July 14, 2023

Economists continue to expect a recession. Some in the second half of this year. Others, like ourselves, a mild one in the first half of next year. But the stock market is telling a different story. Somewhat remarkably the stock market is within 5% of a record high level. Corporate earnings reports for the second quarter thus far have beaten the consensus forecasts. Corporations seem to be adjusting well to this new, higher interest rate environment. Consumer sentiment is rebounding. The economic tea leaves do not suggest that a recession is imminent. If the economy does not dip into recession, won’t the inflation rate remain elevated? Perhaps not. After an earlier explosion in the money supply created surplus liquidity, M-2 has been falling rapidly and by yearend any remaining surplus liquidity in the economy should have disappeared. If that is the case, the inflation rate should continue to trend lower and, perhaps, by 2025 will be back to its 2.0% target. It may take it a while to get there, but that path seems acceptable to both the Fed and the markets. If real interest rates return to a more historically normal level, and money supply growth going forward tracks along its long-term growth path, 2024 could bring sustained, positive GDP growth and an inflation rate that steadily creeps lower toward the Fed’s target. That sounds very much like a soft landing to us. Could the Fed actually pull this off?

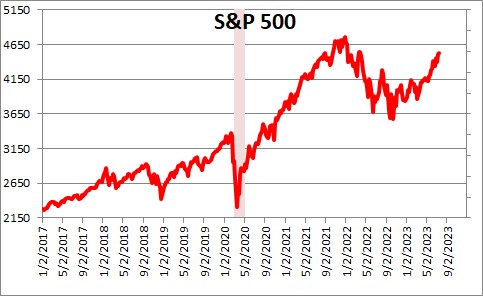

The stock market continues to climb. Slowly but steadily the S&P 500 has risen to within 5.0% of the record high level it achieved in December 2021 — just prior to the beginning of the Fed’s tightening initiative.

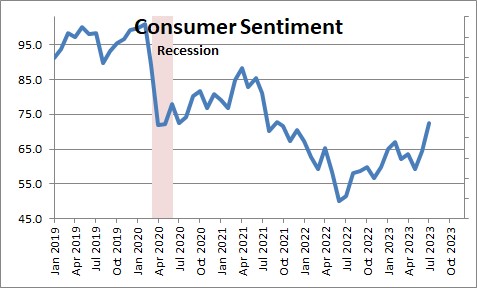

The run-up in stock prices is bolstering consumer sentiment, which surged 8.2 points in July after climbing 5.2 points in June. It is at its highest level since September 2021. If we are more confident, the odds are we will actually accelerate our pace of spending.

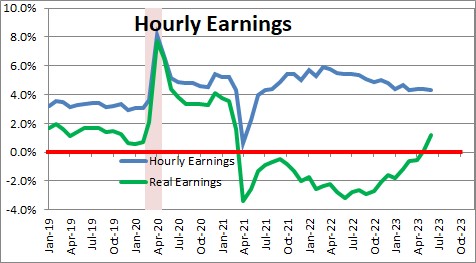

Some have argued that real hourly earnings have been declining and the consumer’s purchasing power is being eroded by inflation. That was true for two years. Nominal earnings were rising steadily, but inflation was climbing more quickly and real earnings were falling. But no more. Real earnings have been positive in each of the past four months and in the past year have risen 1.2%. In the year prior to the 2020 recession real earnings grew 1.0%. While the level of real earnings remains substantially lower than it was prior to the recession, it is no longer losing ground. It has begun to climb, and by doing so it provides the consumer with ammo to keep spending.

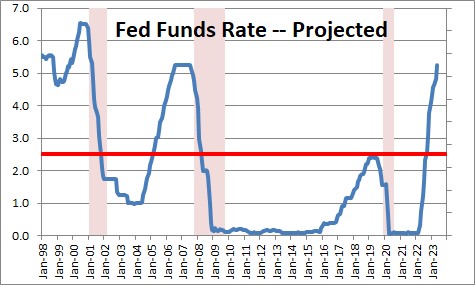

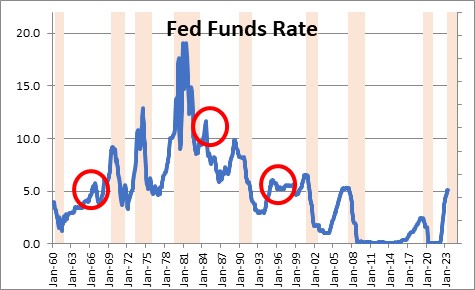

The Fed did not raise rates in June, because monetary policy works with a lag and it wanted to see if there would be any additional slowing in the economy from its earlier rate hikes. But the reality is that the only interest rate that is significantly higher today than it was in November of last year is the fed funds rate (5.25% vs. 4.0%). The 2-year is 4.7% today vs. 4.5%. The 10-year is 3.8% vs. 3.9%. Basically, most rates are no higher today than they were eight months ago. How much further slowdown might be forthcoming?

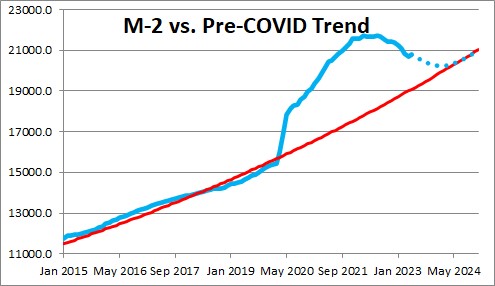

If the economy does not slip into recession won’t that prevent the inflation rate from dropping back to the Fed’s 2.0% target? Perhaps not. We have been staunch advocates of the notion that the disquieting increase in the inflation rate was largely caused by dramatic growth in the money supply. It exploded during the recession and remained excessive through July of last year. But it has been falling rapidly for the past year and much of the surplus liquidity that existed has disappeared. What surplus liquidity remains should be eliminated by yearend. If M-2 growth then returns to its longer-term 6.0% growth path, the inflation rate should eventually return to its 2.0% target. It may take until 2025 to get there, but the Fed seems comfortable with that path as do market participants.

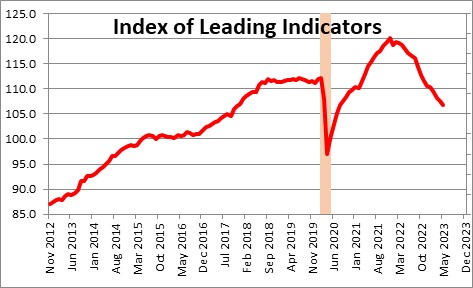

The index of leading indicators has been pointing towards a recession for more than a year. Thus far, it has not materialized and it does not seem poised to do so any time soon. This LEI has never fallen so far for such a protracted period of time without a recession occurring. But the world is a different place today that it was three years ago. The old rules of economic forecasting are not working as well as they used to. We all continue to guess.

The Fed does not have a good track record of pulling off soft landings. There have been 12 Fed tightening initiatives since 1960. Nine of the 12 have resulted in a recession. The odds are not in the Fed’s favor, but the data suggest that they just might be able to pull it off this time.

We are not quite ready to pull our moderate recession forecast for the first half of next year – but we are getting close. The economics profession continues to underestimate the strength and resilience of the U.S. economy.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me