February 2, 2024

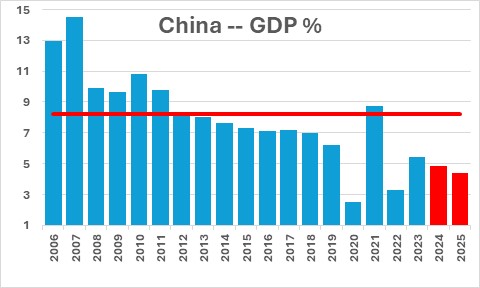

The IMF revised its global and individual country GDP growth estimates at the end of January. The most notable finding is that GDP growth in China is expected to remain anemic for the foreseeable future at a pace that is roughly one-half of its average over the past 20 years. The earlier period of extraordinarily rapid GDP growth known as the Chinese miracle was fueled by highly leveraged investment in heavy industry and real estate. But with no population growth, the labor force shrinking, high and rising debt levels, the property market becoming unglued and the stock market plunging, the day of reckoning,has finally arrived.

The IMF reported anemic GDP growth in China of 5.2% in 2023 which is expected to slow to 4.6% this year, and 4.1% in 2025. Those growth rates are roughly one-half of the 8.2% pace registered in the previous 20-year period. The Chinese growth bubble has burst with no reversal in sight. Economic stagnation is likely to continue. China needs 5% growth to sustain its current pace of social spending, research and development, and security. That is not likely to happen.

China can ill afford a prolonged slump. Its per capita GDP of $12,500 in 2023 is 16% of per capita GDP for the United States which is $80,400.

What has gone wrong?

First, China’s population has not only stopped growing, it is rapidly aging. While the oldest contingent of the population increases, the working age population is shrinking. That puts a huge burden on the younger generation to support their elders. It also means that the required 5.0% GDP pace must be accomplished by sustained 5.0% gains in productivity. But with vast overinvestment in the manufacturing sector, more than ample roads, ports, railways, and housing projects, and a dim economic outlook, businesses will be wary of increasing investment which will likely short-circuit the required growth in productivity.

Second, China relies on foreign technology to upgrade its industry. But its rifts with the U.S. and the West have reduced China’s access to foreign hi-tech products and limited the markets for its exports.

Third, the real estate bubble has burst, property developers are heavily indebted, some developers, like China Evergrande, have defaulted and many more like the property giant Country Garden are on the verge. In China new home buyers begin paying their mortgage the moment they sign a contract for their new home, regardless of when it might completed. As completion dates kept getting pushed farther and farther into the future, some homebuyers have simply stopped making their mortgage payments which makes the situation worse for the builders who need to begin construction on the next unit to raise the money to finish the initial project. As a result, they have gone deeper and deeper into debt. As huge apartment complexes remain vacant, the developers are all struggling. Meanwhile, home prices have plunged 15% in the past couple of years. There is no way this situation will get resolved any time in the near future without significant government stimulus packages.

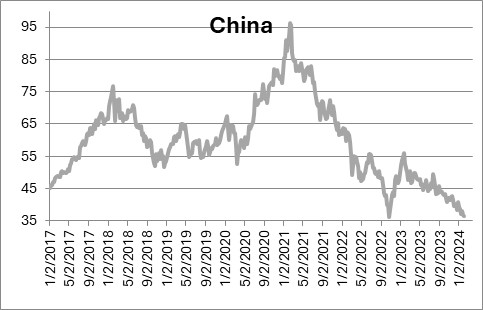

What China really needs is a recovery in consumer spending. That will be difficult to achieve. The Chinese stock market has plunged. For example, the MCHI Index has fallen 62% from its peak in February 2021. The Shanghai SSE Composite has declined 25% and the Hang Seng Index has shed 50%. Falling stock prices make it difficult for private sector firms to raise the capital needed for investment.

Falling stock prices and declining property values are crushing consumer confidence. If the solution to China’s economic woes is to boost the pace of consumer spending, it will be difficult to achieve when consumers are nervous about the economic path ahead.

The bottom line is that these economic challenges will not be resolved quickly without significant economic stimulus which does not appear to be forthcoming in the absence of a financial crisis. This means that GDP growth elsewhere around the world will be reduced as demand from Chinese businesses and consumers turns down. It also means reduced inflation globally caused, at least in part, by reduced demand for oil which is lowering the price of crude oil.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve, since China has been a significant part of world economic growth for the last decade, what do you expect the impact of the slowdown your predicting will have in the future? Next question. How politically unstable would this make China?

Steve, since China has been a significant part of world economic growth for the last decade, what do you expect the impact of the slowdown you’re predicting will have in the future? Next question. How politically unstable would this make China?

Hi Neil. I am not an expert on China but George Friedman is. Here is an article he wrote a couple of months ago. Interesting thoughts.

https://geopoliticalfutures.com/the-chinese-mystery/

From an economic viewpoint the continuation of sluggish growth in China suggests that global GDP growth will be moderate and the inflation rate should continue to subside. Helps to reinforce the global soft landing scenario.

But if we get new leadership in China the ballgame could change. Not smart enough to know exactly what that might look like.