July 5, 2024

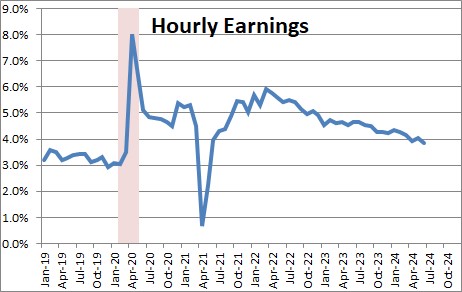

Average hourly earnings rose 0.3% in June to $35.00 after having gained 0.4% in May and 0.2% in April. Earnings growth continues to slow from 5.5% at the beginning of last year to 3.9% currently. Presumably, the flood of workers from Latin America crossing over our southern border with Mexico are willing to take a lot of low-paying jobs as they try to survive in their new home.

These hourly earnings data may understate the growth in wages. The Atlanta Fed’s wage tracker has risen 4.7% in the past year compared to a 3.9% increase in the officially-published hourly earnings data. However, both series are headed in the same direction and gradually slowing.

![]()

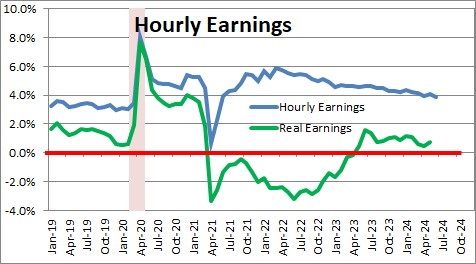

The problem is that while nominal earnings have risen 3.9% in the past year, inflation has risen almost as quickly and real or inflation-adjusted earnings have risen only 0.7% in that same period of time.

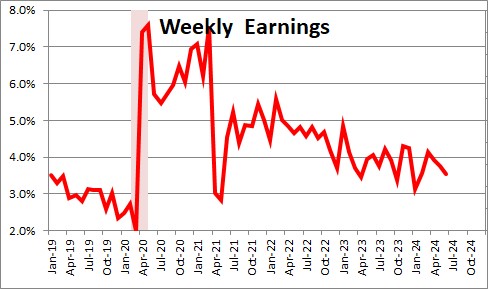

Average weekly earnings rose 0.3% in June to $1,200.50 after climbing 0.4% in May and having declined 0.1% in April. In the past year weekly earnings have risen 3.6%.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me