August 6, 2010

Most economists are painting a rather gloomy outlook for the economy for the balance of this year. They point to weakness in housing, the modest rate of GDP growth in the second quarter, and less than impressive employment gains. They worry about a double dip in the economy. They fret about deflation. While economic activity is not nearly as robust as one might hope, it continues to chug along at a moderate clip and will continue to do so for some time to come.

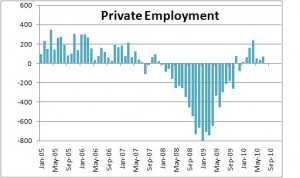

At first blush a private sector employment gain of 71 thousand seems rather anemic. However, employment has come a long ways during the course of the past year. Fifteen months ago the economy was losing 700 thousand jobs a month. Going from job losses of that magnitude to job gains of 50 thousand per month in the past three months is not bad. We still have a long ways to go, but we are moving in the right direction. Will the employment data continue to improve? Probably.

In today’s world businesses need to boost production to satisfy demand. They have two choices. They can hire more bodies, or they can work their current employees longer hours. At the moment they are choosing option two – working people longer hours. If you are one of our currently unemployed workers, that is obviously not good news. But the fact that the workweek is climbing is a sign that the economy continues to expand and firms need to step up the pace of production.

Take a look at the nonfarm workweek. After reaching a low point of 33.0 hours during the depth of the recession, the workweek has steadily risen and now stands at 33.5 hours. Prior to the recession the workweek was averaging 33.8 hours. If the demand for goods and services holds up, at some point in the not-too-far-distant future businesses will need to hire more workers. The fact that the workweek keeps getting longer and longer flies in the face of the notion that the economy is weakening.

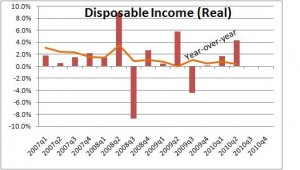

How can we be sure that the demand side of the equation will hold up? That’s easy. People are making more money. Real disposable income rose 1.6% in the first quarter and then surged 4.3% in the second. We also know that employment, hours, and earnings continued to rise in July. Thus, it is a relatively sure bet that disposable income will rise again in the third quarter, probably by another 3.0%. So what is the consumer going to do with all that the money? He has several choices.

He could save it. The savings rate has been between 5.0-6.0% since the middle of 2008. That sudden willingness to save is not surprising given that the consumer lost a sizeable chunk of his net worth during the recession as home prices and the stock market fell. Also, with the unemployment rate at 9.5% he is worried about might happen if he were to be laid off. Finally, the consumer has determined that he has too much debt. So, it is not surprising that the consumer has suddenly decided that savings is a virtue. But given its stability in the past couple of years, it is unlikely that the consumer wants to push the savings rate even higher.

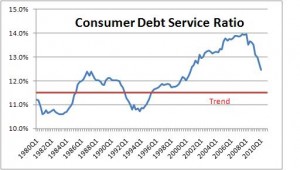

As noted above, over the course of the last couple of years, the consumer has decided that debt is not a good thing. The consumer’s “debt service ratio”, which measures the percent of income used to service debt, has been steadily falling. Every month he takes some of his savings and uses it to pay down debt which pushes this ratio closer and closer to its average over the past 30 years. By this time next year the consumer should be comfortable with his reduced debt burden, and be in a position once again to spend and borrow. That is a very positive development.

The point of all this is that as employment, hours, and earnings continue to climb, consumer income will grow sufficiently rapidly that he can both pay down debt and, perhaps, have enough money left over to simultaneously boost his pace of spending. That does not sound like an economy that is on the verge of dipping back into recession.

Stephen Slifer

NumberNomics

Charleston, SC 29492

Follow Me