April 4, 2024

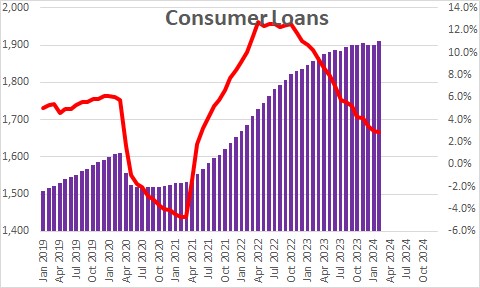

The economy has been chugging along at about a 2.5% pace. Consumer loans growth in the past year has been climbing at a roughly comparable 2.9% pace. Nothing too surprising with the extent of consumer borrowing from banks.

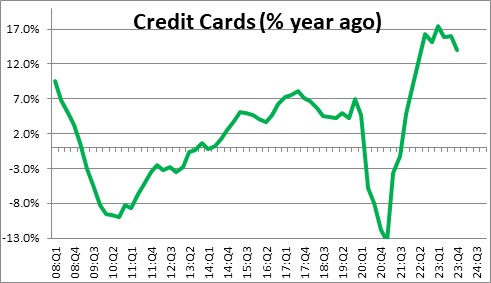

Rather than borrowing from a bank consumers today are using their credit cards to maintain their lifestyle. Credit card debt has risen almost 15% in the past year. This is very expensive credit and growth at that pace cannot be sustained.

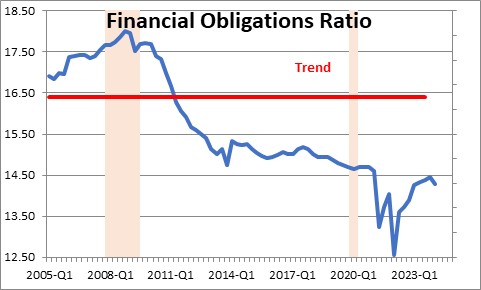

However, the consumer does not have a lot of debt, so he/she can continue to rely on their credit cards for some time to come The financial obligations ratio includes mortgage loans, rent payments, auto lease payments, autos loans, homeowner’s insurance, property tax payments, and personal loans as a percent of income. This ratio was low prior to the 2020 recession. But when the government started passing out $1,000 stimulus checks, at least some of those funds were to pay down debt. As a result, the ratio dropped to its lowest point since1980. The run-up in credit card borrowing has caused this ratio to rise in the past year, but it started at a record low level.

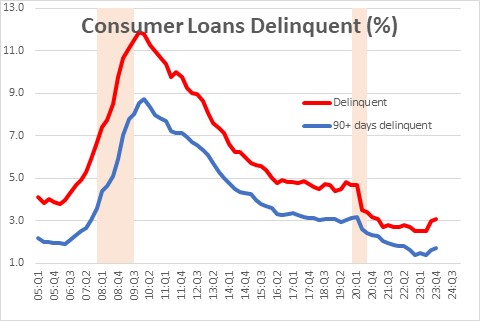

If with the additional credit card debt consumers were causing a problem delinquency rates should have begun to rise, and that has not been happening.

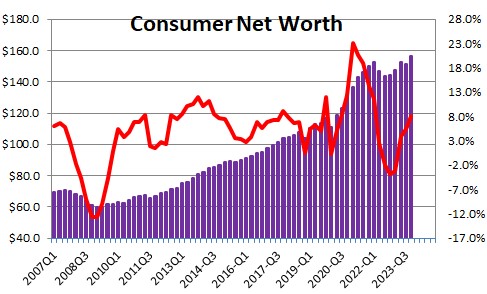

Finally, consumers net worth has increased dramatically in recent quarters drive by the increase in stock prices and the increase in house prices and now stands at a record high level.. The consumer is in surprising good financial shape.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me