April 4, 2024

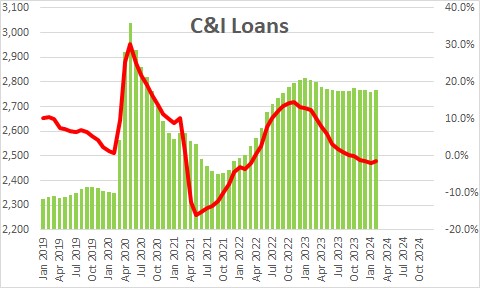

Commercial and industrial loans have declined 1.5% in the past year as both large and small banks are being more cautious about lending as the result of the failure of two medium-sized banks last year Silicon Valley Bank and First Republic Bank) which were overextended on loans to Silicon Valley firms. After a moderate downturn in C&I loans in the spring of last year, C&I loan growth has been essentially unchanged since.

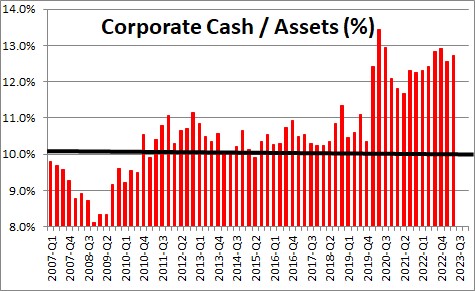

As a precaution of against any potential problem, banks have been holding a relatively large portion of their assets in liquid form for the past couple of years.

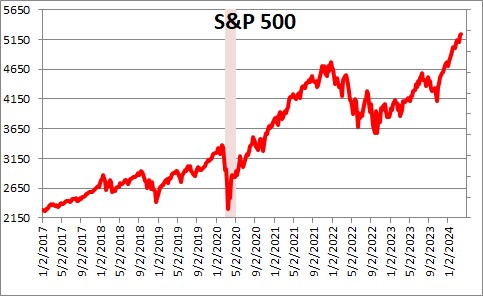

Meanwhile, the stock market has climbed to a record high level so firms have been able to satisfy some of their need for funds internally as their market cap has grown.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me