February 25, 2022

Let’s be real. Nobody knows exactly what is going to happen next in the war between Russia and Ukraine. But a couple of things seem obvious. Russia appears to be handily dismissing its Ukraine rivals. Europe and the U.S. continue to do what they do best – talk and impose toothless sanctions that will do nothing to deter Putin. There has been no talk of any military response. There is no willingness to prevent Russia from using the SWIFT network to curtail its access to foreign capital. There is no talk of reducing or eliminating Russia’s exports of oil or natural gas. No one is willing to stand up to a bully. Putin wins. Within hours Ukraine has moved into Russia’s sphere of influence. In light of that tepid response by the U.S. and Europe there is likely to be little impact on the U.S. economy. Firms will continue to create jobs. The consumer will continue to spend. The economy will continue to grow at a reasonably rapid pace. Inflation may be higher than thought previously. In view of the heightened uncertainty, any notion that the Fed will respond aggressively to counter rising inflation is off the table. Rates will rise but not rapidly enough to do any particular damage. Ho hum. More of the same. The outcome could be different, but that requires political courage. That willingness to act aggressively is distinctly lacking on both sides of the Atlantic.

When the war first broke out on Tuesday all sorts of fears emerged – a possible cutoff of off oil and gas supplies to Europe, a dramatic rise in inflation, an aggressive response by the West that could result in cyber-attacks not only in Ukraine but in Europe and the U.S. Citizens and countries across the globe were understandably nervous. The stock market tanked in the morning. Oil prices surged. Bond yields plunged. But then came the news of the relatively tepid response by the U.S. and Europe. Suddenly the markets’ worst fears were not going to be realized. Movements earlier in the day were completely reversed as the afternoon progressed.

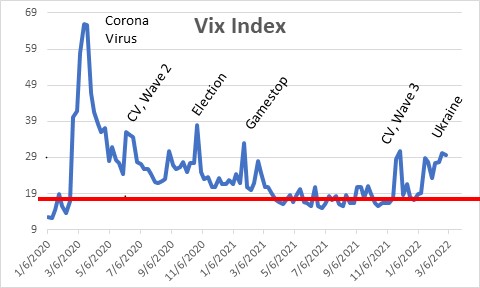

What do we conclude from all this? First, volatility in all markets will remain elevated for some time to come and will ebb and flow with every successive news headline.

As long as this nervousness persists it will be hard for the stock market to rebound. But in the absence of a more vigorous response by the West it may not sell off that much either. As amazing as it seems, the S&P 500 index is only 8% below the record high level it set in December. It feels more like 40%.

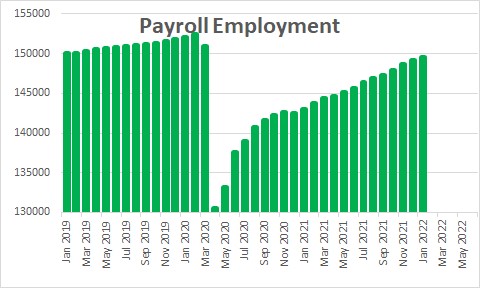

Why is the stock market hanging in there? First, firms are still creating jobs. Payroll employment has risen on average 540 thousand per month for the past three months and the weekly data on initial unemployment claims and the number of people receiving unemployment benefits suggest that we will get another solid report for February which we will see next Friday, March 4. For what it is worth we expect to see an increase in employment of 500 thousand in that month and a decline in the unemployment rate of 0.2% to 3.8%.

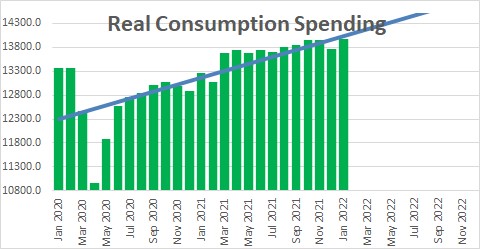

Second, consumers are continuing to spend. Consumption spending jumped 2.1% in January. While a part of that gain was attributable to inflation, real consumption spending climbed by 1.5%. The first quarter is off to a great start.

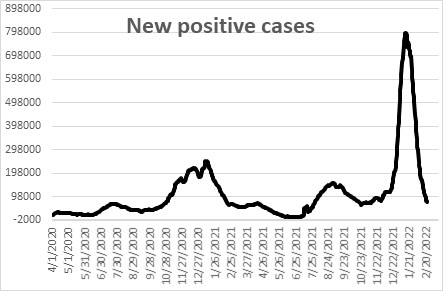

Perhaps contributing to the January spending spree is the fact that the number of new COVID cases daily has fallen by more than 90% from its mid-January peak. Consumers now feel comfortable going places and doing things that made them uncomfortable in the past couple of months.

At the same time, the beleaguered manufacturing sector may finally be emerging from its supply constrained doldrums. Durable goods orders, for example, jumped 3.2% in November, 1.2% in December and 1.6% in January. In the past year durable goods orders have risen 14.1%. In the past three months that has picked up to a breath-taking 24% pace.

The bottom line is that through January the economy was on a roll. Maybe the situation in Ukraine will change all that and growth will soften. But the weekly data on layoffs and the number of people receiving benefits suggest that nothing has changed through mid-February. The rebound in stock prices seems to indicate that investors have not lost the faith. The economic fundamentals thus far suggest solid growth in the economy. Unfortunately, that steamy growth rate has pushed inflation higher as demand far outstrips supply. The Fed’s inflation target – the core personal consumption expenditures — has risen 6.1% in the past year and is showing no sign of slowing down. We look for it to climb by 5.2% in 2022.

To alter all this there needs to be a game changer. The United States and Europe need to do something to induce fear in Putin. Despite his threat of retaliation for the sanctions, he does not need to do anything else. He has Ukraine. Anything further on his part could trigger a more vigorous response by the West. Why bother? He has won. Sad.

Stephen Slifer

NumberNomics

Charleston, S.C.

not that i want the economy to change for US, but i found it morally unacceptable for western countries to do nothing. why is there no appetite for taking away SWIFT from Russia?

Hi Wendy,

I agree with your comment that it is morally unacceptable for western countries not to do more to support Ukraine.

I am no expert on SWIFT and international clearance mechanisms but here are a couple of the likely reasons why they chose not to boot Russia out of SWIFT.

If cut off from SWIFT Russia could still process international transactions the old fashioned way by telephone, telex or e-mail. Clumsy, but do-able. Thus, cutting the Russians out of SWIFT may not achieve the desired result.

Further, it might encourage Russia and its trading partners to shift their financial payments to an alternative clearance mechanism — like ones being developed by China.

Third, if you cut Russia off from SWIFT it will likely fall into a steep recession this year with GDP declining 5.0% or so. And European countries do a lot of business with Russia. But the Russian economy could slip into recession anyway. In the past week the Russian stock market has fallen more than 20%, and the Ruble has declined by 15%. Sounds like their economy is going to be in trouble even without SWIFT, and inflation is probably going to climb to double-digits. That is not stag-flation but something worse. But isn’t that the whole idea of sanctions? Weaken their economy enough that you force them to negotiate (or better yet withdraw).

Finally, and perhaps most important, many European countries import much of their oil from Russia. Germany imports around half of its gas from Russia, France about 25%, Italy 46%. Shutting Russia out of SWIFT could trigger a move by Russia to cut off the flow of oil to these countries.

What a mess.

Good commentary Stephen! I had picked what I thought was a bottom in the equity markets back in late January but its hard to anticipate a black swan event on top of bearish Fed moves and constantly changing virus action. Too many variables. Markets came back strong though after the initial invasion of Ukraine. As I recall, sometimes war is a stimulant to the economy. Check out the English version of the Russian Times to get the other sides view on things at RT.com It puts it in perspective for me even though I am not a Putin fan. Thanks!