July 1, 2024

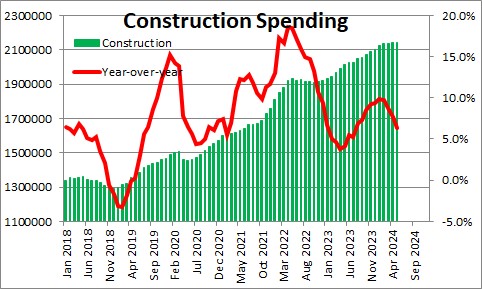

Construction spending (the green bars above) declined 0.1% in May after rising 0.3% April and 0.1% in March. Construction spending climbed sharply for 16 consecutive months, but it has slowed considerably beginning in March of this year. In the past 12 months it has risen 6.4%. But in the past three months it has slowed to a 1.1% pace.

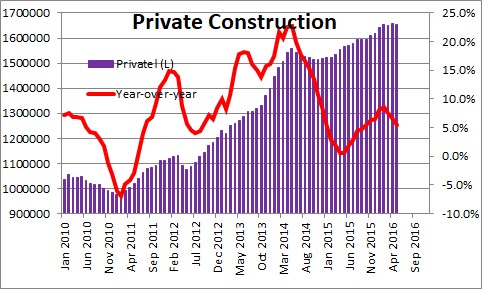

Private construction spending (excluding the government sector) fell 0.3% in March after rising 0.4% in April and declining 0.2% in March.. In the past year private construction has risen 5.4%. In the past three months it has declined at a 0.3% pace.

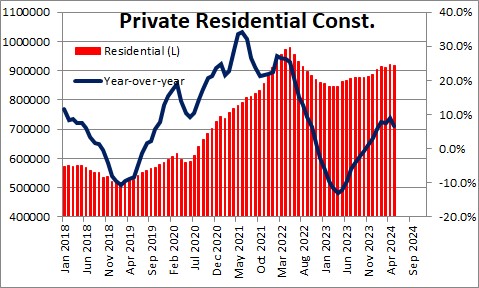

Within the private construction spending category, residential spending fell 0.2% in May after rising 0.9% in April and falling 0.2% in March. Residential spending had been gradually rising for almost a year.. In the past 12 months residential construction spending has risen 6.5%. It has risen at a 1.8% pace in the past three months.

.

.

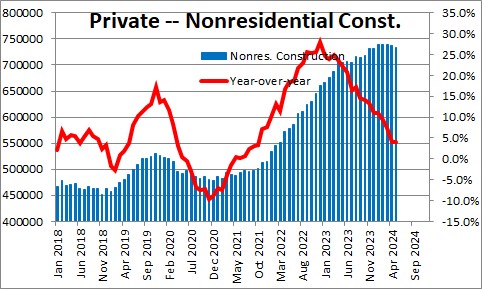

Nonresidential construction fell 0.2% in May after declining 0.3% in April and falling 0.1% in March. It had been climbing rapidly but has begun to decline in the past three months, In the past 12 months nonresidential construction has risen 4.1%. In the past three months it has fallen 2.9%. In May the nonresidential construction drop was led by declines in office construction, commercial space, health care, educational institutions and power generation. In contrast, manufacturing construction rose 1.3%,

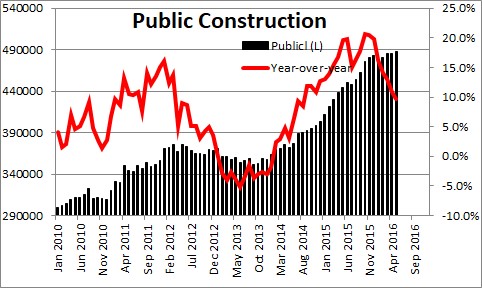

Public sector construction rose 0.5% in May after having been unchanged in April and climbing 1.1% in March. In the past year such spending has risen 9.7%. The increase in this category in the past year has been led by construction of offices, commercial space, health care, educational, amusement and recreation, power, highway and street, sewage and waste disposal, water supply, and conservation and development. But in the past three months that rate of increase has slowed to 6.0%.

.Stephen Slifer

NumberNomics

Charleston, SC

Follow Me