October 2, 2024

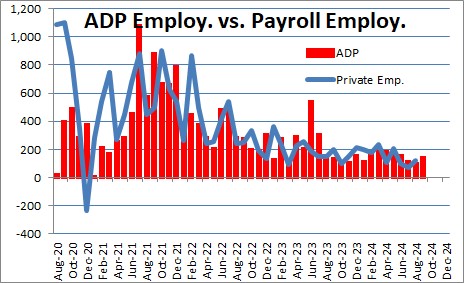

As shown above the ADP survey shows a respectable correlation with the private sector portion of the payroll employment data to be released a couple of days later. And well it should. ADP, or Automatic Data Processing, Inc. is a provider of payroll-related services. Currently, ADP processes over 500,000 payrolls, for approximately 430,000 separate business entities, covering over 23 million employees. The survey has been in existence since January 2001, and its average error in the past couple of years has been 87 thousand.

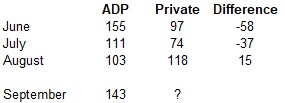

The ADP report showed a jobs gain of 143 thousand in September after having risen 103 thousand in August. The employment gains on this report are slightly smaller now than they were earlier in the year.

.Nela Richardson, the Chief Economist for ADP said, ““Stronger hiring didn’t require stronger pay growth last month.” She added that, “Typically, workers who change jobs see faster pay growth. But their premium over job-stayers shrank to 1.9 percent, matching a low we last saw in January.”

Payroll employment has slowed gradually with job gains averaging 116 thousand per month. The labor market appears to have shifted from being exceptionally tight to being roughly in balance.

Given the ADP report, we are looking for payroll employment to rise by 130 thousand in September. We will get that report from the BLS on Friday. We also expect the unemployment rate to be unchanged at 4.2%.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me