desperately seeking to hire workers, not fire them. It is hard to imagine a steady increase in layoffs any time soon.

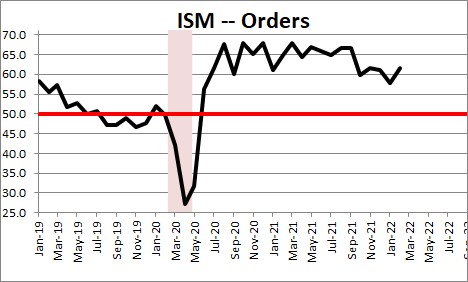

Orders. When the economy softens manufacturers will find that orders begin to decline. If orders continue to slide eventually manufacturers will cut production. Like payroll employment, a drop in industrial production typically marks the beginning of the recession. Thus, orders are a leading indicator. We look at durable goods orders but because this series is extremely volatile from month to month and subject to large subsequent revisions, its value as a leading indicator is limited.. We tend to focus more on the orders component of the Institute for Supply Management’s monthly survey of manufacturers. Orders are rising when the level is above 50.0. It is currently at a very healthy level of 61.7 and orders have been rising for 21 straight months. No sign of any problem here either.

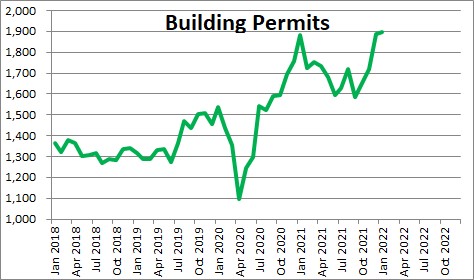

Building permits. The housing sector has been hot with the average home selling in just 19 days which is the shortest length of time between listing and sale ever recorded. But at some point the steady run-up in mortgage rates and continuing climb in home prices will take a toll. If consumers begin to feel strapped the place where that angst shows up first is in housing which is not surprising because housing is the biggest item in any consumer’s budget. Because most municipalities require a builder to get a permit before beginning construction, a drop in building permits is a leading indicator of an impending decline in housing starts. Currently building permits are much higher now than they were at the beginning of the recession and are, in fact, at their highest level since the final days of the housing boom in 2006. Once again, no indication of softness in the housing sector despite the jump in mortgage rates from 3.0% to 4.4% and a 20% increase in home prices.

From what we can see, all sectors of the economy currently are particularly robust. For that reason, we do not expect a recession between now and the end of next year. But the Fed has made it clear that rates are headed higher and it will soon begin to shrink its balance sheet. Eventually the economy will go over the edge, but you will get an early warning signal from one or more of the above indicators.

Stephen Slifer

NumberNomics

Charleston, S.C.

Stephen, Terrific writeup on ways to foresee a recession! I have a file where I keep economic indicators and this will be right at the top of the list for future reference.

Thanks Blake. Hope all is well.

Spot on. Just like our days at Lehman Brothers

Hi Jack. Those were the days. I think we all loved that time early in our careers. But, as always, life goes on.

Glad to see you are doing well.

Best.

Steve