January 22, 2021

President Biden has proposed an additional fiscal stimulus package of $1.9 trillion. A significant part of the spending takes the form of a $1,400 cash payment to taxpayers on top of the $600 payment that was approved in December and sent out earlier this month – for a total of $2,000. We are not opposed to support targeted towards those who have experienced a loss of income caused by the virus and assistance to the poor, but this is, in our opinion, an indiscriminate giveaway. The vast majority of Americans are still working and have not lost income. Those who draw pension or Social Security benefits have not seen their income decline. Americans have $3.5 trillion more in their checking accounts today than they did prior to the onset of recession. They can draw on $1.3 trillion of excess savings left over from the CARES Act last year to pay their mortgage, rent, or car lease. At the same time, consumer debt in relation to income has fallen to a record low level. Thus, consumers today have plenty of cash to pay their bills without an additional $1,400. Our hope is that the stimulus package gets whittled down to $1.0 trillion or so with the reduction coming from far-too-generous cash payments.

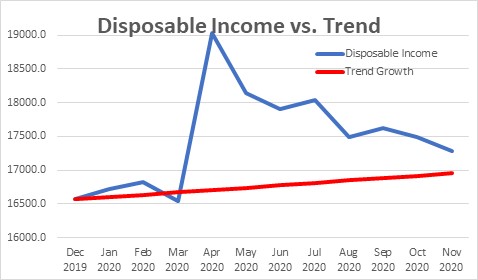

Disposable income in the first two months of last year was climbing at about its 2019 pace of 2.5%. As the recession hit in March and the federal government sent out those $1,200 tax refund checks, income soared. As the economy opened up income has fallen, but as of November income is still 20% higher than it would have been if income had continued to grow steadily throughout last year at its 2.5% trend rate. Any income loss caused by the virus and the recession has been fully replaced.

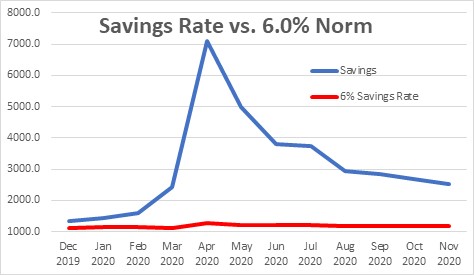

Some of the $1,200 fiscal stimulus money from last year remains in consumer saving. Once the tax refund checks were sent out in March of last year the economy was largely closed down so consumers were unable to spend the money and the savings rate soared to 33.7% which compares to an average savings rate of 6.0%. It has since declined to 12.9% but that is still more than double its historical average. In dollar terms, that means that consumers today have $1.3 trillion more savings than they would have if they had maintained a normal 6.0% rate.

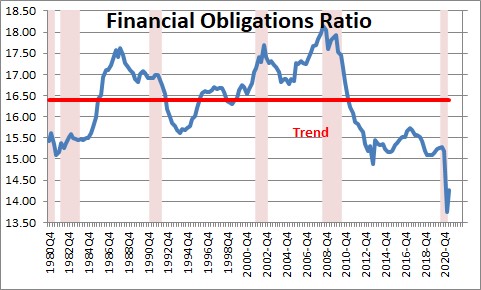

Some of the funds distributed in the spring of last year appear to have been used to pay down debt. Consumers financial obligations ratio — which includes their payments on mortgages, auto lease payments, rent, homeowner’s insurance, and property tax payments as a percent of income, plunged in the second quarter of last year to a record low level of 13.7% versus its long-term average of 16.3% and it remained low in the third quarter. Consumers who are struggling to pay the rent or make the car payment did not pay down debt. That was almost certainly attributable to wealthier consumers who used a cash windfall to pay down some of their outstanding debt obligations.

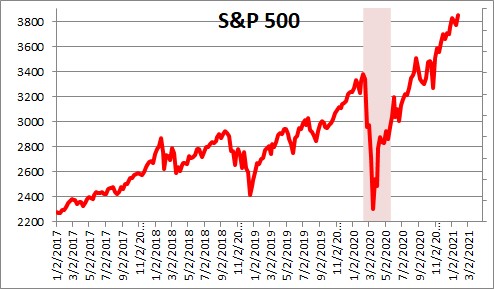

It is also likely that some of the $1,200 tax refund last year was invested in the stock market which regained all of its February/March decline in just five months and every few days it sets another record high level. In the so-called “great Recession” in 2008-09 it took five years for the stock market to fully recover.

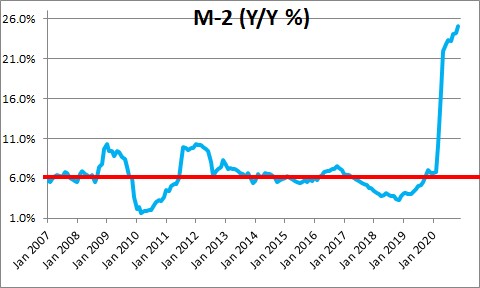

In addition to the $3.0 trillion fiscal stimulus package last year the Fed purchased about $3.0 trillion of U.S. government securities in March and April and it has continued to buy Treasuries every month since. Fed purchases of U.S. Treasury securities bolster the money supply which has soared 25% in the past year. The money supply today is currently $3.5 trillion higher than it was in February – before the onset of the recession. M-2 consists of checking account balances, money funds, CD’s and other very liquid instruments. Thus, consumers have more than enough cash sitting around in bank accounts to pay their bills for a long time to come.

As described above, consumer income is elevated, consumers have far more savings than usual, their bank accounts are bloated, they have invested in the stock market, and have paid down a considerable amount of debt. All of this describes the situation today. Another $1,400 cash payment will further boost the surplus liquidity that already exists. When the virus is finally brought under control, hopefully sometime around mid-year, Americans will feel more comfortable going to restaurants and bars, sporting events, and travel. That should trigger a dramatic spending spree which is certain to boost the inflation rate – perhaps by considerably more than the Fed would like to see.

We fully recognize that there are people who have lost their jobs as a result of the recession. There are others who were poor before the recession and their situation may have gotten worse. Giving virtually every taxpayer a $1,200 tax refund check last year clearly helped to turn the economy upwards quickly. That was a good thing. However, much of the economic stimulus was short-circuited as many people chose to save, pay down debt, or put their money in the stock market. The same thing will happen again this year if the Biden Administration sends out yet another $1,400 check.

The government clearly needs to spend money on the production and distribution of vaccines, provide income support to those who remain unemployed, assist lower income families, and help state and local governments re-hire teachers, police, and fire personnel. The previous Administration faced a crisis and had to act quickly and, as a result, its stimulus package was crude but still effective. Today the Biden Administration has the luxury of taking its time to find the best way to spend our tax dollars. In the end we hope that the proposed $1.9 trillion package gets trimmed to perhaps $1.0 trillion which will, hopefully, be spent wisely.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me