April 4, 2024

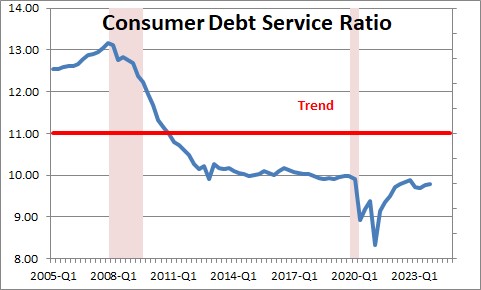

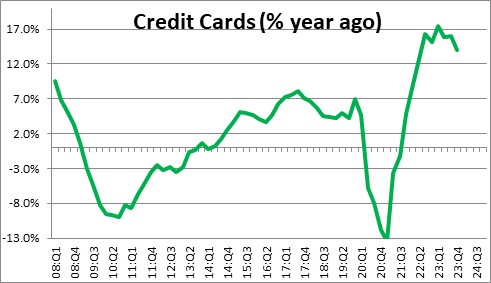

Consumers debt service payments relative to income rose somewhat in the fourth quarter to 9.8%, .Consumer debt in relation to income is slightly higher than it was a couple of quarters ago as the result of a rapid increase in credit card debt. But the starting point for the recent increase was from a near-record low level for this series. It turns out that in the wake of the pandemic-induced recession in 2020, some portion of the $1,000 stimulus checks that the government handed out were used to pay down debt and this debt service ratio fell to its lowest point since 1980. The average for this series is 11.0%. But in the last year or so consumers have run up their credit card borrowing which has boosted this ratio somewhat.

The household debt service ratio is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.

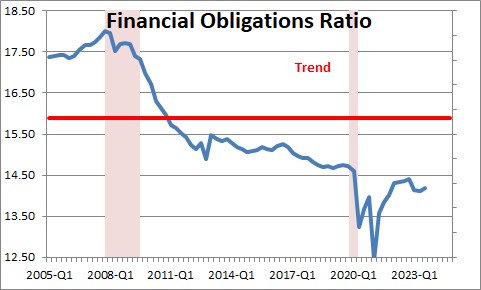

The financial obligations ratio is a somewhat broader concept and adds automobile lease payments, rental payments on tenant-occupied property, homeowners’ insurance, and property tax payments to the debt service ratio. The picture looks much the same. It is now at 14,2% which is slightly above that record low level but well below its historical average of 15.9%.

Any way one slices it consumer debt is at a very comfortable level despite the combination of the recession and a pandemic in 2020.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me