May 27, 2025

.

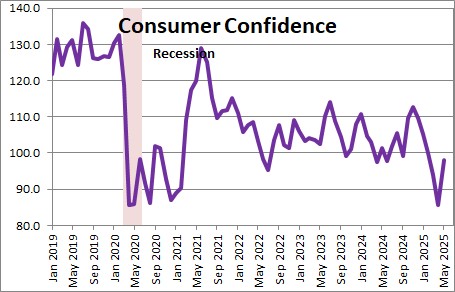

The Conference Board reported that consumer confidence jumped 12.3 points in May to 98.0 after having fallen 8.2 points in April, 6.2 points in March and 5.2 points in February. After hitting a peak in November confidence plunged for five months in a row as consumers worried about the inflationary impact of tariffs and the prospect of possibly losing their jobs. But once Trump relented on many of the tariffs he announced in early April, confidence soared.

Senior Economist at the Conference Board, Stephanie Guichard, said, “Consumer confidence improved in May after five consecutive months of decline. The rebound was already visible before the May 12 US-China trade deal but gained momentum afterwards. The monthly improvement was largely driven by consumer expectations as all three components of the Expectations Index—business conditions, employment prospects, and future income—rose from their April lows. Consumers were less pessimistic about business conditions and job availability over the next six months and regained optimism about future income prospects. Consumers’ assessments of the present situation also improved. However, while consumers were more positive about current business conditions than last month, their appraisal of current job availability weakened for the fifth consecutive month.”

We have a hard time getting as pessimistic as what this index has been indicating. The economy keeps cranking out new jobs although the pace of job creation has slowed down a bit. Trump is promising significant de-regulation in coming months. The stock market and most economists expect GDP growth this year of 0.8%. We are looking for GDP growth of 1.9% for the year.

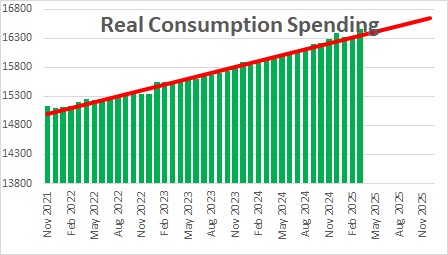

Given the magnitude of the earlier declines in confidence in the past thee months one might have expected a sharp pullback in consumer spending. But that has not happened. Instead, real consumer spending has risen 3.3% in the past year. With real disposable income rising 1.7%, we expect consumer spending to climb by about 2.0% in 2025.

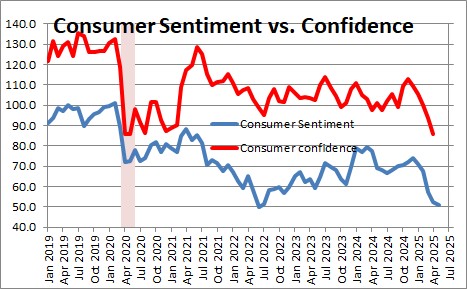

Confidence data reported by the Conference Board are roughly matched by the University of Michigan’s series on consumer sentiment. As shown in the chart below, trends in the two series are identical but there can be month-to-month deviations.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me