May 5, 2023

Data for the second quarter are beginning to filter in. One has to squint closely to find signs of further slowing in the pace of economic activity. Payroll employment rose 253 thousand in April. The unemployment rate declined 0.1% to 3.4%. Car sales for April jumped 7.2%, which probably suggests that overall retail sales rose somewhat in that month. We have been, and still are, projecting GDP growth of 2.0% in the second quarter. The widely followed Atlanta Fed GDPNow forecast currently stands at 2.7%. It is still early and who knows what will happen in the next couple of months. But, for now, second quarter GDP growth appears to be solid. We will get our first look at second quarter growth at the end of July. But, astonishingly, the markets expect the Fed to begin easing by 0.25% in August followed by two additional rate cuts to 4.5% by yearend. The markets clearly expect a recession to occur in the second half of this year. Fed Chair Powell has indicated that the Fed has the same expectation. Perhaps they are right, but if the economy is on the cusp of recession, we would have thought that by now there would be some hint that the economy is beginning to hit the brakes. That does not seem to be happening. We envision a different scenario. We anticipate growth continuing at a moderate pace through yearend, inflation remains stubbornly high, and the funds rate ends the year at the 6.0% mark – not 4.5%. Somebody has this wrong.

First quarter GDP growth came in a 1.1% and the interpretation was that the economy slowed significantly in the first quarter. But the only reason GDP growth came in at 1.1% was because of a dramatic slowing in the pace of inventory accumulation. Strip out the inventory growth and one finds that — led by the consumer — final sales rose at a solid 3.3% pace in the first quarter. So was the economy weak in that first quarter, or not? We would certainly not characterize it as weak. Nevertheless, that seems to be the spin because almost everybody is looking for a recession in the second half of the year.

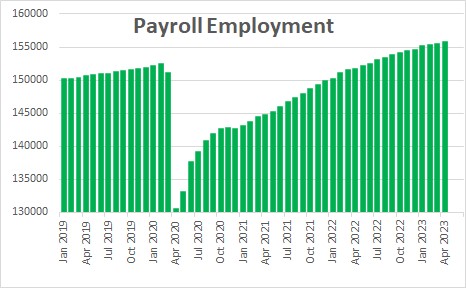

So what about the second quarter? How is it shaping up? We obviously know little at this point, but we do know that payroll employment rose 253 thousand in April. We also know that instead of rising 0.1% in April the unemployment rate declined 0.1% to 3.4%.

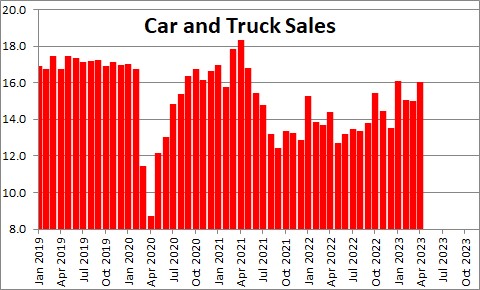

And new car and truck sales jumped 7.2% to a 15.9 million pace which duplicates the sales pace in January, and stands as the most rapid rate of car sales in two years. The market is currently expecting retail sales to decline 0.7% in April. But given the performance of car sales we seem far more likely to see an increase in retail sales of 0.7% for April than a decline of that magnitude. None of what we have seen thus far suggests that second quarter GDP growth will be anemic. We expect to see an increase of 2.0% in that quarter. The Atlanta Fed has it pegged at 2.7%.

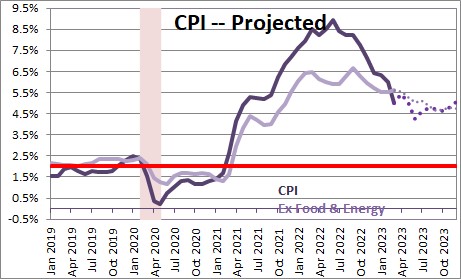

Perhaps the core inflation rate will begin to decline more quickly than it has up to this point. We will learn about the CPI for April on Wednesday morning. We and the market expect the core CPI to rise 0.4% in that month. If that is the case, the 12-month increase will edge lower to 5.5% from 5.6% in March. Thus, the inflation rate still seems to be edging its way lower, but it is taking its sweet time. At 5.5% versus a 2.0% inflation target, the Fed is hardly in a position to stop raising rates.

At its most recent meeting the Fed raised the funds rate 0.25% to 5.25% and, for the first time, did not suggest that additional rate hikes were inevitable. Rather, the Fed said that future action would be determined by the data. If, as Chair Powell has indicated previously, the Fed expects a recession in the second half of the year, then it makes sense to put further rate hikes on hold – for the time being.

Powell also said that the Fed wanted to see the cumulative effect of its tightening. What cumulative effect? Other than the fed funds rate, market rates are no higher than they were in September of last year, and lower than they were in December. For example, the funds rate in September was 2.56%. Today it is 5.25%. The 2-year was 3.86% in September. Today it is 3.92%. The 10-year note was 3.52% in September. Today it is 3.42%. Thus, the Fed has been busily raising the funds rate, but the markets are blowing off its tightening moves. So exactly how is the economy going to slow further when market rates have not risen in the past eight months? Why are we so surprised that the economy continues to chug along?

The next FOMC gathering will be June 13-14. If the April and early May data do not provide solid evidence that the economy is continuing to slow, and the inflation rate does not give any hint of slowing more quickly, we think the Fed could well raise the funds rate to 5.5% in June.

If that is the case, the market will need to do a re-think.

Stephen D. Slifer

NumberNomics

Charleston, S.C.

Could it be that new car sales Rose at such a good rate because finally their cars available to sell?

Hi Neil. I suspect you are right to some extent about the availability of new cars. But it also seems to suggest that consumers are not backing away. As Kevin Costner said, “Build it and they will come”.