July 3, 2024

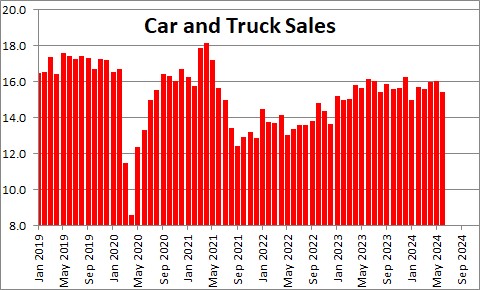

Unit car and truck sales fell 4.0% in June to 15.290 million after having risen 0.5% in May. However, June sales were undoubtedly held down by a computer hack that delayed dealer deliveries to customers. Thus, sales are sure to rebound in July.

We expect GDP growth of 1.9% in the second quarter of this year. Steady gains in employment and higher wages should keep the economy going at a moderate pace We then look for 1.7% GDP growth in the final two quarters of the year.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me