November 3, 2022

The employment report for October confirmed that the monthly gains in employment continue to slow gradually. The 150 thousand increase in employment was held down by the loss of 33 thousand workers in the automobile industry caused by the UAW strike, The strike may also have biased downwards the hours worked data and accounted for the small increase in the unemployment rate. Even with a snapback in all of those categories in November as the auto workers return to work, it seems clear that the economy is continuing to cool and that fourth quarter GDP growth will likely be about 1.5% following the outsized 4.9% increase in the third quarter. Meanwhile, the money supply continues to decline which means that the surplus liquidity in the economy should almost disappear by the end of the year. That, in turn, suggests that the inflation rate will continue to slow. It may not reach the Fed’s 2.0% target until 2025, but it will steadily move in that direction. Against that background, it is hard to imagine that Fed policy makers will vote for another rate hike any time soon. Fed officials have already indicated that they will be unlikely to raise rates at the next FOMC meeting in December. We believe that by early next year the Fed will indicate more clearly that the rate tightening cycle is over. Once additional rate hikes are off the table, consumer and business confidence will climb and attention will shift to the timing of the first rate cut by the Fed. That change in sentiment should lead to somewhat more GDP growth in the second half of next year of perhaps 1.5% following anemic growth in the first half. If so, the Fed will have successfully pulled off the elusive soft landing. Kudos to the Fed. That does not happen often.

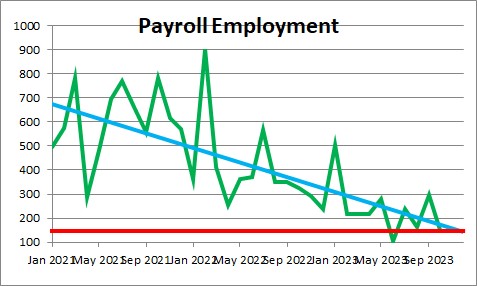

Payroll employment rose 150 thousand in October. That included a 33 worker decline in employment in the automobile industry caused by the UAW strike. Those workers will return to their jobs in November and bias upwards the overall increase for that month. Even so it is clear that employment growth has been slowing. A year ago we were seeing a steady diet of employment gains in excess of 300 thousand per month. Today they are 204 thousand and seem headed lower.

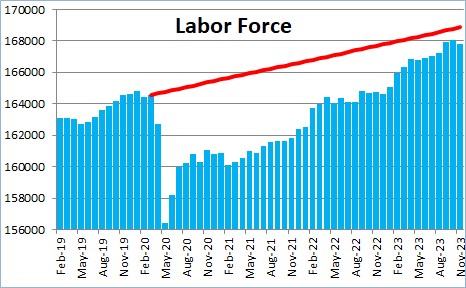

Throughout this year the monthly jobs gains have been bolstered by workers returning to the labor force. But, at long last, the labor force is close to where it would have been if the 2020 pandemic-induced recession had not occurred. If that is true, then labor force growth should soon return to its longer-run growth rate of 1.0% which works out to about 150 thousand per month. If both the labor force and employment are heading towards roughly 150 thousand per month, then the unemployment rate should be reasonably steady at its current level of 3.9% for the foreseeable future. Remember, the Fed believes the economy is at full employment – meaning that everybody who wants a job has one – if the unemployment rate is 4.0%. If that is accurate, then the Fed has successfully slowed GDP growth without generating significant weakness in the labor market.

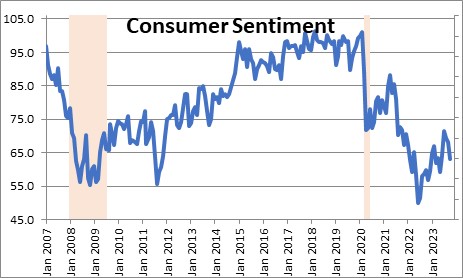

Consumers play a key role in this anticipated soft-landing scenario. Consumers continue to fret about the still high inflation rate and the possibility of further rate hikes. As a result, consumer sentiment is still 30 points below where it should be.

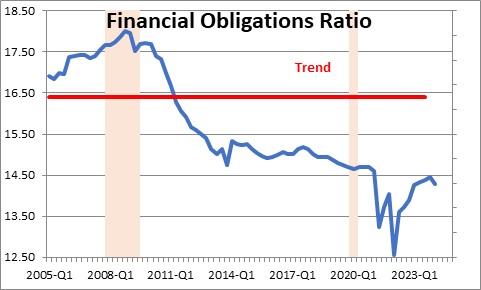

Despite worries about the future consumers have been spending at a relatively robust 2.4% pace. But to do so they have been saving less each month. The savings rate today is 3.4% compared to its long term average of about 7.0%. At the same time consumers are relying on their credit cards. Credit card debt has increased 16% in the past year. This is not a sustainable situation. However, it can continue for a while because consumer debt in relation to income remains very low. Our expectation is that by early next year the pace of consumer spending will have slipped to 0.5-1.0% which should cause GDP growth to slow to about 0.6% in both the first and second quarters of 2024.

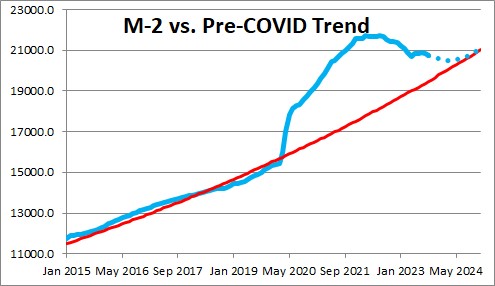

On the inflation front we are comforted by the steady decline in the growth rate of the money supply. Following explosive growth in 2020 and 2021 as the Fed bought trillions of dollars of government securities and mortgage-backed debt, the economy at one point had roughly $4.0 trillion of surplus liquidity which fueled the dramatic increase in the inflation rate. That has shrunk to $1.3 trillion currently and should be largely eliminated by yearend. That gives us confidence that the inflation rate will continue to gradually slow towards the Fed’s 2.0% target. Given still rising wages and a resumption of increases in home prices and rents, the descent towards the 2.0% mark may be very slow and not achieve the objective until 2025, but it should continue to move steadily in the right direction.

We thought that Fed officials might want to hasten the inflation slowdown by raising the Fed funds rate a couple more times from 5.5% currently to the 6.0% mark, but no Fed official at the moment seems inclined to do so. Accordingly, we have dropped the two additional rate hikes and now believe that the current 5.5% level of the funds rate is most likely its peak level. Rate cuts are far distant and may not begin until the second half of next year. But after 2-1/2 years of steady Fed tightening it is comforting to think that the funds rate may have finally reached its peak.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me