June 25, 2024

.

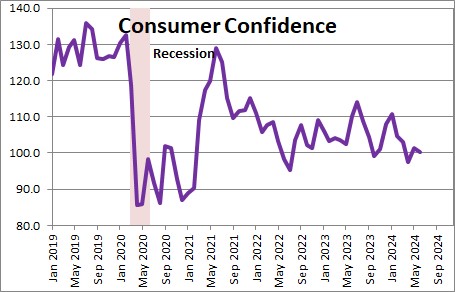

The Conference Board reported that consumer confidence fell 0.9 point in June to 100.4 after rising 3.8 points in May. it continues to hover near the low end of the 100-110 ban that it has been in for the past two years.

Chief Economist at the Conference Board, Dana Peterson, said “Confidence pulled back in June but remained within the same narrow range that’s held throughout the past two years, as strength in current labor market views continued to outweigh concerns about the future. However, if material weaknesses in the labor market appear, Confidence could weaken as the year progresses.”

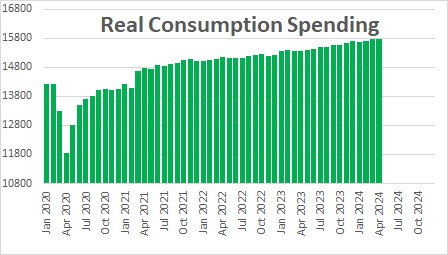

Despite the low level of consumer confidence we envision moderate economic growth in the months ahead. The economy keeps cranking out new jobs although the pace of job creation seems to be slowing down a bit. With the funds rate at 5.3% and the core CPI at 3.4% the real funds rate is +1.9% which may be high enough to slow the pace of economic facticity. The bottom line is that the economy is likely to grow at roughly a 2.8% rate in the second quarter followed by 1.5-2.0% in the final two quarters of the year. Given the magnitude of the earlier declines in confidence one might have expected a sharp pullback in consumer spending. But that has not happened. Instead, real consumer spending has risen 2.7% in the past year. But to maintain their pace of spending they are relying heavily on credit card borrowing. This is not sustainable. Should lead to a slower pace of spending in the second half of the year.

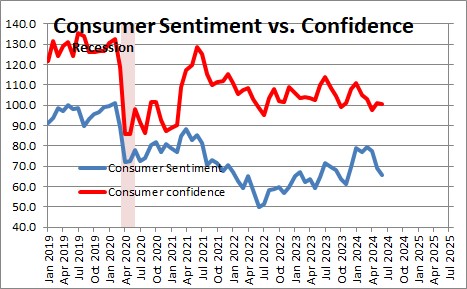

Confidence data reported by the Conference Board are roughly matched by the University of Michigan’s series on consumer sentiment. As shown in the chart below, trends in the two series are identical but there can be month-to-month deviations.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me