February 9, 2024

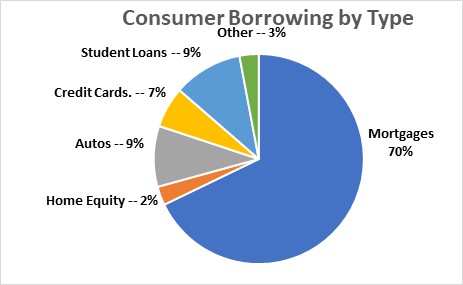

The Federal Reserve Bank of New York provides an in depth look at consumer borrowing every quarter. Data for the fourth quarter reveal that consumer debt continued to grow steadily. But consumer debt in relation to GDP – which measures the consumers ability to repay that debt –remained at a near record low level. Many economists point out, correctly, that very expensive credit card debt has recently begun to climb at a rapid pace which appears troublesome. But the reality is that 70% of all outstanding consumer debt is mortgage related. Credit card borrowing, while growing rapidly, is still only 7% of the debt pie. Furthermore, if consumers were beginning to struggle, delinquency rates would rise appreciably. But that is not happening. The delinquency rates both overall and for credit card debt in particular increased slightly in the fourth quarter, but remain historically low. While consumers could eventually get into trouble by relying too heavily on credit cards to maintain their pace of spending, that potential stumbling block appears to be far into the future.

Consumer debt outstanding increased $212 billion in the fourth quarter to $17.502 trillion. After rising sharply in 2021 and 2022, growth has slowed in recent quarters and the 4.9% annualized rate of growth in the fourth quarter is roughly in line with other recent quarters. During the past year consumer debt has risen 3.6%..

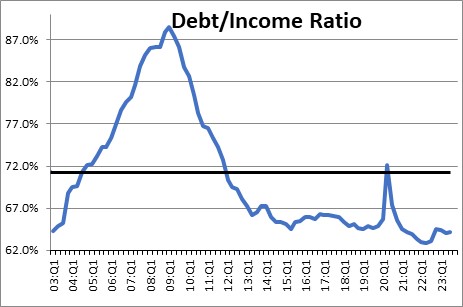

What is important is whether consumers can afford that additional debt. The ratio of consumer debt to income, which is a measure of our ability to repay that debt, has remained near a record low level.

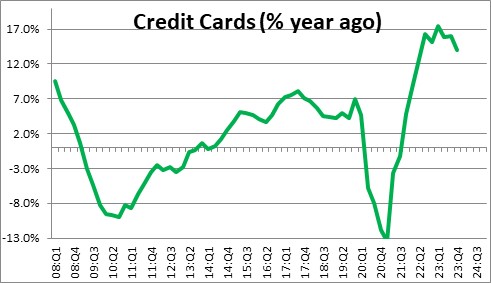

One type of consumer borrowing that has raised eyebrows recently is the extremely rapid growth of credit card debt which has risen 14% in the past year.

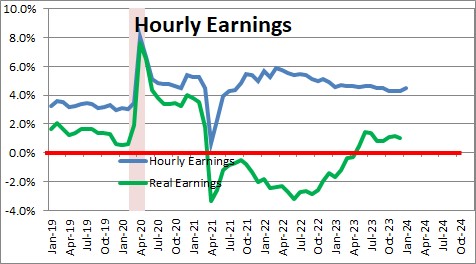

In 2021 and 2022 nominal wages were rising but rapid growth in inflation caused real wages to decline. Consumers began to rely on credit cards to maintain their lifestyle. Because credit cards charge interest rates in excess of 20% on outstanding balances, relying on credit cards for a protracted period of time can be both expensive and potentially dangerous. But the inflation rate has been slowing and real wages are once again growing so, hopefully, the pace of credit card borrowing will moderate in the quarters ahead.

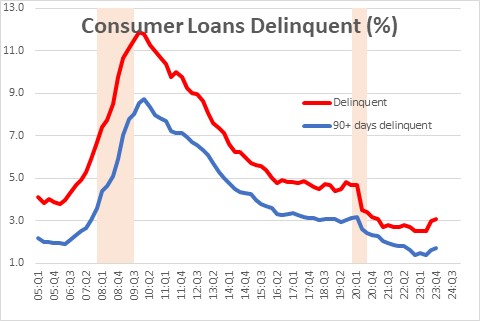

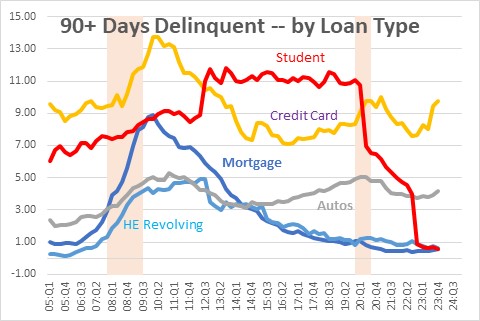

If greater reliance on credit cards were causing a problem for consumers, one would think that delinquency rates would begin to climb appreciably. That has not happened. While delinquency rates did rise in the fourth quarter, they remain at one of the lowest rates on record.

Focusing specifically on the delinquency rate for credit card debt the story remains the same The delinquency rate has risen in the last couple of quarters, but remains very low and roughly in line with where it was prior to both the 2008-09 and 2020 recessions.

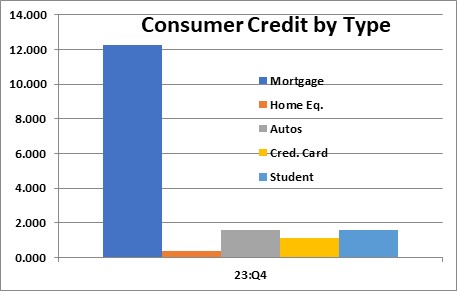

While credit card borrowing is a potential trouble spot for consumers at some point, it is important to remember that such borrowing is only a small fraction of the overall debt picture. The big gorilla is mortgage debt which is $12.25 trillion out of total consumer debt of $17.5 trillion. By way of contrast auto loans are in second place at $1.6 trillion. Credit cards are third at $1.1 trillion.

This means that mortgage debt represents 70% of all outstanding consumer debt. Auto loans are 9% and credit cards 7% of the consumer debt pie.

Economists are correct in highlighting potential trouble spots. A 14% increase in expensive credit card debt sounds problematical, but if it represents only 7% of all consumer debt and the delinquency rate is relatively stable, the potential problem sounds manageable. Let’s not let the tail wag the dog.

Stephen Slifer

NumberNomics

Charleston, S.C.

How do they compare on a percentage of disposable income to dedicated to debt service. Not sure where car loans are at the moment but maybe 1/3 of current cc rates? Not sure this makes sense, just trying to compare vs actual dollars out of pocket.

Hi Barry. Sorry I missed your question earlier. I will send you an e-mail since i can’t figure out how to send charts in this format. The answer is that the big gorilla is mortgages. Right now mortgage debt outstanding is $12.3 trillion out of total debt outstanding of $17.5 trillion. Auto loans (and student loans) are each $1.6 trillion. Credit card debt — which is growing rapidly — is $1.1 trillion.

Steve