November 11, 2022

The CPI for October came in far below what had been expected and the stock and bond markets staged powerful rallies. The S&P 500 index jumped 5.5% in a single day. The yield on the 10-year note fell 0.33%. to 3.82%. While the inflation rate has almost certainly peaked, the targeted 2.0% rate is far distant and unlikely to be achieved until 2024. Keep in mind that the enormous stock market rally and drop in bond yields have eased financial conditions which is likely to bolster both consumer and business confidence, provide additional economic stimulus, and be counter-productive in the fight against inflation. The Fed will almost certainly raise the funds rate by 0.5% in mid-December which is smaller than the steady diet of 0.75% increases that we have seen since midyear. However, the issue is not the speed of rate hikes going forward but the peak level which we expect to reach 6.0% by the middle of next year.

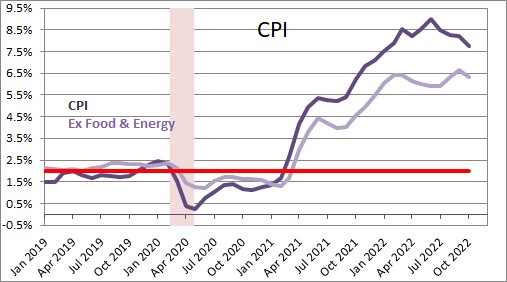

The core CPI rose a smaller-than-expected 0.3% in October. After reaching a peak in June of 9.0%, the 12-month increase in the overall index has now slowed to 7.8%. The core CPI reached its peak in September at 6.7% and has now dipped to 6.3%. While slower than a few months ago, neither inflation measure is even remotely close to the desired 2.0% pace. The Fed has a long ways to go. Is it possible that the October outcome signals the beginning of a rapid decline in the inflation rate? Probably not. We saw a 0.3% increase in the core rate in July. It was then followed by disquieting gains of 0.6% in both August and September. We suspect a similar pattern of a slowdown in October followed by more normal-looking gains in November and December.

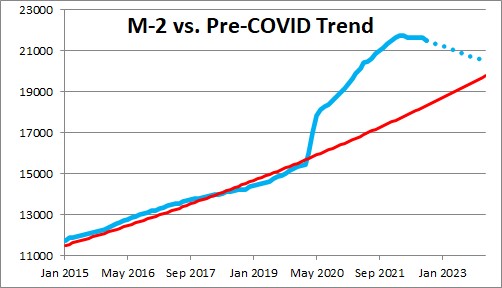

We continue to believe that the primary reason that inflation has exploded is because of unprecedented growth in the money supply that began during the lockdown in March and April 2020. The M-2 measure of the money supply typically grows roughly in line with nominal GDP or roughly 6.0%. At the end of last year the actual level of the money supply exceeded its desired growth path by $4.0 trillion. That represents surplus liquidity in the economy that is just waiting to be spent. The money supply has declined slightly since the spring but is still $3.2 trillion above where it should be. If the Fed continues to shrink its balance sheet the surplus liquidity may drop to about $0.9 trillion by the end of 2023. It is moving in the right direction but the remaining excess liquidity is not conducive to a significant slowdown in the inflation rate.

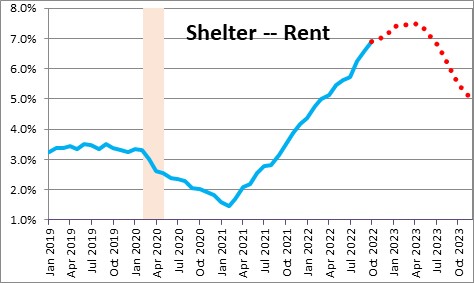

An important part of the inflation equation is the shelter component of the CPI which is largely comprised of rents. What happens to rents is a big deal because the shelter component represents one-third of the overall CPI. Currently, rents are rising rapidly and actually seem to be accelerating. The year-over-year increase is 6.9% but in the past three months it has quickened to a breathtaking 8.8% pace. Rents typically follow home prices by about one year. If rents begin to fall in the middle of next year, that is when we should see a more rapid decline in the inflation rate.

Even a single month’s improvement in the inflation rate is welcome news, but it would be grossly premature to think that the trend rate has changed. The dramatic increase in the stock market means that it has recovered about one-third of its loss since the beginning of the year. A rebound of that magnitude may bolster sagging consumer and business confidence which could stimulate GDP growth.

Similarly, the yield on the Treasury’s 10-year note had climbed to 4.15% but quickly fell 33 basis points to 3.8% which means that mortgage rates are likely to decline from 7.1% earlier in the month to 6.8%. These changes in long-term interest rates will also tend to bolster the economy.

Currently, fourth quarter GDP growth appears to be about 2.0%, but the widely followed Atlanta Fed GDPNow forecast is at 4.0%. A GDP growth rate of anywhere between 2.0-4.0% is far higher than the Fed would like to see.

With the funds rate likely to be 4.4% at the end if this year and the core CPI likely to increase 6.1%, the real funds rate will be negative by 1.7%. A negative real funds rate combined with additional stimulus from the recent rise in stock prices and drop in bond yields is not about to produce a meaningful decline in inflation any time soon.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me