August 10, 2012

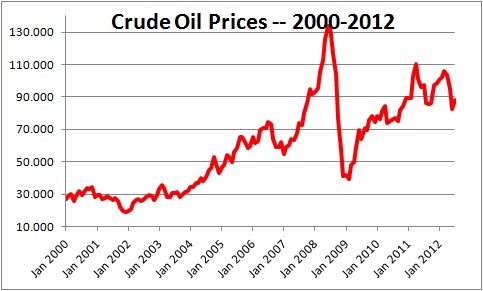

Oil prices rose sharply early this year and then declined sharply in the spring. Those fluctuations were largely attributable to increased demand prior to the summer driving season, and reduced demand thereafter. But in the past month prices have been on the rise again. What is happening?

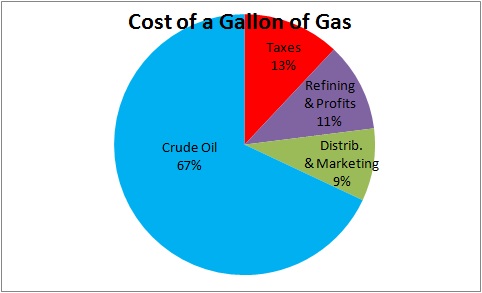

The gas station owner is frequently viewed as the culprit, but the reality is that the station owner’s ability to affect retail prices is limited. The pie chart below highlights the factors that determine the price of gasoline.

Cost of Crude Oil. The cost of crude oil is by far the most important factor in determining the price of a gallon of gas. At 67% it is more important than all of the other factors combined. Like any other commodity its price is affected by worldwide supply and demand.

On the demand side, world economic growth is the biggest factor. Perhaps the classic example of excessive demand occurred in 2008 when crude prices reached a record high level of $134 per gallon as oil demand surged relative to supply.

As noted above, there are also seasonal fluctuations in the demand for gasoline. Retail prices tend to rise gradually in the spring, peak in late summer, and then drop in the winter gas as summer vacations temporarily increase demand.

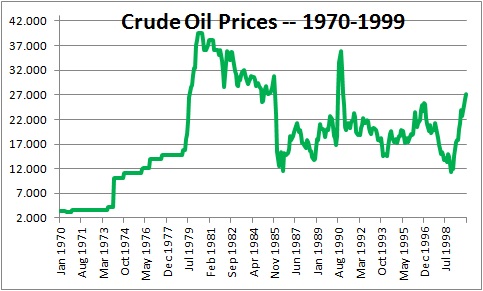

On the supply side, oil crises can interrupt the supply of oil and cause the price of crude to surge upwards. First, there was the Arab oil embargo in 1973. Then came the Iranian revolution in 1978, the Iran/Iraq war in 1980, and the Persian Gulf War in 1990. More recently, the early 2011 the revolutions in Tunisia, Egypt, and Libya threatened to interrupt the supply of oil. As these crises unfold, oil companies find it difficult to drill and ship crude oil.

Even without a crisis, oil prices can be affected by decisions made by OPEC. This group of 14 countries controls more than 40% of the world’s crude oil and has more than two-thirds of the world’s estimated crude oil reserves. They are the only countries that have spare production capacity and the ability to bring more oil into production quickly to offset higher prices.

Federal, state, and local taxes. Federal excise taxes are currently 18.4 cents per gallon. State excise taxes average 21 cents and some states tack on a sales tax. These federal, state, and local taxes combined add 48 cents onto the price of a gallon of gas which accounts for roughly 13% of its price. It could be worse. In Europe gas prices are roughly $8.00 per gallon versus $3.40 in America because taxes on gas are so much higher.

Refining Costs and Profits. Refining costs account for roughly 11% of the cost of a gallon of gas. These refining costs vary widely from region to region in the U.S. and are partly dependent upon the type of crude oil being processed. Some oil, like West Texas Intermediate, is heavy and requires extensive refining. In contrast, Brent crude is lighter and in need of less processing. Thus, refining costs can vary depending upon the type of crude oil that is available.

Refining costs are also affected by the grade of gasoline produced – regular, midgrade, and premium. Typically there is a difference between grades of about 10 cents per gallon.

Some states, like California, and some cities, like Chicago and Milwaukee, have their own reformulated gasoline rules that are stricter than the federally mandated clean gas laws. The additional refining causes gasoline prices in these areas to be 25-50 cents higher than the national average.

Distribution, Marketing, and Retail Dealer Costs. This final factor accounts for the remaining 9% of the cost of a gallon of gasoline. Most gasoline is shipped from the refinery first by pipeline to a terminal near the consuming area where it may be blended to satisfy local standards, and then delivered by tanker truck to the individual gasoline station. Retail gasoline prices tend to be higher farther from the source of supply like ports, refineries, and pipeline terminals. The U.S. Gulf Coast is the source of about one-quarter of the gasoline produced in the United States and the starting point for most major gasoline pipelines, so states farther from those refineries most likely have higher prices. Because Charleston happens to be a port city, gasoline prices in this neck of the woods tend to be 20 cents or so below the national average.

The price charged at the pump includes the station owner’s cost to purchase the finished gasoline and reflects the costs of operating the service station – wages and salaries, benefits, equipment, rent, insurance, licenses and taxes.

The point of all this is to highlight some of the myriad of factors that cause gasoline prices to fluctuate. The local station owner plays a very small role.

Recent increase. Most explanations for the recent jump in prices focus on refinery fires and pipeline leaks, particularly at a Chevron plant in Richmond, CA. However, refinery fires will eventually be put out and pipeline leaks will be fixed. At that point, prices will retreat. Thus, there will be only a short-term impact on economic activity and inflation.

However, lower gas prices were expected to provide considerable stimulus to the economy in the second half of this year. If prices remain elevated for several months (which seems likely) their beneficial impact will be muted.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me